Last Updated on May 7, 2025

Has your friend ever borrowed money from you and never returned it? If the answer is yes, then this is the perfect example of a bad debt in accounting terms. You might forget it, but an accountant never will. Now, think about this on a larger level. If you are operating a firm that gives products to customers on credit and they never pay the bill, this comes under a bad debt. You have to remove such bad debts from your company’s overall accounting journal. If you prefer QuickBooks, knowing about the steps to write off bad debt in QuickBooks is going to help you a lot. In this blog, we will help you know about the concept of bad debts, the need to write them off, and the QuickBooks bad debt write-off process.

Are you still confused in the process of writing off bad debt in QuickBooks? Don’t worry! The Accounting Helpline experts are just a call away. Take out your mobile and dial our toll-free number 1.855.738.2784 to get quick assistance in no time!

What is Bad Debt in QuickBooks Desktop?

We are familiar with the word ‘bad debt’ in general. Bad debt refers to a sum of money that becomes unrecoverable for the payer or the organization. This happens because of the customer’s inability to return the amount of money borrowed from the organisation.

Bad debt in QuickBooks refers to the situation when the invoices you send in QuickBooks Desktop become uncollectible. As a result, you put them under the category of bad debt and write them off. Writing off in accounting is a phrase used to refer to the elimination or reduction of a transaction.

What is the Need to Write Off Bad Debt in QuickBooks?

When you say you want to write off a bad debt in QuickBooks, you mean to remove the transaction from the accounting journal. There can be several reasons to write off bad debt in QuickBooks Desktop. Some of these reasons are as follows:

- Writing off the bad debt accurately reflects the company’s financial records.

- Writing off the bad debt is a part of Generally Accepted Accounting Principles (GAAP) that is accepted worldwide.

- It helps in the tax deduction process while following the accrual methods.

- It helps in improving the cash flow forecasting in QuickBooks.

These are the reasons why some users prefer writing off invoices in QuickBooks. Now you know the need to write off the bad debt, let’s discuss how it is done.

02 Steps to Write Off Bad Debt in QuickBooks Desktop

Writing off the bad debt in QuickBooks will make sure that your accounts receivable and net income are up-to-date. On the Desktop version, we need to follow the two steps to write off a bad debt. The two steps that we will implement under the QuickBooks Desktop write-off bad debt process are as follows:

- Adding an Expense Account

- Closing Out the Unpaid Invoices

Let’s now look at these two steps to write off QuickBooks bad debt for the Desktop version.

Step 1: Adding an Expense Account to Track the Bad Debt

Before writing off the bad debt, you need to identify it. You need to add an expense account to track the bad debt in QuickBooks Desktop with the help of the following steps:

- You need to visit the Lists menu in QuickBooks and choose the Chart of Accounts option.

- Next, you need to click on the Account menu and choose New.

- Here, you need to choose Expense and pick Continue as an option.

- You need to enter an Account Name here; it can be anything (for example, use Bad Debt).

- Finally, you need to click on the Save and Close option.

After you have completed these actions, you are ready to proceed to the next step.

Step 2: Closing Out the Unpaid Invoices

The next step involves the closing of the unpaid invoices. The actions for the second step are mentioned below:

