Last Updated on August 28, 2025

One of the most essential add-on services QuickBooks offers is Payroll. The QB payroll makes processes like calculating taxes and sending paychecks to your employees much easier, saving your valuable time. It also offers you the option to print paper checks if you wish to. However, you might notice that the checks printed through QuickBooks are not aligned and don’t print correctly. This issue can be found in all Basic, Enhanced, and Full Service Payroll subscriptions.

The check alignment problem can waste a lot of time and expensive check paper. So in this blog, we’ll learn how to align pre-printed checks in QuickBooks Payroll. So let us guide you through the alignment process, starting with learning what it is in the next section.

Facing problems with printing checks in QuickBooks Payroll? Speak to our Accounting Helpline’s experts at 1.855.738.2784 to eliminate this issue today!

When Do I Need to Align Pre-Printed Checks in QuickBooks Payroll?

You might need to align pre-printed checks in QuickBooks Payroll when you notice that the text in your printed checks is cutting off because it is too low, too high, too left-centered, or too right-centered. This problem can occur in both QB Desktop and Online because your alignment settings weren’t properly configured. It is critical to fix this issue on time, as it can delay the earned payments of your employees, ultimately affecting their spirit to work. So now, let us learn how you can align your pre-printed checks in QuickBooks Basic Payroll and others.

Align Pre-Printed Paychecks in QuickBooks Online Payroll

If your pre-printed checks aren’t aligned in the QuickBooks Online Payroll, it can be because you aren’t using Adobe Acrobat for printing checks, so let us first get that out of the way with the following steps:

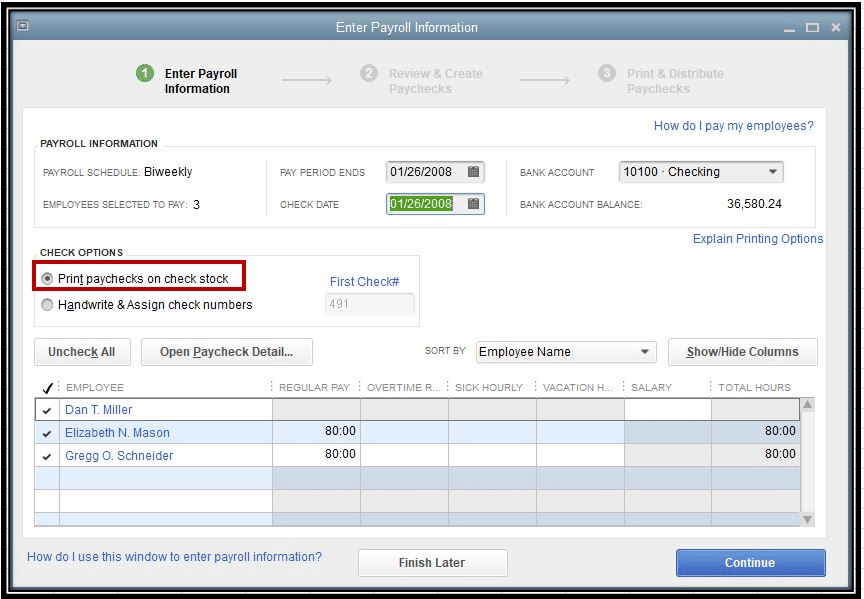

- Firstly, open QBO and select + Create.

- Click on Print checks.

- Then, press Print setup.

- Click the No, continue setup option.

- Now, press the latest version of the Reader link.

- You’ll be redirected to Adobe’s page, where you can download the Acrobat Reader.

- After installing the Reader, open the QB window again.

- Now, click on the How? Link:

- From this, you can set up Reader as your browser’s default PDF viewer.

Now, if you face the same issue, you can align your paychecks in QuickBooks Online Payroll. However, you need to first see where your text is leaning towards, i.e, left, right, low, or high. Now, follow these steps:

- Open your QuickBooks Online website.

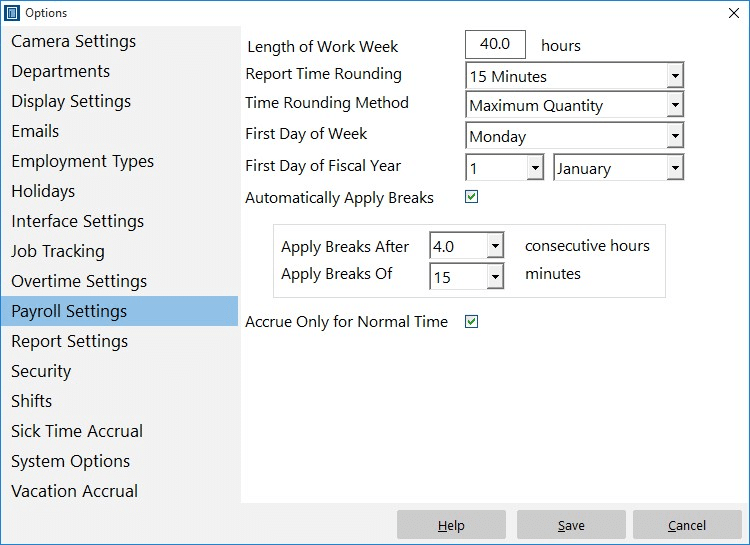

- Now, click on the Settings option.

