Last Updated on March 10, 2025

QuickBooks payroll most common errors are inclusive and cannot be guaranteed while running payroll. Therefore, knowing the numerous types, causes, and resolutions of these errors lets you breathe a sigh of relief when needed. With this guide, you’ll discover the world of bugs and glitches encountered when you run QuickBooks Payroll.

QuickBooks Payroll is one of the most desirable services that allows you to automate calculations and facilitate tax implications. Despite its significance for the user community, the reports regarding error codes, glitches, and crashes occurring while running or submitting payroll, direct deposits, etc., are high. Therefore, anybody intending to use QuickBooks Payroll needs a basic understanding of these glitches, what they can do, and how to prevent them. So, let this expert guide understand the payroll errors in detail.

Do you wish to know why you encounter QuickBooks Payroll most common errors? Or are you fascinated by the ways it can be resolved? Regardless of what your query is regarding, this guide will satisfy each question seamlessly. However, some detailed or specific questions will need personal expert guidance, which you can avail of at 1.855.738.2784 by Accounting Helpline team.

A Checklist of Common Payroll Errors- Codes and Descriptions

Here is a list of some of the most common QuickBooks Payroll errors & their solution, descriptions, codes, etc.

QuickBooks PSXXX-series errors

QuickBooks PSXXX-series errors correspond to issues arising while downloading payroll updates. Users undergo trouble updating downloads because of incorrect internet connection settings, firewall blockages, and a damaged CPS folder file.

Some PSXXX codes and their descriptions include:

| PSXXX Code | Description |

| PS033 | The QuickBooks payroll update could not download successfully because the company file necessary to undertake payroll is damaged or missing. |

| PS032 | An incorrect service key or damaged files yield trouble installing payroll updates. |

| PS077 | An incomplete or damaged update seeds troubles in downloading the latest payroll tax table updates. |

| PS058 | Your payroll subscription has an invalid or incorrect Employer Identification Number (EIN). |

| PS060 | You have not updated the company file utilized for payroll to the latest QuickBooks version. |

| PS034 | The application couldn’t detect/ find/ access the crucial program files necessary to undertake QuickBooks Payroll updates. |

| PS036 | An inactive QuickBooks payroll subscription or outdated billing information causes trouble downloading payroll updates. |

| PS101 | The error pops up since the QuickBooks payroll server couldn’t establish any connection while updating QB. |

| PS107 | Downloading or installing payroll updates becomes troublesome with this error. |

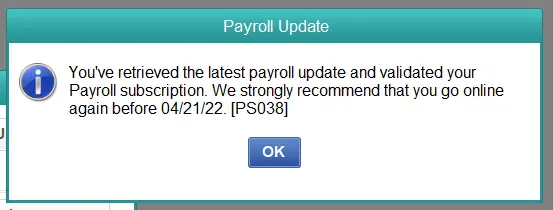

| PS038 | When QuickBooks can’t validate the subscription because an invalid or expired service key exists, the error PS038 emerges. |

QuickBooks 15XXX-series Errors

The 15XXX series errors in QuickBooks also arise while downloading payroll updates and halt the procedure. It usually throws an error when companies try availing of the latest payroll tax table updates.

QuickBooks error 15242

QuickBooks users encounter the 15XXX-series errors due to the following triggers:

- Inaccurate mapping of the Shared Download Drive

- Not possessing a critical file or component for payroll updates

- Misconfigured Internet Explorer settings

- Firewall blockages halting payroll updates in QBDT

- Disabled QuickBooks File Copy Services (FCS)

- Ineptitude to verify digital signatures

The numerous 15XXX-series error codes have the following descriptions and implications:

| 15XXX Error Code | Description |

| Error 15215 | The error 15215 halts QuickBooks update processing because the program encounters challenges verifying the digital signature of a file required for payroll updates. |

| Error 15311 | You may have to go through Error 15311 because of problems with the digital signature verification of a file during the QuickBooks payroll update. |

| Error 15101 | A flashing Error 15101 on a user’s screen indicates an issue with the QuickBooks update program or service preventing payroll updates. |

| Error 15240 | QB error 15240 relates to issues downloading payroll updates caused by internet connectivity problems or incorrect settings. |

| Error 15243 | Encountering QB error 15243 suggests that a file required for QuickBooks update or payroll is not accessible or is missing. |

| Error 15102 | QuickBooks users experience error 15102 when the program fails to access or verify the location of the payroll update files. |

| Error 15320 | QB users face error 15320 when there is a problem with file access or digital signature verification during the QuickBooks payroll process. |

