Last Updated on March 11, 2025

It is not unusual to find a miscalculation or error in scheduled payroll tax liabilities in quickbooks. Even a minor mistake while setting up payroll taxes can result in huge discrepancies when you finally run the payroll for your employees. These miscalculations and faults in payroll setup can cause errors like wrong scheduled payroll dates, incorrect pay period, overdue liabilities, and inaccurate paychecks. Deleting or removing scheduled payroll liabilities can fix such errors in quickbooks, and this article will walk you through each step of removing and eliminating scheduled payroll liabilities in quickbooks. Follow the complete article for more details.

Get Assistance from Accounting Helpline’s Payroll Error Support Number 1.855.738.2784

Important Points to Consider Before You Delete or Remove a Scheduled Payroll Tax Liability

- Make sure you have an active payroll subscription. (Sign in to verify your payroll service status)

- Tax tables must be updated with the latest updates. (Update QuickBooks Payroll Tax Tables Now)

- Install the most recent updates available of quickbooks Desktop application. (Update QuickBooks Desktop Now)

- Tax liabilities cannot be deleted from the payroll schedule.

- Marking payroll tax liabilities as Inactive will not clear the taxes. You need to define the tax amount in prior tax payments to resolve the error.

Steps to Delete or Remove Scheduled Payroll Liabilities

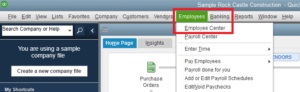

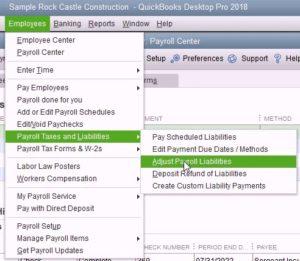

- Click Payroll Center under the Employees tab in quickbooks Desktop.

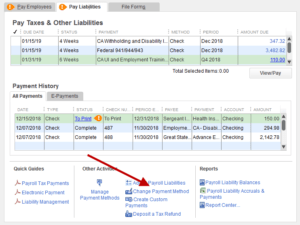

- Navigate to the Pay Liabilities section and click the Other Activities drop down menu.

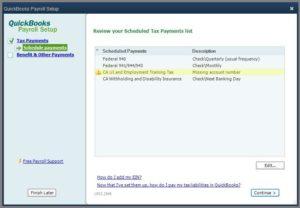

- Click Change Payment Method and from the quickbooks Payroll Setup screen choose Benefit and Other Payments.

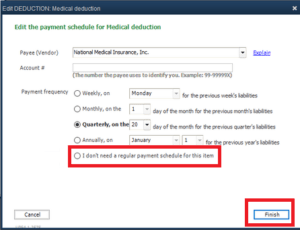

- Click Schedule Payments, and then select the payroll item that you want to edit.

- Click I don’t need a regular payment schedule for this item from the Payment Frequency option.

- Click Finish twice to save the changes.

Steps to Resolve Tax Liability Errors in Scheduled Payroll Liabilities

If you have already paid your payroll tax liability and it is still showing up in the scheduled payroll liabilities even after marking it as inactive then follow the steps below for a quick resolution.

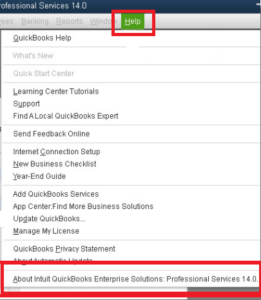

- Click About quickbooks under the Help tab.

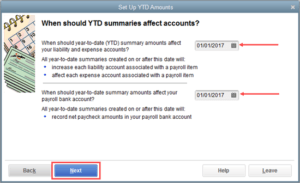

- On your keyboard press Control + Alt + Letter Y key together to bring the Setup YTD Amount screen.

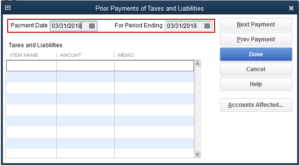

- Click Next until you get the Enter Prior Payments screen.

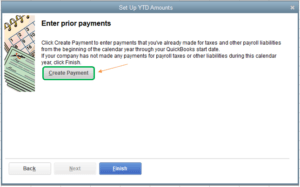

- Click Create Payment and input your payroll tax liabilities payments for the previous and current year.

- Carefully input the For Period Ending and Payment Date.

- Now choose the account that needs to be affected.

- Hit Done and then click Finish.

Steps to Delete Old Payroll Schedule Liabilities

Before deleting the payroll scheduled liabilities make sure that you have paid the liabilities.

- Under the Payroll Center click the Payment Activities drop down list and choose Adjust Payroll Liabilities.

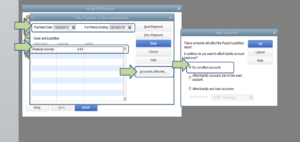

- Enter the total amount for the complete liability period.

- Now double click the payroll item and enter the adjustment as a negative number.

- Click Accounts Affected option and select Do Not Affect Accounts.

- Hit OK and edit the next payroll item.

If somehow your liabilities have gone missing from the scheduled liabilities in quickbooks then you can get detailed instructions on generating a custom liability from our article How to Generate a Custom Liability in quickbooks Payroll.

Following the steps mentioned above, you can easily edit or remove a scheduled payroll liability like health insurance, dental insurance, 401k, and others. In case if you are facing issues managing payroll tax liabilities in QuickBooks you can get help from certified experts by calling Accounting Helpline Payroll Support Number 1.855.738.2784.

Related Search Terms: Clear out old payroll liabilities, How do I remove already paid payroll liability?, Delete old PR liabilities, Delete or void a scheduled payroll liability, How to delete scheduled payroll, Modify scheduled payroll liabilities, Delete scheduled payroll liability QBO, Delete scheduled payroll liability taxes, Scheduled payroll liability showing as overdue, Remove payroll liability dues from pay scheduled liabilities

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.