Reconciling is not just associated with cross-checking your current and the savings bank accounts. A lot more needs to be reconciled to be certain that your financials are accurate. To get the correct, liability-free financial report of your business, it is important to know what more lies with reconciling. We all know, apart from the benefits of reconciling the accounts during the tax season, you must also know how to reconcile payroll liabilities in QuickBooks. In this article we have discussed the method to reconcile payroll tax returns, payroll garnishments along with final steps to clear overdue payroll liabilities in QuickBooks so follow the entire article until the end for complete info.

To get help from professionals on how to reconcile payroll liabilities in QuickBooks dial 1.855.738.2784. The Pro team can effortlessly help you med your book work so that it causes no issue later

Understanding Payroll Liabilities in QuickBooks

Depending upon the bookkeeping system of your business, let us look into the liabilities. Later in the blog we list down details of Payroll Tax Deductions and Payroll Garnishments.

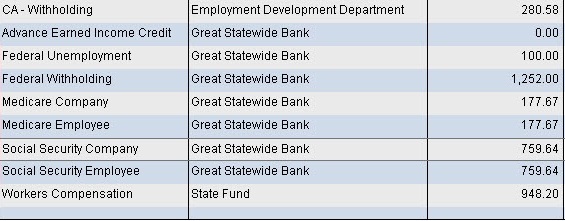

Payroll Tax Deductions

Employer expenses and employee liabilities fall under the category of Payroll Liabilities. The expenses will be labeled based on the taxes of your state as they differ between states. In Utah, the liabilities are broken down into Federal Income Tax, State Income Tax, Social Security Withholding, and Medicare Withholding. These are items that should never hit your expense report and be recorded in the liability accounts that your bookkeeper set up when the books were started.

The balances in these liabilities should almost be zero. In an understandable language, the money is held from the employee check, and that money is paid to the IRS or proper tax agency. A part of the employee paycheck is an expense, and should be booked to the liability. The same goes for the tax check. After entering both checks, you will see that the payroll liability accounts have transactions in them, but they net out to zero.

Payroll Garnishments

The garnishments should not fall into your expense reports as they are held from the employee’s paycheck, which is paid to proper agencies. The money is to be accounted properly and is to be booked to a corresponding liability account. The wages are to be garnished by the business owners and when talking about the category they fall into the following:

- Child support, spousal support, and medical support

- Creditors

- Federal and State Tax Levies

- Federal debts such as Student Loans and AWG (administrative wage garnishments)

You zero out payroll liabilities in QuickBooks once the monies are paid to the agencies. What needs to be kept in mind is that this money is not the expenses and hence must not be reflected in the profit and loss of the business.

Methods Involved for QuickBooks Payroll Liabilities Adjustment

Look out for the Discrepancies in the Payroll: Before you move ahead to adjust tax liabilities in QuickBooks, this step is essential to get all the information that you need to make the adjustment. Once you have gathered the details then move ahead with QuickBooks payroll liabilities adjustment.

Run Payroll Checkup:

Payroll Checkup is the tool available in QuickBooks Desktop that helps to do the following:

- Scanning the payroll data so as to find the missing information and the discrepancies.

- Review employee records, payroll item set up, wage and tax amounts.

- Give suggestions related to identified tax amount discrepancies on flat-rate tax.

- Click on Employees and select My Payroll Service.

- After that select Run Payroll Checkup.

- Go through the steps as they appear on the screen. Hit on Continue and go through the various steps.

Further, you have to correct the errors as informed by Payroll Checkup tool

- For each item that has error, read “fix this error now” in Data review. You will find all the troubleshooting related information along with the detailed instructions in the displayed window.

- Print the Payroll Item Discrepancies report if you find wage and tax discrepancies.

- When you click on NO, you give permission to Payroll Checkup to create wage base discrepancy adjustments.

Identify the tax discrepancies using Payroll Detail Review Report. This will eventually help you zero out payroll liabilities in QuickBooks

- Manual Adjustments are to be created so that you can correct wage or the tax discrepancies.

Steps to Create a Payroll Summary Report

- Select Reports menu and click on Employees & Payroll.

- Choose Payroll Summary and set a date range.

- Hit Refresh and Remove Hours and/or Rate.

- From the Print drop-down, choose Report to print it.

- (Optional) Change the printer setting and then select Print.

- Adjust tax liabilities in QuickBooks.

Adjust Tax Liabilities in QuickBooks Payroll

- Navigate to the Employees menu and select Payroll Taxes and Liabilities.

- Click Adjust Payroll Liabilities.

- With the tips provided below, you can effortlessly complete the fields.

- The date must be same as that of last paycheck of the affected quarter. In case you are working on the current quarter, use the present date.

- With the effective date, calculate the amounts on the 940 and 941 forms.

Based on where you need to make the adjustments, select the following:

- Click on Employee Adjustment if adjustment is to be made in the item that is company paid item.

- Select Company Adjustment if you want the balance to be removed from the Payroll Liability Balances Report.

- Select Employees.

- Fill in the Taxes and Liabilities.

- Choose Item Name that you want to adjust.

- Enter the adjustment Amount.

- Wage Base does not come to use much.

- Income that is Subject to tax, makes the adjustment in the wage base.

- To enter a note about QuickBooks payroll liabilities adjustment, use the Memo field.

Click on Accounts Affected where you want to zero out payroll liabilities in QuickBooks and press OK.

- To leave out the balances unchanged for the liabilities and expense accounts, select Do not affect accounts.

- Select Affect liability and expense accounts to enter an adjusting transaction in the liability and expense accounts. With this you will be able to Adjust Tax Liabilities in QuickBooks Payroll.

If required, repeat the steps for other employees and that is how you know how to reconcile payroll liabilities in QuickBooks.

After QuickBooks Payroll Liabilities Adjustment, See that Liabilities are Updated

You need to run the Payroll Summary report once again to ensure that everything is fine.

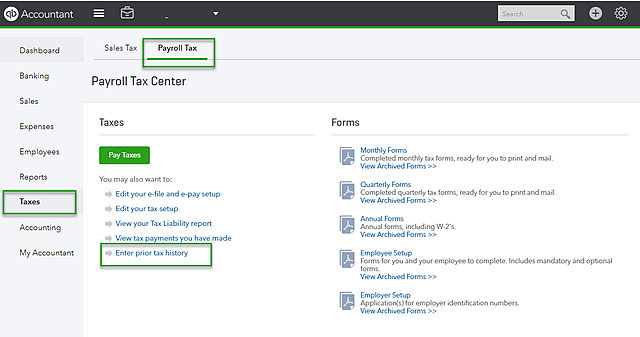

Reconcile Payroll liabilities in QuickBooks Online

Given below are the steps that will help you reconcile payroll liabilities in QuickBooks Online manually. A number of reasons might require you to edit payroll liabilities including payroll credits, penalty and interest, late filings and many more. Follow the steps for the same.

- In the QuickBooks Online Navigation bar, select Taxes.

- Click on Payroll Taxes option and under Pay taxes, press Enter prior tax history.

- Choose Current Year and Liability Period.

- After you click Add Payment, select Tax Type to reconcile payroll tax returns.

- Enter Liability Period and Period date along with Check number and Notes.

- By creating a negative amount, create a credit.

- Click on OK once you have entered all necessary information.

Inaccurate books would lead to poor financial decisions and no owner wants that. At the same time it is essential to reconcile QuickBooks payroll tax forms. Some states ask for quarterly reconciliation while some states require filing an annual reconciliation for income tax at the end of the year. To talk more about how to reconcile payroll liabilities in contact our Support at 1.855.738.2784.

Edward Martin

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.