- Then, press Payroll Settings.

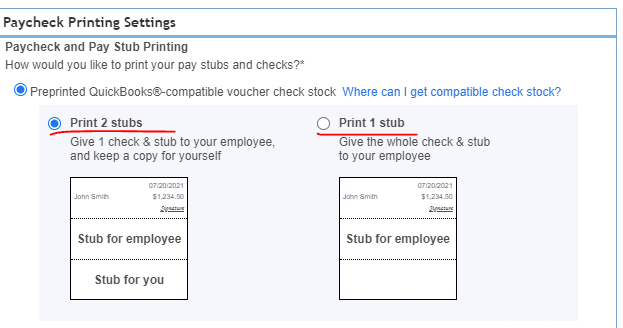

- Next, go to the Printing section.

- Click on Edit.

- Then, choose Paycheck on QuickBooks-compatible check paper.

- Now, proceed to select one of the two:

- Print paycheck and 1 pay stub.

- Print paycheck and 2 pay stubs.

- Print paycheck and 1 pay stub.

- Click on the Align check option.

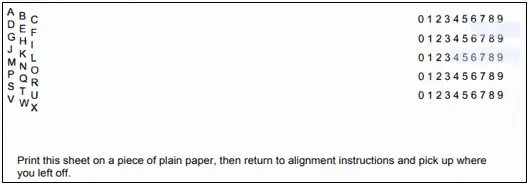

- Select Print alignment form:

- This would print a sample check.

- Follow the instructions and close the window.

- Now, follow the instructions again.

- Enter the number that suits you best for aligning the paycheck:

- If the printed text is too low:

- Enter a letter between A and J to move the info upwards (Don’t go higher than J).

- If the printed text is too high:

- Enter a letter between L and X to move the info downwards (Don’t go lower than L).

- If the text is far towards the right:

- Enter a number between 0 and 4 to move the info to the left (Don’t go higher than 4).

- If the text is far towards the left:

- Enter a number between 6 and 9 to move the info to the right (Don’t go lower than 6).

- Enter a number between 6 and 9 to move the info to the right (Don’t go lower than 6).

- If the printed text is too low:

- After aligning, press Save.

- Lastly, click on Done.

This would align the pre-printed check in QuickBooks Enhanced Payroll and more in the Online version. Then, if needed, you can fine-tune your check alignment with the steps given below:

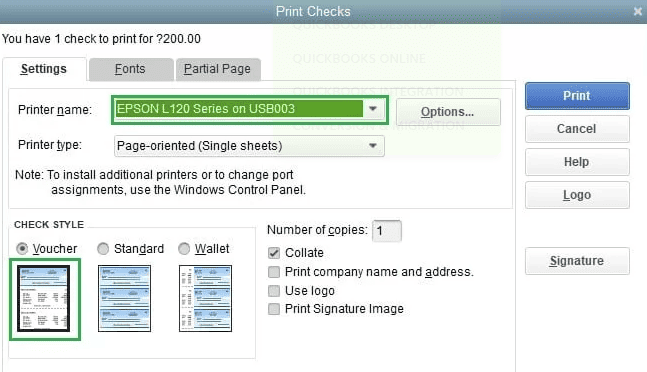

- Click on + Create.

- Select the Print checks option.

- Click on Print setup.

- Then, select No, continue setup.

- Choose No, continue setup again:

- This would open the check in the alignment window.

- Now:

- Move the grid so the numbers are in the same place as they appear on the sample print.

- QB will auto-adjust the alignment.

- After adjusting the grid:

- Click on View preview and print sample.

- Press the Print button.

- Now, follow the steps you see:

- The steps would help you print the sample check.

- Repeat these steps as many times as needed.

- After the check is aligned, click on Finish setup.

Now, let us see how to align checks in QuickBooks Desktop Payroll.

Align Pre-Printed Checks in QuickBooks Desktop Payroll

You can make coarse adjustments to your printed checks in the QuickBooks Desktop Payroll if you’re using checks purchased from Intuit and continuous-feed printers. To make coarse alignment adjustments, follow the steps given below:

- First, open the QBDT application.

