Last Updated on November 17, 2025

In an effort to run payroll without any errors using QuickBooks, it is crucial to Update Payroll Tax Tables in QuickBooks with the latest released updates. While QuickBooks Payroll Tax Table Update ensures error-free tax filing for the users having an active subscription of QuickBooks payroll. In this article, we have discussed every relevant detail that might be required while downloading and installing the most recent updates of QuickBooks Payroll Tax Table Update. Follow the complete article until the end for detailed information.

Dealing with QuickBooks Payroll Update can be a bit of a technical task. And payroll errors can just add more to it. Need Help Downloading and Installing Latest QuickBooks Payroll Tax Table Update! Call Helpline Number 1.855.738.2784 for Immediate Assistance. Our team of Accounting Helpline experts will help you resolve your query in no time!

What is QuickBooks Payroll Update?

The most recent updates to users are given by QuickBooks Payroll Update. These updates give the most accurate and up-to-date rates. Federal and state tax table calculations, payroll tax forms, and the e-file and pay option also arrive in these updates. Most fees are published at the end of the year so that federal and state authorities publish most of its changes for the following year. QuickBooks Payroll publishes payroll updates during the year so that most agencies update their payroll tax calculations and tax forms throughout the year.

How to Check Your Current QuickBooks Payroll Tax Table Version?

It is very important to check the current version of the QuickBooks Payroll Tax Table that you are using before updating it. The steps to check the current version of the QuickBooks payroll tax table update are as follows:

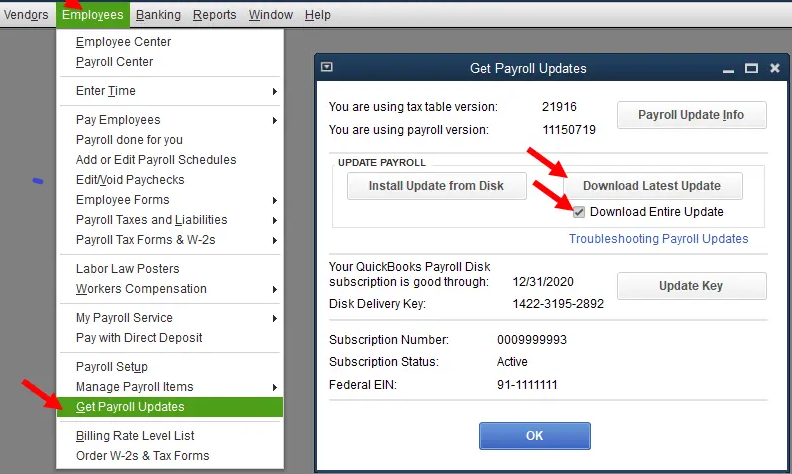

- Open QuickBooks Desktop, and from under the Employees tab select My Payroll Service and then click Tax Table Information.

- Note down the first three numbers displayed under the You are using tax table version section.

- If you are already using the latest tax table updates in QuickBooks Desktop, then the tax table information section will display 10929004.

- If you are not getting 109 at the beginning of the numbers, then it means your tax tables are outdated, and you must follow the instructions mentioned further in this article to install the updates.

IMPORTANT: To use the latest tax table updates, you will be required to install the 2019 version of the QuickBooks Desktop application.

QuickBooks Payroll Update: List of Recent Payroll Update

One easy way to check your current payroll version is through your QuickBooks Desktop company file. You just need to select Employees and then select Payroll Updates, and then choose Payroll Update Info.

You might be wondering what is the latest payroll update for QuickBooks Desktop. Below is a list of the past payroll updates released by QuickBooks, along with their release date.

| Payroll Update Number | Date Released |

| 22506 | 20/02/2025 |

| 22504 | 24/01/2025 |

| 22501 | 19/12/2024 |

| 22416 | 19/09/2024 |

| 22413 | 18/07/2024 |

| 22412 | 20/06/2024 |

This is the list of the QuickBooks tax table updates, along with the dates released. Let’s now proceed to the methods to download the QuickBooks Payroll Update.

How to Download QuickBooks Payroll Update?

If you want to download the latest payroll update, you must have subscribed to the QuickBooks payroll. If you are already subscribed to QuickBooks Payroll, you can easily download your updates over the internet. Here are some steps

- If your automatic updates are turned on, then QuickBooks Payroll will automatically download and install the most recent updates of tax tables.