| Error 15241 | Error 15241 signals a QB user that the QuickBooks payroll update could not be concluded due to a file being in use or permission issues. |

| Error 15242 | With QB error 15242, you can’t accomplish QuickBooks payroll update or download because of insufficient permissions or files in use. |

| Error 15243 | Error 15243 suggests that you miss a file required for QuickBooks update or payroll, OR it is not accessible. |

| Error 15212 | The error 15212 interrupts the payroll update procedure because of inaccurate mapping of the shared download drive. |

| Error 15222 | Failure to establish an internet connection to download the payroll update files leads to error 15222 in QB payroll. |

| Error 15270 | A missing file can cause significant trauma while updating QuickBooks payroll. |

| Error 15271 | If the Windows Registry is damaged, you cannot escape QuickBooks error 15271 while downloading payroll. |

| Error 15276 | Not having the latest tax tables arranged in your system can lead to this error. |

QuickBooks Error 2170

QuickBooks users experience error 2170 when attempting to pay via the direct deposit feature in the employee payroll. This payroll glitch usually arises because of the following:

- Erased QB records that were critical to the transaction

- Corrupt Windows Operating System

- Out-of-date QB Desktop

Resolving this problem would require verifying whether the critical files are present, QB is up-to-date, and Windows OS is perfectly functional.

QuickBooks 12XXX-series Errors

QuickBooks payroll errors also include the 12XXX series, which usually correspond to glitches in payroll services. Internet connectivity is one of the significant reasons for such errors. Some of these codes for the QuickBooks Payroll error include

QuickBooks Error 12007

| 12XXX Error Codes | Description |

| Error 12002 | QuickBooks Error 12002 interrupts a user attempting to communicate with the QuickBooks Payroll service due to a network timeout or connectivity issue. |

| Error 12007 | Error 12007 suggests a problem with the internet connectivity settings, firewall, or security software blocking QuickBooks Payroll updates, thereby delaying seamless payroll functioning. |

| Error 12029 | QB users experience error 12029 when there is a network connection issue preventing QuickBooks from accessing the QuickBooks Payroll service. |

| Error 12031 | Error 12031 signals a problem with the internet connection settings, firewall, or network configuration, preventing QuickBooks Payroll updates and causing security concerns. |

| Error 12037 | With Error 12037, QuickBooks users experience a problem with the SSL settings or internet connectivity while attempting to access the QuickBooks Payroll service. |

| Error 12045 | Error 12045 restricts communication because of a problem with the security certificate used by the QuickBooks Payroll service. |

| Error 12052 | QuickBooks Error 12052 doesn’t let users access payroll features because a problem exists with the QuickBooks Payroll service. It creates significant troubles in seamless payroll functioning. |

| Error 12057 | Error 12057 indicates that there is an issue with the internet connectivity settings or network configuration preventing QuickBooks Payroll updates. |

| Error 12058 | With Error 12058, QuickBooks users encounter a problem with the internet connectivity or security settings, preventing QuickBooks from accessing the QuickBooks Payroll service. |

| Error 12059 | Error 12059 flashes on a user’s screen with a warning when an issue with the internet connectivity settings, firewall, or security software exists, thereby blocking QuickBooks Payroll updates. |

Payroll Service Server or Payroll Connection Error

The common QuickBooks Payroll errors include two error descriptions that arise while users download payroll updates or direct deposit paychecks. These descriptions state the following:

- “Payroll Service Server Error. Please try again later. If this problem persists, please contact Intuit.

- Payroll Connection Error.”

These error messages have the following triggers as their source:

- The security certificate may be invalid

- You might have sent Payroll data in multi-user mode.

- A Network timeout may block QB users from availing of the server.

- General connection issues on the internet.

- Security and personal firewall settings may be limiting.

- The system time and date properties may not sit well with the program as they’re incorrect.

Other QuickBooks Payroll Errors

Several other error codes related to the payroll feature of QuickBooks Desktop exist, indicating specific issues and crashing the existing payroll functioning. Some of these error codes include 30115, 30102, 176103, etc.

While some of these arise due to internet connectivity issues, others emerge when the payroll service keys or subscriptions can’t be validated. Regardless of the causes for these payroll errors, their interruption is annoying and requires immediate troubleshooting.

Probable Reasons Why QuickBooks Payroll Most Common Errors Arise

To Resolve QuickBooks Payroll Most Common Errors, QuickBooks users must acquire sufficient insights about their origin reasons. That is why we have detailed the triggers causing payroll update procedures to halt, payroll tax tables not to download, and other payroll functionalities to crash.