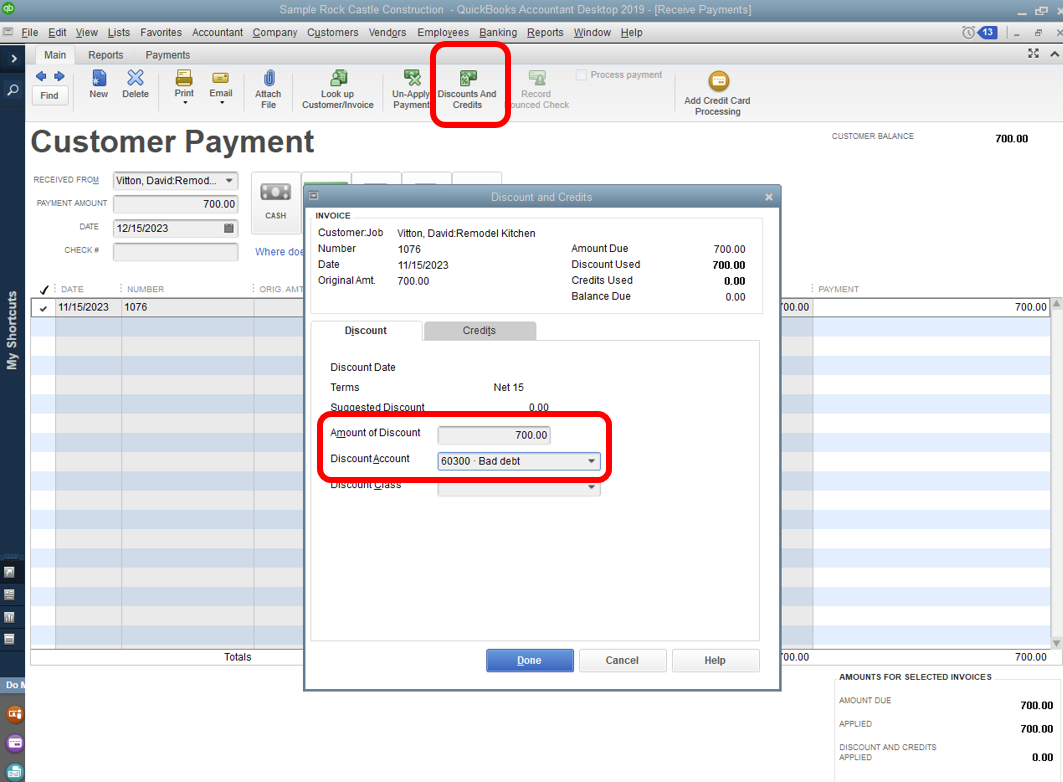

- You need to go to the Customers menu and choose the option Receive Payments.

- Now, you have to fill in the name of the customer in the Received from box.

- Here, you need to enter $0.00 as the payment amount and proceed to the Discounts and Credits.

- You have to enter the amount that you want to write off in the Amount of Discount field.

- You need to select the account that you created in step 1 for the Discounts Account.

- Finally, you need to click Save and Close.

These actions mark the end of the write-off process for bad debt in QuickBooks Desktop. Now, there will be some people using QuickBooks Online. We have got them covered in the sections below.

Quick Methods to Write off Bad Debt in QuickBooks Online

For online users, the process of writing off bad debt in QuickBooks can be a bit lengthy and confusing. That’s why we have covered this under the six simple steps. The overview of the steps to write off bad debt in QuickBooks Online is as follows:

- Checking Your Aging Accounts Receivable

- Create a Bad Debts Expense Account

- Creating a Bad Debt Item

- Creating a Credit Memo for the Bad Debt

- Applying the Credit Memo to the Invoice

- Running a Bad Debt Report

These are the six steps that we will discuss to write off an invoice in QuickBooks Online. Let’s cover these steps in detail.

Step 1: Checking Your Aging Accounts Receivable

Under this step, you also need to review other invoices or receivables that must be labeled as bad debt according to the Accounts Receivable Aging Detail (ARAD) report. The process to check your accounts receivable is as follows:

- You need to go to the Reports section.

- Here, you need to search for and open an Accounts Receivables Aging Detail report.

- Lastly, you need to check which outstanding accounts receivable should be written off.

After you have completed the above actions, you need to proceed to the second step.

Step 2: Create a Bad Debts Expense Account

Creating a bad debt expense account is important, so if you have not created it yet, you can do it with the help of the following action points:

- Proceed to the Settings and select the Chart of Accounts option there.

- Now, you need to select New from the top right space to create a new account.

- Click and choose Expense from the account type dropdown menu.

- You need to tap on Bad Debts from the Detail Type dropdown menu.

- Finally, you need to enter ‘Bad Debts’ in the name field and select Save and Continue.

Now, you have successfully created a bad debts expense account. You can move to the third step from here.

Step 3: Creating a Bad Debt Item

Have you created a bad debt item in QBO? If not, you need to make a non-inventory item responsible for the bad debt. The process to create a bad debt item in QuickBooks Online is as follows:

- Visit the Settings menu and choose Products and Services.

- Select New from the top-right corner and choose Non-Inventory from there.

- Type in ‘Bad Debts’ in the name field.

- You need to choose the Bad Debts from the Income Account dropdown menu.

- Tick in the checkbox stating ‘I sell this product/service to my computers’ and select Save and Close.

Note: This is just a virtual process followed to balance out the Accounting in QBO. These actions result in creating a bad debt item in QuickBooks Online. You can move to the fourth step to continue writing off the bad debt in QuickBooks Online.

