Transferring QuickBooks license to new owner is a complicated topic, but knowing a little about the QuickBooks license transfer policy can help you better understand the procedure. Transferring the ownership of QuickBooks to a new owner will require registering the product under the new owner’s name. Unfortunately, as per the Intuit’s “License Grant and Restrictions” policy, a user is not allowed to transfer the QuickBooks software’s license to any other party. However, in some exceptional cases, when a business is sold, or donating the license to a non-profit organization, Intuit allows to do so. Further, in this article, we have listed the complete method of transferring your QuickBooks subscription to a new business owner.

Need Help Changing the Ownership of your QuickBooks Software! Call Support Number 1.855.738.2784 for General Advice and Guidance

Intuit License Grant and Restriction Policy Explained

As mentioned in the QuickBooks End User license agreement, QuickBooks is protected by copyright laws, and a user is only provided with certain rights to install and use the application. The license agreement also acknowledges the user that the software is not transferable and cannot be sold in any circumstances. This policy has been created in accordance with the country laws, and in the US only limited types of businesses are allowed to transfer the license of their accounting software to other business owners.

NOTE: In case if you are looking for a way to transfer your QuickBooks License to a new computer then you can follow our article How to Move QuickBooks Desktop to a New Computer.

In what Circumstances Intuit Allows a User to Transfer the License?

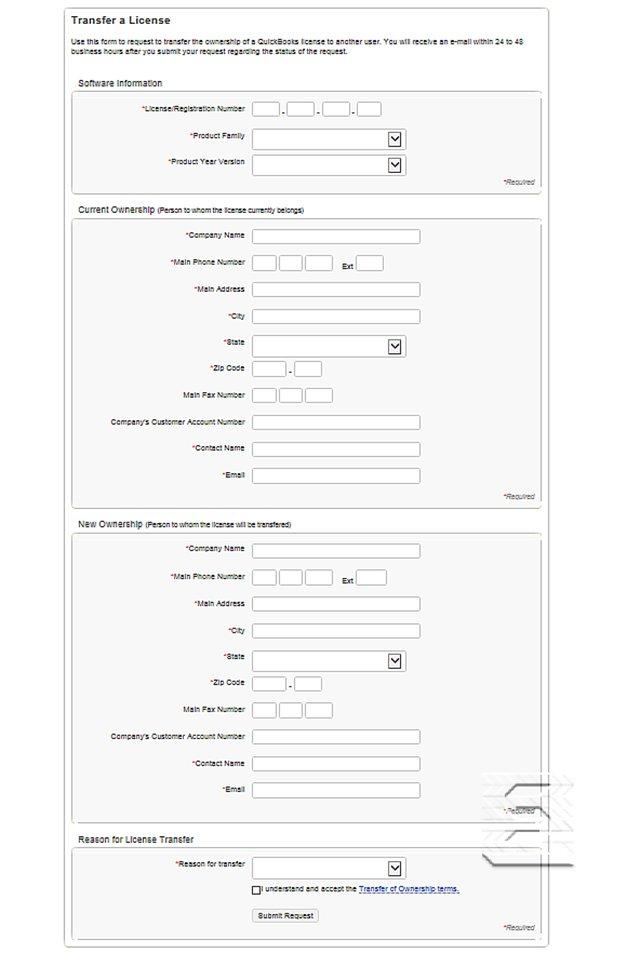

There are only a few conditions where Intuit allows a user to transfer its QuickBooks Desktop license to a new owner. A user requires filling and sending the “Transfer a License” form that will be reviewed by Intuit after submission.

Once the form gets submitted, you will get notified about your QuickBooks license transfer request through email within 24 to 48 hours. Following are the circumstances where Intuit allows you to change the ownership of QuickBooks software:

- If a business is sold to a new owner including, the assets.

- In case, a user is donating the software to a non-profit organization.

- Incorrect user information is filled during the product registration.

IMPORTANT: You can directly request Intuit for license transfer by logging in to your CAMPS account and filling up the QuickBooks Transfer a License Form.

Transferring QuickBooks Subscription to a New user

Condition 1: When a Business is Sold to a New User

In a situation where a business is sold to a new user including all the assets then in order to transfer the license, both the parties are required to submit a completed and signed (TOL) QuickBooks Transfer of License Form. Along with the TOL Intuit also requires Notarized Bill of Sale to be signed and submitted by both the parties.

Condition 2: When the QuickBooks is being Donated to a Non-Profit Organization

If such cases where a user wants to donate the QuickBooks license to a non-profit organization, intuit requires such users to submit a completed and signed 501 C Form from the IRS.

Condition 3: Changing Ownership Info when Incorrect Registration Information is filled

There are times when a user accidentally enters incorrect owner information during the product registration process. If this is the case, then you need to contact support and provide them a copy of Proof of Purchase to get the information changed.

If you are still having some concerns about changing the ownership of your QuickBooks Desktop software, then you can reach us at our Desktop Number 1.855.738.2784. Our experts are proficient in dealing with such issues and can help you transfer QuickBooks license to a new owner in the shortest time possible.

Edward Martin

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.