Last Updated on May 5, 2025

Are you curious about the QuickBooks 941 Form? This 941 form allows companies to report federal income tax, social security, and medicare withholdings to the Internal Revenue Service. It calculates taxes for you, drafts Form 941, and reminds you of deadlines, too. And you can e-file QuickBooks Form 941 for quicker processing or print copies for your files. But you know, there is still confusion floating in the air regarding the 941 forms in QuickBooks. In this blog, we will talk about the meaning of the 941 form, usage, filing steps, and solutions to fix the errors related to form filling. All you need to do is read till the end to get your queries resolved.

We have tried our best to inform you about the 941 form in QuickBooks. If you are still not able to determine the cause of the 941 form error and are finding it hard to fix, you can contact the Accounting Helpline experts at the toll-free number 1.855.738.2784 and get your issues resolved within minutes.

What is the QuickBooks 941 Form?

Form 941 in QuickBooks is the quarterly tax return most nonfarm businesses are required to file with the IRS if they have more than $1,000 in total federal payroll taxes due, including income tax withholding, Social Security, and Medicare. Both the Online and Desktop QuickBooks Payroll products support this form. The 2023 tax year lookback period is July 1, 2021, to June 30, 2022.

You can use the table to determine whether your company is a semi-weekly or monthly tax depositor.

| Deposit Schedule | Threshold for Each Deposit Schedule |

| Semi-Weekly | Businesses that reported more than $50,000 in taxes during the lookback period |

| Monthly | Businesses that reported less than $50,000 in taxes during the lookback period |

Now you know about the QuickBooks 941 form. Let’s now have a look at the due dates of this form.

Due Dates to File QuickBooks 941 Form?

As mentioned, employers submit this form to the IRS on a quarterly basis. Another important point is that the timely filing of Form 941 during the year is required. So, it’s important to know the last day before you can file it. As for the form’s due date, it is the last day of the month after the quarter ends. Below is the table that denotes the due dates to file the 941 form in QuickBooks:

| Qurter | Form 941 Due Date |

| Jan 01 to Mar 31 | 30th April |

| April 01 to June 30 | 31st July |

| July 01 to Sep 30 | 31st October |

| Oct 01 to Dec 31 | 31st January |

The table denotes the due dates to file Form 941 in QuickBooks Desktop and Online. This will help you prevent deadlines.

Uses of Form 941 in QuickBooks Desktop & Online

Form 941 in QuickBooks helps companies in reporting payroll taxes to the IRS. QuickBooks Desktop and Online make filing this form easier. The common uses of QuickBooks Form 941 are mentioned in the pointers below:

- QuickBooks computes Federal income tax, Social Security, and Medicare taxes from the wages of employees quarterly.

- QuickBooks completes Form 941 based on payroll information, minimizing errors in manual entry.

- You can review unpaid taxes in the “Payroll Tax” area prior to filing.

- QuickBooks enables e-filing Form 941, saving time and facilitating quicker processing.

- Previous filings are stored, allowing easy review or revision of returns if necessary.

- QuickBooks generates payment vouchers (Form 941-V) for mailing with checks when the taxes are due.

- Federal tax payments can be made directly from QuickBooks using the Electronic Federal Tax Payment System.

- The 941 form also reminds you about filing and payment deadlines.

These are some common uses of the QuickBooks 941 report. Now, it is the right time to know about the steps to file a corrected federal Form 941 in QuickBooks Payroll.

How to File a Corrected Federal QuickBooks 941 Form?

Do you often make mistakes on your federal tax return? In this scenario, you need to file an amended tax form for the Federal 941 form. QuickBooks Desktop Payroll Enhanced allows you to file an amended tax return. QuickBooks also pays and files taxes for you if you have QuickBooks Desktop Payroll Assisted. Here are the steps to file QuickBooks Online Form 941:

Step 1: Selection of the 941 QuickBooks Form

You need to file an amendment form as soon as possible after you find an error on a previously filed federal form. You can correct the error by filing these forms:

- Form 941-X for the Federal Form 941.

- For federal form 940, there isn’t an “X” form. You must file the same federal Form 940 that was first filed on.