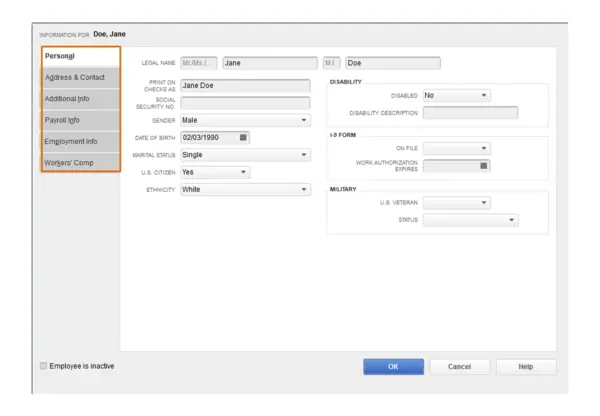

Incorrect Payroll Setup

QuickBooks Payroll errors may arise if the payroll settings in QuickBooks are not configured correctly or if discrepancies exist in the payroll setup process. These issues take the form of incorrect tax settings, invalid payroll item setup, or incorrect employee information.

Outdated QuickBooks Version

If you’re still fixed on an outdated version of QuickBooks, you may fall prey to compatibility issues with payroll updates that result in errors.

Internet Connectivity Issues

As witnessed above, several QuickBooks payroll errors arise because the system lacks stable internet connectivity. Without a sturdy internet connection, various payroll-related tasks such as downloading updates, processing payroll taxes, or accessing online payroll services crash, load sluggishly, etc. Further, during these activities, QuickBooks users can encounter network problems, firewall settings, or slow internet connection.

Damaged or Corrupted Company File

If the QuickBooks company file associated with payroll is damaged or corrupted, payroll errors can emerge. The company file corruption and compatibility with payroll operations can occur due to power outages, network issues, computer crashes, or improper file handling.

Incompatible, Corrupt, or Outdated Operating Systems

Running QuickBooks payroll on a conflicting, corrupt, or outdated operating system may cause errors to emerge while functioning normally. QuickBooks has specific system requirements, so you’ll encounter compatibility issues when you utilize an unsupported OS version.

Incomplete or Failed Payroll Updates

QuickBooks payroll errors arising while you undertake a function, computation, etc., may emerge if payroll updates are not installed correctly or fail to complete. So, ensure the QuickBooks payroll updates do not face interrupted downloads, installation errors, or insufficient user permissions.

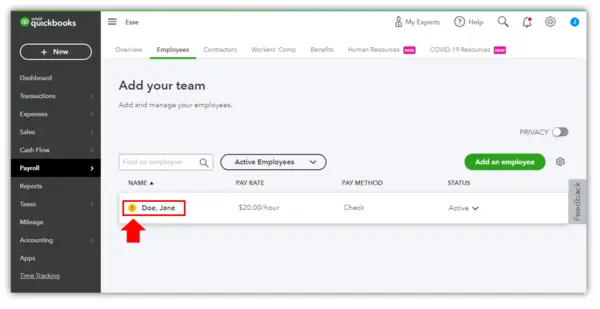

Incorrect Employee Data

QuickBooks payroll errors can occur if employee data, such as Social Security numbers, addresses, or tax information, is entered incorrectly or incomplete. Accurate employee information for payroll calculations and tax filings is a must for QB to run seamlessly, and any conflicts can lead to glitches.

Payroll Tax Table Issues

QuickBooks uses tax tables to calculate payroll taxes accurately. So, issues like outdated or missing tables can mess up payroll and lead to errors or incorrect tax calculations.

Third-Party Software Interference

Specific third-party applications, antivirus software, or firewall settings can interfere with QuickBooks payroll processes and cause errors.

User Error

Mistakes made during payroll processing, such as erroneous entries, improper payroll item selection, incorrect billing details, wrong bank information input, or faulty pay rate calculations, can result in glitches.

The incapability of verifying digital signatures

QuickBooks Payroll requires verifying digital signature certificates of several updated files or payroll procedures for security reasons. Failure to do so or having an invalid digital signature can lead to some of the most common QB payroll errors.

Accessing Payroll While Multi-user Mode is ON

Facilitating QuickBooks payroll while the multi-user mode is turned ON can trigger various operating errors.

Firewall and Security Software Threats

Suppose your firewall settings and security programs do not consider QuickBooks. In that case, they will restrict its internet functioning and prevent it from running without errors.

Problems with the System’s Date and Time

No internet browser or QuickBooks function can run seamlessly if the time and date settings are inaccurate.