Step 4: Creating a Credit Memo for the Bad Debt

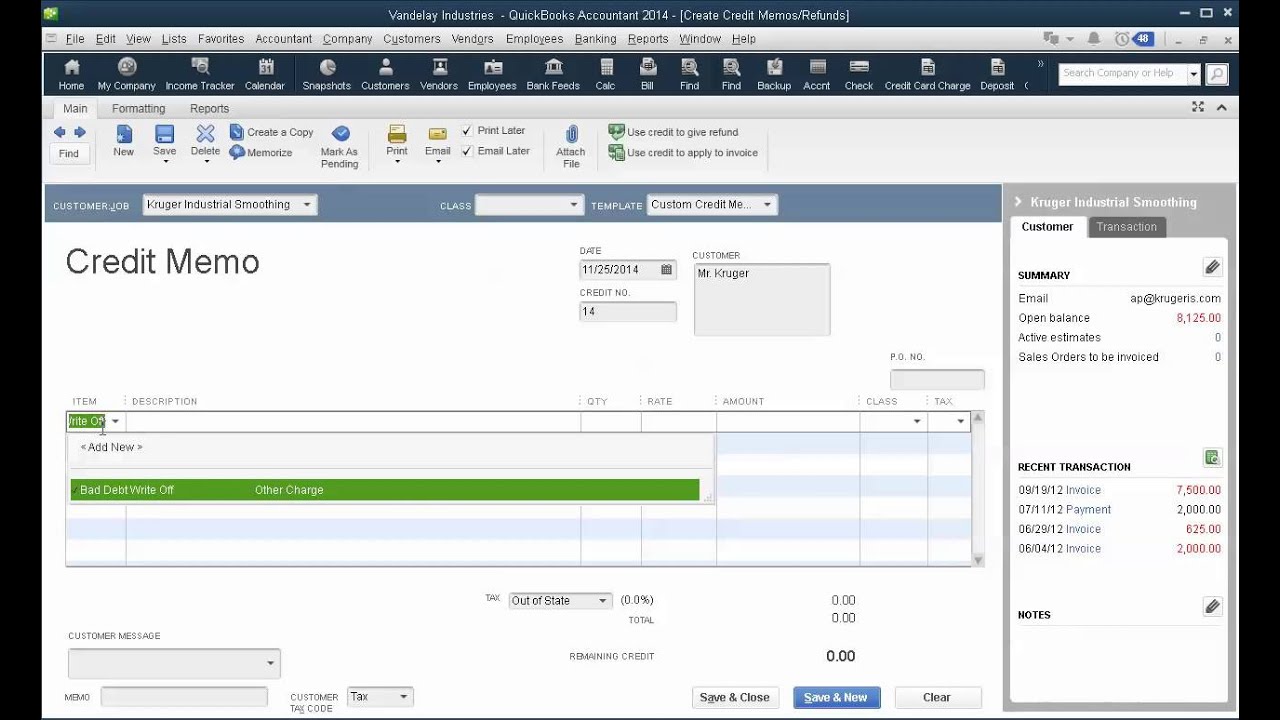

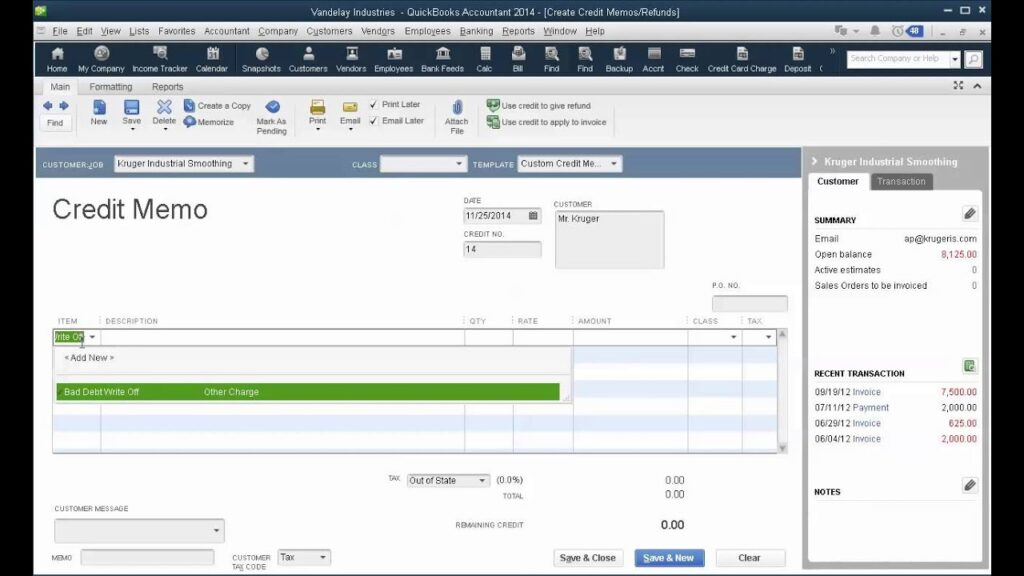

The next step is to create a credit memo for the bad debt. The actions to create a credit memo are as follows:

- You need to select the New option and choose Credit Memo from there.

- Now, you need to choose Customer from the Customer Dropdown menu.

- You need to choose the Bad Debts from the Products/Services section.

- Here, you need to enter the amount that you want to write off.

- Now, you need to enter ‘Bad Debt’ in the message displayed on the statement box.

- Finally, you need to select Save and Close to complete the process.