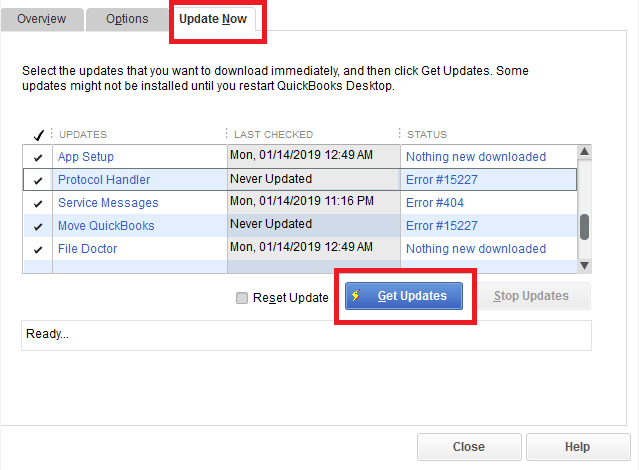

- If you want to manually update the tax tables in QuickBooks Desktop, then open QuickBooks Desktop and from under the Help tab, click Update QuickBooks.

- Under the Update Now tab, click Get Updates.

- After the updates are successfully downloaded, restart your computer.

- If you are using QuickBooks Desktop Pro, Premier, or Accountant version, then click the link to download the Latest Payroll Tax Tables.

NOTE: If you have your employees in Nova Scotia, then you need to calculate the taxes differently because of the recent changes made to the TD1.

By the methods mentioned above, you can get payroll updates in QuickBooks Desktop in a simple way. The updated version of QuickBooks Desktop Payroll updates will help the application to run smoothly.

QuickBooks Payroll Update: Automated Payroll Tax Withdrawals

Now, QuickBooks Payroll withdraws your payroll taxes at tax time. Starting in 2025, payroll taxes will be withdrawn every time you run payroll or if there’s a change in the taxes due.

This is how it operates:

- The taxes will automatically get pulled every time payroll runs, payrolls that have passed get corrected, and tax rates get changed.

- You can preview exactly how much you’re being withdrawn when processing payroll.

- For tax periods ending prior to January 1, 2025, taxes will continue to be withheld as previously planned.

- Intuit will hold funds in a secure manner until they become due to taxing authorities, though no interest or earnings will accrue.

If you would rather manually manage payroll taxes, you may exclude automated taxes in Payroll Settings > Taxes and Forms. Manual management entails monitoring due dates and making sure payments are received on time, though. The user needs to update the QuickBooks tax table to the latest version.

QuickBooks Payroll Update: Common Related Errors

While proceeding with the QuickBooks Payroll Updates, there is a chance that you might encounter some errors. These errors are very common errors, and you must know about them. The table below contains the common QuickBooks payroll update error.

| QuickBooks Payroll Update Common Errors | Reason for Occurrence |

| 12XXX series errors such as 12002, 12007, 12009, and 12029 | A widely used accounting application, QuickBooks, has been updated. An error message appears when QuickBooks fails to access the internet. Sometimes you may get the error message “QuickBooks you must Download and Install the Latest Payroll Update” |

| QuickBooks Error 12152 | Due to an issue with Internet settings, this error message appears. This makes QuickBooks take a very long time to connect with the internet server, which also stops the software from downloading updates. |

| QuickBooks Error 15240 | Due to improper Internet Explorer or system date and time settings, QuickBooks updates do not work. |

| QuickBooks Error 15270 | There was a payroll update failure in this instance. This failure is due to a missing file on your computer. |

| QuickBooks Error 15271 | It’s a web browser misconfiguration or improper SSL payroll update problem. |

| QuickBooks Error 17337 | Misconfigured Internet Explorer or improper SSL are the culprits of the paycheck update issue. |

| QuickBooks Error PS032 and PS077 | An erroneous tax table, payroll file, or improper billing information, amongst others, results in a payroll update challenge. |

| QuickBooks Error PS034 | An improper tax table, payroll file, or improper billing information results in a payroll update issue. |

| QuickBooks Error PS038 | Payroll update issue when you receive the alert “update the Payroll since it was last updated in a previous version with which some files can’t be accessible.” |

These are some common QuickBooks payroll update related errors that you must know about. Now, we must know about the general troubleshooting steps for resolving the QuickBooks payroll tax table update errors.

