Last Updated on March 12, 2025

Nearly 30% of small business owner’s overpay their taxes every year to the state and federal tax authorities either because of the incorrect tax payment calculation or because of the fear of getting penalties from the IRS. If you are an employer who has overpaid payroll tax liabilities using QuickBooks, then you might want to get the overpaid amount credited as your payroll tax liabilities and get this over payment adjusted in QuickBooks Company file. This article clarifies every step on how to adjust payroll liabilities in QuickBooks and getting it as a credit to payroll tax liabilities.

If you have any Questions or Need Help Adjusting Payroll Liabilities, then Connect with our Accounting Helpline’s Payroll Experts at 1.855.738.2784

Why you Need to Use Payroll Liability Adjustment?

Following are the scenarios where you will require to make changes to your payroll liabilities in QuickBooks:

- In case, you have accidentally set up incorrect tax tracking type for health insurance company contribution.

- When an employee is no more receiving paychecks, you might need to make changes to the deductions, additions, or YTD wages of the employee.

- When you require to make changes to 401(k) Company match or Health Savings Account (HSA) which falls under the company contribution items.

Now let’s move on to making changes to the payroll tax liabilities in QuickBooks, but before that ensure you have the latest payroll tax table updates installed.

Steps to Adjust Overpaid Payroll Liabilities in the Company File

The following steps only works for Enhanced, Basic, and Standard payroll service users. If you are using QuickBooks Online Payroll or Assisted Payroll, then you cannot make changes to payroll liabilities on your own and need to contact support for assistance. Adjusting payroll liabilities is a complex process and if you are not already familiar with liability adjustment in QuickBooks, then we suggest you to contact your accountant or Accounting Helpline support at 1.855.738.2784.

Adjustment for the Company

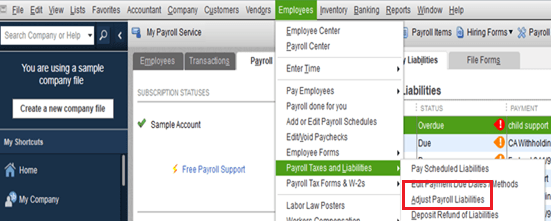

- From the dashboard of your QuickBooks Desktop application click the Employees tab and select Payroll Taxes and Liabilities.

- Select Adjust Payroll Liabilities and then select the date on which you want the adjustment.

- Now select the Effective Date for the adjustment.

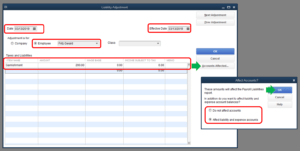

- Select Company under the Adjustment is for segment.

- Now choose the adjustment item from the Item Name drop down list.

- Enter the negative amount that you have paid for the adjustment.

- Type your explanation for the transaction in the Memo section.

- Hit the Accounts Affected button.

- Click Affect Liability and Expense Accounts if you want your accounts to be affected or else click Do Not Affect Accounts.

- Hit OK on the Affect Accounts screen.

- Click OK again to save the adjustment.

Adjustment for the Employee

- Follow step first to third from the Adjust your Company method as given above.

- Select Employee under the Adjustment is for segment.

- From the drop down list, click the employee’s name for which you want to make the adjustment.

- From the Taxes and Liabilities section select the payroll item for adjustment and enter the negative amount.

- Follow step 7 to 11 as mentioned in the Adjustment for the company method to save the changes.

Steps to get Overpaid Liability as a Payroll Tax Liability Credit

NOTE: Make sure to select the correct account to avoid any mistakes in the tax forms.

- Generate a liability check by following the steps mentioned in the article Set up and pay scheduled or custom liabilities.

- Under the Expenses tab in QuickBooks, select the account, which you want to be credited.

- In the Amount section, enter the negative amount that needs to be credited.

- Type the explanation for the adjustment in the Memo section.

- Click Recalculate to adjust the check amount with the credit amount.

- Follow the same steps if there is any credit balance left.

Hope this article has answered your question regarding the over-payment of payroll tax liabilities and if you have, any more questions on how to adjust payroll liabilities in QuickBooks Payroll then feel free to contact us at Accounting Helpline’s Payroll Helpline Number 1.855.738.2784. Our tax accountants are always ready to help small and mid-sized business owners to maximize their income by managing their finances and taxes online.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.