- Go to the File menu.

- Click on Printer Setup.

- Select the Form name dropdown menu.

- Choose the form you want to print.

- Select the Printer type dropdown menu.

- Click on Continuous (Perforated Edge).

- Then, press Align.

- Choose a template to use.

- Hit OK.

- Now, press the Coarse option.

- Select OK to print a sample form.

- Analyze the pointer line you see in the middle of the sample that QuickBooks printed.

- Note down the number that is closest to the arrow points.

- Then, in the Pointer Line Position field, enter the number.

- Press OK.

- Now, QB might print an additional sample:

- If QB prints a third sample, then that means there’s something wrong with the sample test print.

- Verify your printer settings.

- Make sure you don’t adjust the printer manually.

Then, if needed, you make the fine alignment adjustments with the following steps:

- First, navigate to the File menu.

- Click on the Printer Setup

- Select the Form name dropdown menu.

- Now, choose the form you wish to print.

- Open the Printer type dropdown menu.

- Click on Continuous (Perforated Edge).

- Then, press Align and choose a template to use.

- Press OK.

- Choose Fine, followed by OK.

- This would print a sample form.

- Then, check the alignment grid printed on the sample by QuickBooks.

- Estimate how far you should move the info.

- In the Vertical and Horizontal fields:

- Enter a number to select how much you want to move the printed text and in what direction.

- Press Print Sample.

- Check if the form alignment is correct.

- Repeat the steps if it is not.

Then, just press OK twice when the alignment is correct.

Align Pre-Printed Checks in QuickBooks Payroll Mac

You can adjust the pre-printed checks in QuickBooks Payroll for the Mac version with the following steps:

- First, open the form for which the alignment needs to be adjusted.

- Click on Print.

- Press the Show Details option if you can’t see the details.

- Click on the Alignment tab.

- Then, move the block box and adjust the alignment.

- In the print preview, check the paycheck alignment.

- Click Print to test the alignment.

- If not correct, repeat the steps again.

Performing these steps would align the pre-printed checks in QB Payroll for Mac.

How to Align Pre-Printed Checks in QuickBooks Payroll – A Quick View

Given in the table below is a concise summary of this blog on the topic of aligning pre-printed checks in QuickBooks Payroll:

| Aligning paychecks | You might need to align pre-printed checks in QuickBooks Payroll if you notice that the text on the printed paycheck is either low, high, far-left, or far-right. |

| Steps for QuickBooks Online | To align your checks in QBO, first install the Adobe Acrobat Reader, and proceed to make adjustments to your paycheck alignment by going to the Printing section in the Payroll settings. |

| Steps for QuickBooks Desktop | To align your pre-printed paychecks in QB Desktop, first you need to make coarse alignment adjustments and then fine-tune them by making fine alignment adjustments. |

Conclusion

In this blog, we talked about how to align pre-printed checks in QuickBooks Payroll in great detail. We provided you with the steps you can use to align your paychecks in both QuickBooks Desktop and the Online versions. If you need further assistance with aligning your paychecks or are facing any paycheck printing issues, you can contact our Accounting Helpline’s experts at 1.855.738.2784 today to resolve your problem in no time.

FAQs

How can I align the pre-printed checks in QuickBooks Desktop Payroll

To align pre-printed checks in QuickBooks Payroll for Desktop, you have to first go to the File menu and click on Printer Setup. Then, select the form you want to print, choose your printer type, and click on Align. Now, choose the Coarse option and align your paycheck according to the grid you see. Lastly, if needed, make fine adjustments to your paycheck alignment.

How to adjust print alignment for paychecks in QuickBooks Online?

To make paycheck alignments in QuickBooks Online, go to Settings, click on Payroll Settings, and navigate to the Printing section. Then, click on Edit and choose the Paycheck on QuickBooks-compatible check paper option. Choose between 1 pay stub or 2 pay stubs, and click on Align check. Lastly, just follow the instructions to align the paycheck.

How to fix a payroll check in QuickBooks Online?

To fix a payroll check in QuickBooks Online, first go to the Payroll menu and click on the Overview or the Employees tab. Then, choose Paycheck List, select the paycheck, and in the Action column, select the dropdown menu. Lastly, choose if you want to Edit, Delete, or Void the paycheck and press Save after confirming.

Related Posts-

How to Fix QuickBooks Error 1327: Invalid Drive Installation

Comprehending the QuickBooks Error 15276 With Causes & Solutions

Powerful Methods to Overcome QuickBooks Payroll Error PS036

How to Resolve QuickBooks Error 15263 Like a Pro?

How to Patch QuickBooks Error 12002: Guided Solutions

A Comprehensive Guide to the QuickBooks Migration Tool for Data Transferring

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.