Methods to Fix QuickBooks Payroll Update Error

Resolving the payroll-related error is important to continue working in QuickBooks. In this section, we will talk about the methods to fix the tax table update error in QuickBooks. The common solutions that you can follow to fix this payroll error are:

- Changing Billing and Subscription Settings

- Updating the QuickBooks Payroll Resources

- Updating QuickBooks to the Latest Version

These are some of the common methods to troubleshoot the QuickBooks payroll update error in a short and crisp way. Let’s now look at the above-mentioned solutions in brief for better clarity.

Solution 1: Changing Billing and Subscription Settings

Sometimes, you might need to tweak some subscription settings or billing settings in QuickBooks to resolve the tax table update errors. Here are the steps for reviewing and changing the settings:

- First, open the My Account section in QuickBooks.

- Choose the company you wish to make edits or changes to.

- Proceed to the Billing Section and click on the Edit option.

- Check the information and make changes if required.

- Click Save and Close to update payment details

- Check that billing details are correct by viewing a preview of the same.

- Lastly, click on Save Changes and log out.

Now, you can restart the QuickBooks application and check if the tax table error is still present there. If it is still there, you can move to the next solution.

Solution 2: Updating the QuickBooks Payroll Resources

Sometimes, it happens that the current version gets outdated, and the payroll services in QuickBooks stop working. and this can cause the QuickBooks Payroll Update error. In this case, you need to update the QB resources to the latest versions. The steps for the same are outlined below:

- Launch QuickBooks and explore new QuickBooks updates

- Choose the correct updates to install and click on Get updates.

- You need to restart QuickBooks and check for payroll tax table updates

- Now, you need to select the proper update method and wait for the download to be completed.

- Lastly, verify the updates and perform a test run to check for errors.

This was the approach in case your payroll services are not updated to the latest version. This can help in the resolution of the QuickBooks tax table update errors.

Solution 3: Updating QuickBooks to the Latest Version

This option is your best bet to remove tax table update errors in QuickBooks if nothing else works. All you have to do is keep the license, product, and such essential information handy. Also, make backups of your important QB files, company files, data files, etc.

- After doing so, go to the Control Panel > Programs and Features > Uninstall a program > QuickBooks option.

- Follow the prompts on the screen asking for your permission and confirmation of this decision.

- Once done, clear your space, junk files, temporary files, and folders from your computer.

- After all this happens, you are now ready to reinstall QB in your system. Simply go to Intuit’s website and enable the download and installation of the application.

In this way, you can resolve the QuickBooks Payroll update error by uninstalling and reinstalling the updated version of QuickBooks Desktop.

Summing It Up!

QuickBooks payroll update is a valuable ally in the operation of your business. From paying workers to dealing with taxes and from HR tools to compliance, QuickBooks Payroll saves you time, minimizes risks, and keeps your business up and running. You need to have the latest version of QuickBooks’ latest payroll update for the smooth functioning of the application.

FAQs

How to Update Payroll in QuickBooks?

To update QuickBooks Desktop Payroll, go to Employees and click on Get Payroll Updates. Now, you need to check for the latest tax table version and download the update if needed.

What is the latest QuickBooks payroll update?

The most updated version of QuickBooks payroll update is the update number 22506. It has been released by QuickBooks on 20th February 2025. Second to this, we have the payroll update number 22504 which was released by QuickBooks on 24th January 2025.

How to Update Payroll the tax table in QuickBooks Desktop?

To update the tax table in QuickBooks Desktop, you need to make sure you have a current QuickBooks Payroll subscription and then go to Employees > Get Payroll Updates > Download Entire Update > Update.

What is QuickBooks Payroll Update 2025?

QuickBooks Payroll update 2025 is set to make tax payments even more convenient for your business. Beginning January 1, 2025, Intuit will roll out updates to automated tax withdrawals aimed at saving you time and making it easier to manage cash flow.

Related Posts-

A Step-by-Step Guide to fix QuickBooks Payroll PIN not working

Easily Fix QuickBooks Payroll Internet Connection Error Read Error

How to Record Tax Payments in QuickBooks Desktop Payroll

Learn How to Add or Change EIN in QuickBooks Payroll Subscription

Learn How to Change Payroll Schedule in QuickBooks Desktop & Online

QuickBooks Payroll Support: 24*7 Live Assistant

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.