Now, after you have selected the form, you need to know about the form and the amendment fields.

Step 2: Knowing Your Amendment Form 941

Now, there are certain things that you can rectify in the form 941 in QuickBooks. Here are the things that you can correct. You can use Form 941 to correct the following items:

- Wages, tips, and other compensation;

- Income tax withheld from wages, tips, and other compensation;

- Taxable Social Security wages;

- Taxable Social Security tips;

- Taxable Medicare wages and tips

The filing due date for Form 941 varies based on when you found the error, and whether you underreported or overreported the tax.

Step 3: Prepare and File Your 941 Form

When you are filing the 941 in QuickBooks, you need to use a paper return unless you have previously e-filed the original form. You should enter any necessary liability adjustments prior to building an amended return. To prepare and submit Form 941 using QuickBooks Desktop:

- Navigate to Employees, and then choose Payroll Tax Forms & W-2s.

- Choose Process Payroll Forms.

- In the File Forms section, choose Quarterly Form 941-X – Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

- Choose Create Form.

- Choose the Filing period that you are correcting, then OK.

- Choose the return you are correcting, then the quarter.

- Enter the calendar year you are correcting.

- Enter the date that you found the errors. Use the format as shown.

- Choose the process to correct your employment tax:

- Underreported amounts only

- Only overreported amounts, through the adjustment process or claim process.

- Merging both under- and over-reported amounts on one 941-X

- Choose Next, then put in the date you found the errors.

- Under Part 1: Choose Only One Process, ensure that the process chosen is the same as the Interview part of the form.

- Under Part 2: Complete the certifications, check at least one box or check all that apply. Then, choose Next.

- Under Part 3, enter the corrections for the quarter. If any line doesn’t apply, leave it blank. Choose Next. (Note: See IRS Instructions for Form 941-X for step-by-step instructions on how to fill out the form.)

- Under Part 4, explain in detail every correction you made in Part 3. You may do this in paragraph form and include any notices from the IRS if required.

- Finally, print and send the form following the IRS guidelines for Form 941.

These are the steps to file a correct 941 report in QuickBooks Online. Now, let’s know about the errors that come while filling out the QuickBooks Online form 941.

What Causes QuickBooks Error Filing Form 941?

The only reason that you are unable to generate Form 941 is that the amount of tax filing exceeds $2500 for a quarter. IRS only requires you to file Form 941 if your total tax filing amount for a quarter is more than $2500. If the total tax amount is less than $1000, then you can file the annual tax form 944 after approval from the Internal Revenue Service.

Solution to Resolve QuickBooks Error Printing 941 Form

If you are getting error Printing Federal Form 941, then it might be because of the incorrect set up of the filing method. Follow the steps mentioned below to resolve the issue.

Solution 1: Re-Verifying the Form Filing Method

In this case, you need to reverify the method of QuickBooks Form 941 filing. The steps of reverification are as follows:

- Open QuickBooks, and from under the Employees tab, click Payroll Tax Forms & W-2s.

- Select Process Payroll Forms, and then from under the File Forms tab, click Change Filing Method from the Other Activities section.

- Follow the instructions displayed on the screen and click Continue.

- Select the Form 941 from the list and click Edit.

- Now, click Print and Mail from the Filing Method options.

- Hit Finish and try to send the form once again.

If the error is resolved, then visit the Electronic Federal Tax Payment System and submit your payment form directly to the IRS. If you are unable to resolve the error, you can move to the next solution.

Solution 2: Updating QuickBooks Payroll

Installing the latest updates of payroll resolves most of the errors related to the tax filing. Follow our article on How to Update Payroll for detailed instructions.

After updating QuickBooks payroll, try to print the tax forms once again.

- From QuickBooks Desktop, go to the Employees tab and select Payroll Tax Forms and W-2s.

- Now select Process Payroll Forms, and from under the Payroll Center, click the File Forms tab.

- Now choose the form that you need to file.

- Click File Form and select the form filing period.

- Click OK and select Check for Errors.

- Review the form and correct any mistakes found.

- Now, click Submit Form and click the E-File button.

