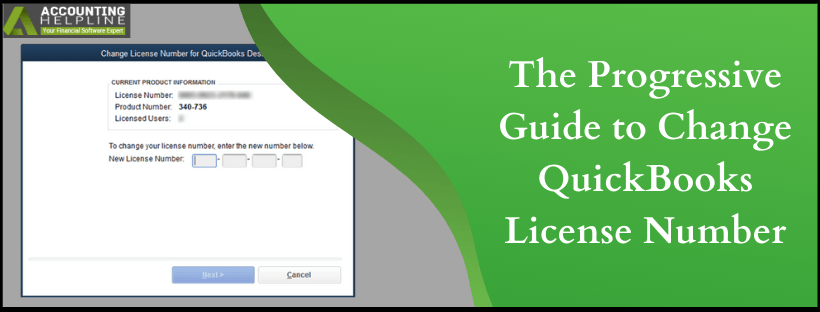

The Progressive Guide to Change QuickBooks License Number

Last Updated on March 10, 2025

When you upgrade to a newer version of QuickBooks Desktop, you are required to change QuickBooks license number to register the latest product. It might be confusing for the users when it comes to updating the license number and product code after the product upgrade. Every year when a newer version of QuickBooks is launched, users start searching for “How do I Change my QuickBooks License Number?” or “How do I Add a License to QuickBooks?” Once you have received your license registration key and the new product number, it is quite easy to enter the product registration information in QuickBooks. This tutorial will show you a step-by-step method to change the license and product number in QuickBooks.

Need Help Updating License and Product Number in QuickBooks? Call the Accounting Helpline Support Number 1.855.738.2784 to Get in Touch with our Support Experts

Read More »The Progressive Guide to Change QuickBooks License Number

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.