Damaged CPS folder or disabled FCS Services

The File Copy Services in QB are critical to running payroll functions, so if they’re disabled, glitches will arise. Similarly, QB payroll’s most common errors will engulf the system if the CPS folder is corrupt or damaged.

These reasons generally apply to all payroll errors, but the specific causes may vary for every code and description. Ensure to consider QuickBooks official documentation and community discussions to verify which error you’re encountering and ways to rectify it.

Now that we’ve got enough insights in our heads about the most common QuickBooks payroll errors and how they interrupt a user’s operations, we can proceed with their troubleshooting.

Rectification Methods for QuickBooks Payroll Most Common Errors

With so much information about the payroll glitches affecting the system, let’s solve them with expert-recommended solutions:

Resolution #1: Update QuickBooks and Payroll Tax Tables

Initiate any resolution concerning QuickBooks payroll errors by verifying your current program and payroll tax table versions. Then, if you find them outdated, your job is to update them to the newest ones and get the benefits of bug removals, security enhancements, and overall better functionality.

Step 1: Look for QuickBooks Updates

Initiate this resolution technique by reviewing the system for new QB updates via the following actions. However, you can first know your existing QB release from the Product Information window (Press F2 or Ctrl + 1 keys on the keyboard)

- When you launch the QuickBooks program, the menu section will contain the “Help” tab.

- Under the Help menu, select “Update QuickBooks Desktop.”

Further, download the newest QB versions via the “Update Now” option in the “Update QuickBooks” window. - Select the “Get Updates” option to trigger the download if any updates are available.

- Once you notice the QuickBooks update ending, restart QuickBooks, and the updates can be installed in your system.

Step 2: Verify Payroll Subscription

Ensure your QuickBooks payroll subscription remains active and functioning through the following measures:

- Begin the procedure by launching QuickBooks and moving to the “Employees” menu.

- The Employees section will have the “My Payroll Service” option, from where you need to tap on “Account/Billing Information.”

- You might be required to log in to the system. So, input your Intuit account credentials in the necessary fields.

- Now, you can review if your payroll subscription is active and up to date.

Step 3: Update Payroll Tax Tables

After QuickBooks is updated, you can direct the cursor toward the payroll tax tables:

- After ensuring that QuickBooks is updated, go to the “Employees” menu.

- Here, hit “Get Payroll Updates.”

- From the “Get Payroll Updates” window, opt for the “Download Entire Update” button, followed by “Update.”

- QuickBooks will initiate the download procedure for the latest payroll tax table updates. Wait a few minutes because the update will finish based on the size of the file and internet speed.

- When the payroll tax tables finish updating, QuickBooks users will receive a message confirming the successful installation of the payroll tax table.

Step 4: Verify the Tax Table Update

Ensure that you have gotten the latest QuickBooks payroll tax tables without a hassle:

- To verify that the payroll tax table update was applied successfully, access the “Employees” menu.

- Prefer the “Payroll Center” for further movements and then pick the “Payroll Center” tab.

- Discover the “Tax Table Information” section and verify that the effective date matches the latest tax table update.

Resolution #2: Fix the System’s Time and Date Properties

You won’t be able to undertake any action if the system’s time and date are messed up. So, give the following steps a try and fix QuickBooks payroll most common errors:

On Windows:

- The time and date settings require you to right-tap the clock in the bottom-right corner of the taskbar.

- When you right-tap, some choices will appear on the screen; hit the “Adjust date/time” or “Date and time settings” from here. Once you do that, you’ll be able to open the Date & Time settings.

- You need to verify that you have enabled the “Set time automatically” toggle in the Date & Time settings window.

- With this procedure, you can ensure that Windows syncs the date and time with an online time server.

- However, Suppose the date and time set automatically are incorrect. In such cases, your task is to disable the “Set time automatically” toggle.

- Instead, you can utilize the mouse to tap on the “Change” option, which you can find while navigating the “Set the date and time manually” tab.

- Then, when you open the Date and Time window, you’ll become capable of modifying the date, time, and time zone settings to be the accurate numbers.

- All these settings need to be saved by tapping “OK” to preserve the changes.

- If you want, you can turn on the “Set time automatically” toggle again to facilitate automatic time syncing with the time server.

On Mac OS:

Correct the System’s Time and Date Properties on Mac

- When incorrect time and date settings hover over Mac OS and overpower other functions, proceed to the Apple menu in the top-left area of the screen.

- Next, you need to choose the “System Preferences” option from the drop-down menu.

- Further, as the System Preferences window opens, you must tap “Date & Time.”