These are the actions that you must follow to make a credit memo for the bad debt. Now, you are all set to proceed to the fifth step.

Step 5: Applying the Credit Memo to the Invoice

Now, you need to use the credit memo on the invoice. This will show the bad debt under the P&L account. The actions for applying the credit memo to the Invoice in QuickBooks Online are:

- You need to click on the New option there.

- Then, you need to choose the Receive Payment option under the Customers tab.

- Again, you need to choose the appropriate customer from the Customer Dropdown menu.

- Now, you need to choose the invoice from the Outstanding Transactions.

- Select the credit memo from the Credit section and tap on Save and Close.

Now, you will be able to see the bad debt or the uncollectible receivables on your Profit & Loss report under the Bad Debts expense account. Now, the only thing left is to run a bad debt report.

Step 6: Running a Bad Debt Report

Last but not least, this step will run a bad debt report. You have almost completed the process of writing off bad debt in QuickBooks Online; it is just the last nail in the coffin. You need to check all the receivables you flagged as bad debt with the following action points:

- Proceed to the Settings option and select Chart of Accounts from there.

- You need to click on Run Report in the Action column of the bad debt account.

Pro Tip: You can also add a note to tell about a bad debt entity.

- You need to visit Sales and then choose Customers.

- Here, you need to select the customer’s name and choose the Edit option from the top right corner.

- Here, you need to type ‘Bad Debt’ or ‘No Credit’ after the customer’s name in the Display Name field.

- Finally, you need to select the Save option to complete the process.

These steps are the in-depth answer to your query of how to write off bad debt in QuickBooks Desktop and Online versions. You just need to follow these action points in chronological order.

Final Flowchart for Writing Off Bad Debts in QuickBooks

A flowchart is a visual set of instructions that is preferred by readers throughout the globe. So, for you, we have come up with the final flowchart for writing off the bad debts in QB. This will help you to view the steps at once and memorise them.

This is the flowchart that will help you with the steps to write off bad debts in QB Desktop & Online. You can take a snapshot or save this for future reference.

Summing It Up!

This blog will help you know the methods to write off bad debt in QuickBooks. There are different ways to approach the same issue, but the crux is the same. QuickBooks’ write-off bad debt process will help you in making seamless accounting journals. It will also help you in tax reductions and increase the cash flow of the organization.

FAQs

How to write off accounts receivable in QuickBooks Desktop?

You need to select the account field and select Accounts Receivable from the list. Now, you have to enter the amount under the debit column and select a customer name there. Finally, you need to offset the account and enter the amount under the credit column to write off accounts receivable in QuickBooks Desktop.

How to record uncollectible accounts receivable in QuickBooks?

You need to make a bad debt expense account and then use a credit memo or discount to reduce the balance on the invoice. And then you have to apply the memo to the original invoice. This will help you in recording the uncollectible accounts receivable in QB.

How to write off bad debt in QuickBooks Desktop?

The first thing that you have to do is create a bad debt account. After this, you have to create a credit memo for the customer using the bad debt item. Now, you need to apply it to the relevant invoices. You must know that there are different ways to write off bad debt in QB Online and QB Desktop.

How to write off bad debt in QuickBooks Online?

The process of writing off the bad debt in QuickBooks Online majorly involves the six steps, namely checking your aging accounts receivable, creating a bad debts expense account, creating a bad debt Item, creating a credit memo for the bad debt, applying the credit memo to the invoice, and running a bad debt report.

How to record bad debt in QuickBooks?

The users generally create a bad debt expense account and then create a bad debt item if required to record a bad debt in QuickBooks. You need to visit the Lists, and then click on Chart of Accounts, followed by New. Then, you have to choose Expense as the account type and name it ‘Bad Expense’.

How to write off an invoice in QuickBooks Desktop?

You need to create a credit memo for the amount you are writing off, followed by applying it to the invoice. This will help you quickly write off an invoice in QuickBooks Desktop. This will further reduce the invoice amount to zero.

How to write off uncollectible accounts receivable in QuickBooks?

The process of writing off the uncollectible accounts receivable is the same as writing off the bad debt in QuickBooks. The basic steps to write off uncollectible accounts receivable are to create a bad debt account or reduce the value of the invoice to zero.

Related Posts-

How to Use the QuickBooks Password Reset Tool

Resolving QuickBooks Error H505: Causes and Troubleshooting Solutions

Is Your QuickBooks Update Stuck? Know How to Fix It!

QuickBooks Sales Tax Center Not Working? Know How to Fix in Simple and Quick Steps

Resolving QuickBooks Payroll Not Deducting Taxes Issue With Causes & Solutions to Fix

Fixing the ‘QuickBooks Requires that You Reboot Loop’ Issue in Simple Methods

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.