Employers are required to eFile W2 and W3 before the end of the tax year usually before 31 January. Both of these forms are filed to Social Security Administration (SSA) to report employee’s annual income and the amount of various taxes paid by employees like Social Security taxes, State’s income tax, Medicare tax, and Federal taxes. The information on these forms must be filled very carefully as once you submit the forms, IRS will match the information on the forms with your income and taxes. If you are an active user of QuickBooks Full Service payroll, then the service will automatically calculate all the taxes and file it for you on your behalf, whereas QuickBooks Enhanced Payroll users needs to fill and submit the forms manually.

Users who are looking to file payroll forms and taxes manually can contact us at our Payroll Support Phone Number 1.855.738.2784 for assistance.

User requirements to e file W2 and W3 in QuickBooks Desktop Payroll

- You must be subscribed to QuickBooks Enhanced payroll services.

- QuickBooks Desktop application installed on your computer.

- An active internet connection.

- QuickBooks Desktop application and Payroll Tax Tables must be updated with the latest updates.

Steps to Setup W2 and W3 Forms with QuickBooks Desktop

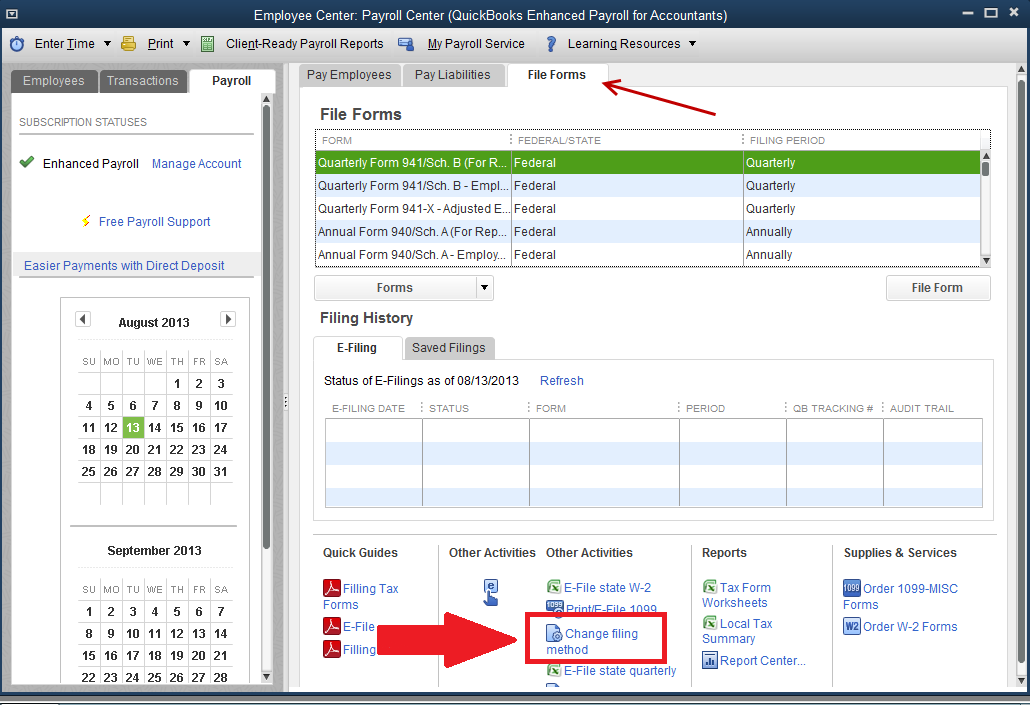

- Open your QuickBooks Desktop application and click Payroll Center under Employees

- Now under the Payroll Center select Pay Liabilities and click Change Filing Method from the Other Activities tab from the bottom.

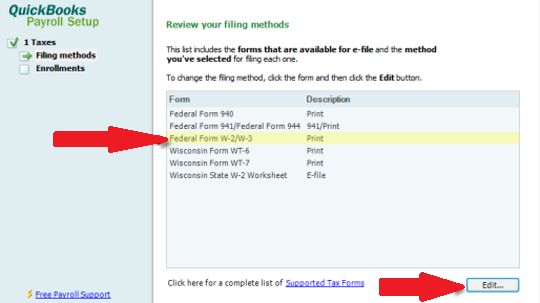

Employee Center: Payroll Center (QuickBooks Enhanced Payroll For Accountants) - Click Continue and choose Federal Form W2 / W3 from the list and click Edit.