- Then, in the Date & Time tab, you must ensure to tickmark the “Set date and time automatically” option. When you configure this setting, you essentially allow macOS to sync the date and time with an online time server.

- If you find out that the date and time values are still incorrect on your system, you can keep the frustrations away by un-marking the “Set date and time automatically” option.

- Then, you need to access the lock icon in the bottom-left corner located in the Date & Time tab and enter the administrator password that grants you to make modifications.

- These settings will ask you to manually adjust the date, time, and time zone settings to the accurate values.

- Recheck the “Set date and time automatically” option to enable automatic time syncing with the time server.

- Finally, conclude this entire ordeal by shutting down the System Preferences window.

Resolution #3: Use Quick Fix My Program

Most QuickBooks Payroll common errors emerge because the files to be updated are still in use and can’t be replaced. In such circumstances, the Quick Fix My Program tool from the QuickBooks Tool Hub is an excellent utility. It is instrumental in rectifying performance problems with the application. So, undertake the QFMP resolution through the following actions:

- As you reach the authentic Intuit website, you can explore the website for the QuickBooks Tool Hub download page.

- Locate the download link for the QuickBooks Tool Hub to let the procedure begin.

- Once you have downloaded the setup file, double-tap it to start the installation process.

- Once you’re done with the download and installation of QuickBooks Tool Hub, it’s time to launch it.

- Once the QuickBooks Tool Hub launches, you will see a variety of tools available. However, we specifically need the “Program Problems” tab for the “Quick Fix My Program” tool to rectify QuickBooks Payroll most common errors.

- After you hit the “Quick Fix My Program” tool, the program automatically scans and diagnoses issues with QuickBooks installation and attempts to fix them.

- Depending on the specific issue detected, the Quick Fix My Program tool may provide you with additional instructions or steps to resolve the problem.

After the tool has completed its process, close the QuickBooks Tool Hub and restart the QuickBooks application.

Resolution #4: Repair the QuickBooks Program

You might need to fix the QuickBooks program from the Control Panel or Settings to fix the most common QuickBooks payroll errors. Any damaged or corrupt file will be addressed when the Repair utility runs. However, you can enforce it through the following measures:

- Open the Control Panel or Settings from where they’re situated in the respective operating system.

- Once these utilities launch, access the Programs and Features >> Uninstall a Program (Control Panel) or Apps >> Apps and Features (Settings).

- When these windows open, you must reach a checklist of programs installed on the system. Your job is to scroll or filter the results to uncover the QuickBooks application.

- As the QB program option emerges, right-hit the application and tap the Modify/ Remove/ Repair a program button to initiate the scanning, diagnosis, and resolution procedure.

- According to your OS, the entire repair procedure will take a few moments. However, once it’s over, you can reboot the system and implement the effects.

- Finally, rerun QB and verify the presence of errors causing glitches in the system.

Bottom Line

Concluding the entire blog, we hope we have offered in-depth insights about the QuickBooks Payroll Most Common Errors. Although we have mentioned the leading solutions to rectify the procedure, we still believe that payroll errors can be pretty complex to deal with. In that case, you can contact our Accounting Helpline representatives at 1.855.738.2784.

FAQs

What are QuickBooks Payroll Most Common Errors?

QuickBooks Desktop Payroll errors arise while a user undertakes payroll functionality and attempts to send, submit, or use those features for calculations, etc. It can also emerge while directly depositing employees’ paychecks, which can cause significant disruptions when not delivered on time. Further, QuickBooks payroll errors impact the update downloading and installation and may trigger glitches, crashes, and freezes when the procedure continues.

Payroll computations and drafts have legal implications due to the tax aspect involved in the procedure. Therefore, any inaccuracy or outdated information, incomplete payroll, or other glitches can lead a business to the trap hole with the Internal Revenue Service (IRS).

How do I know I have been affected by QuickBooks Payroll Most Common Errors?

You’ll know that QuickBooks Payroll errors have impacted your system if you get the following signs:

1. The QuickBooks Payroll functionalities will halt, freeze, and crash.

2. You won’t be able to download and install QuickBooks payroll tax table updates.

3. The Direct deposit feature won’t work anymore.

4. Other payroll characteristics and activities lag in performance.

What should I do to prevent or work as a pre-measure when encountering the most common QB payroll errors?

You can avoid or pre-consider the following things when payroll errors affect the system:

1. Check the QuickBooks application version you currently own and update if necessary. The same applies to QB payroll tax tables.

2. Next, check the time and date.

3. Review if the Internet Explorer, firewall, and security settings need configuration.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.