- Follow the instructions displayed on the screen and submit the form.

If you are still receiving a Quickbooks form 941 error, then we suggest you get in touch with one of our Accounting Helpline certified payroll experts at 1.855.738.2784. Our payroll support experts have years of experience resolving Error Printing Federal Form 941 and can provide you an instant solution to the problem within the shortest time possible.

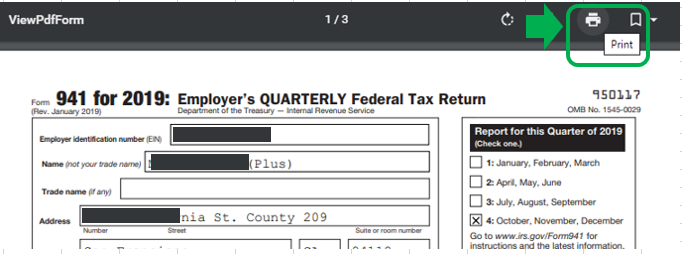

How to Print QuickBooks Form 941?

Some users want to view and print copies of QuickBooks Form 941. But they are unsure of the steps to do so. Here are the steps to print QuickBooks form 941 in easy and simple steps:

- Log in to your QuickBooks Online account.

- Navigate to the Taxes menu and then select the Payroll Tax tab.

- Click on the Forms tab.

- Click on the 941 forms.

- Finally, click on the print option.

You can also generate the Tax & Wage Summary Report to provide you with a snapshot of your employee’s taxable wages.

Summing It Up!

QuickBooks 941 form is an important component of remaining compliant with the IRS when your business has employees and you pay federal payroll taxes. QuickBooks makes filing Form 941 simpler and quicker. QuickBooks computes the taxes, fills out the form, reminds you when deadlines are near, and even lets you e-file. If you do make a mistake, QuickBooks also offers the ability to file a corrected 941 form (Form 941-X). And you can print, check, or refile the form if necessary. We have covered all the information in this blog regarding QuickBooks Form 941. Still, if you need more assistance, you can reach out to us at the toll-free number mentioned.

FAQs

What is QuickBooks Form 941?

Form 941 in QuickBooks is the quarterly tax return most nonfarm businesses are required to file with the IRS if they have more than $1,000 in total federal payroll taxes due, including income tax withholding, Social Security, and Medicare.

Does QuickBooks file quarterly reports?

Yes, QuickBooks assists companies in filing quarterly payroll tax returns such as Form 941, which reports federal income tax withheld, Social Security, and Medicare withholdings. The software computes these taxes automatically every quarter and has the forms ready for you to review and file.

How to enter tax payment in QuickBooks?

To account for tax payments in QuickBooks, first navigate to the “Payroll Tax” section under the Employees menu. Click on “Pay Taxes” and select the type of tax you’re paying (federal, state, or local). Input the payment date, amount, and choose the bank account to be paid from.

How to file Form 941 in QuickBooks Online?

It is easy to file Form 941 in QuickBooks Online. Begin by going to the Taxes tab and choosing Payroll Tax. Choose File Forms, then select Form 941 for the proper quarter. QuickBooks populates your payroll information automatically, but double-check it for correctness. You can e-file directly in QuickBooks or print and mail it if you prefer.

How to find the 941 report in QuickBooks Desktop?

If you want to find the 941 report in QuickBooks Desktop, you must first sign in to QuickBooks Online. Then, visit the Taxes tab, click Payroll Tax, and select the Quarterly Tax option. Now, you need to choose the option containing ‘941 form’, select the time range, and click the view option.

Related Posts-

QuickBooks Check Alignment Problems – Troubleshoot Guide

QuickBooks Sales Tax Center Not Working? Know How to Fix in Simple and Quick Steps

Resolving QuickBooks Payroll Not Deducting Taxes Issue With Causes & Solutions to Fix

Fixing the Save and Close Button Missing in QuickBooks Error

Fixing the ‘QuickBooks Requires that You Reboot Loop’ Issue in Simple Methods

Complete Guide on QuickBooks Payroll Update: Errors & Solutions

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.