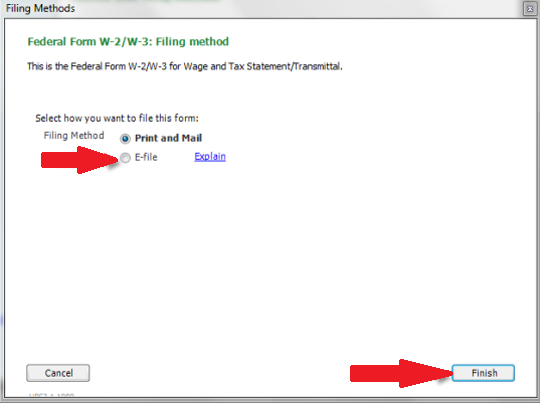

Review your Filing Method in QuickBooks - Now click E File and then click Finish to open form filling instructions.

Federal Form W2 W3 Filing Method - Exit the window, and from the left side of the QB Desktop Payroll window hit Finish Later.

Steps to create and e File W2 and W3 forms

If in case the limitations are exceeded while you eFile W2 and W3 forms you might get errors, you can also view these errors in details by selecting the View Errors option, and once the errors are fixed, you can send the form by clicking the Submit Form button. QuickBooks payroll service can only process payroll if the total number of the amount paid to your employees is less than or equal to $9,999,999.99 and the number of employees is equal to or less than 800. You can read our blog How to Reprint W2’s for your Employees if you get a reprinting request. If in case you get any error then we suggest you call Payroll Number 1.855.738.2784 for troubleshooting help.

- Open QuickBooks Desktop application and click Payroll Tax Forms and W2s.

- Select Process Payroll Forms.

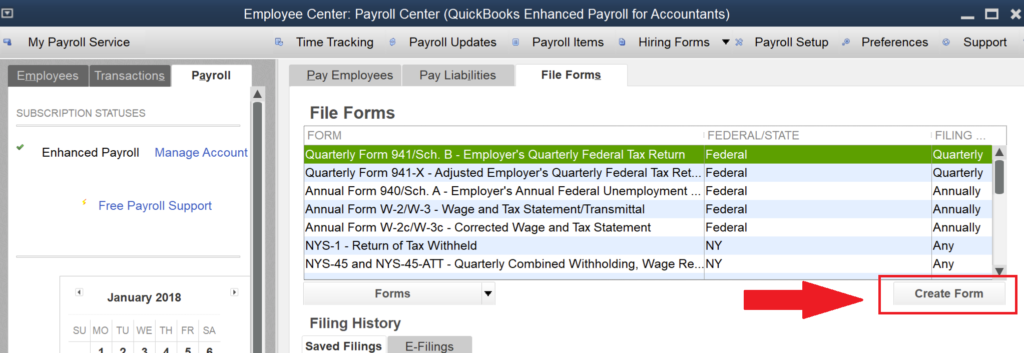

- Now from the list of forms under File Forms Section click Annual Form W-2/W-3 – Wage and Tax Statement/Transmittal and select Create Form.

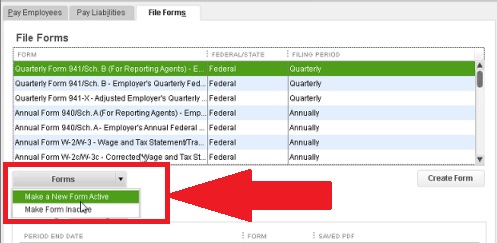

- In case if you don’t find the required form, then it may not be active, in order to activate the form click Make a New Form Active from Forms drop down list.

- Now select Federal under the State drop down list and choose W2 Forms and click the Add Form

- Now from the Forms List in File Forms window you can select the W2 / W3 Forms.

- Select Process W2’s button under the All Employees tab or for batch filing you can select Employees Last Name and From and To option.

- Type the year for which you are filing the Form in the Select Filing Period

- Now click Select Employees for Form W2 / W3 and to apply bulk action click Mark All.

- Hit the E File Federal Forms button and put in the contact number and email address of your company on the login page.

- Now for the last step to complete the e filing process click Submit.

IMPORTANT: In case if you have filed an incorrect form W-2/W-3 by mistake, then you can follow our article on How to Make a W-2 Form Correction. This article will guide you through each step of correcting W2 form errors by filing W2 and W3 correction forms(W-2 C and W-3 C).

After you have successfully submitted the forms, you will be notified by Intuit about the progress of your filed forms on your company’s email address. If you are manually filing the taxes using QuickBooks Payroll service, then we will suggest you carefully examine all the information you enter in the forms as even a minor mistake in the forms can send incorrect info to the IRS which can lead to IRS Penalties. Our team of certified tax advisors helps users to Efile W2 and W3 online in the shortest time possible, and you can reach us any time at our QuickBooks Assisted Helpline Number 1.855.738.2784.

Edward Martin

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.