Last Updated on August 12, 2025

Do you run into various errors and issues as you are trying to update QuickBooks payroll and tax tables? Such errors are related to payroll, which falls under the PSXXX series that many people commonly face. One of these errors, which is QuickBooks error PS077, occurs when you are trying to update payroll tax tables and prevents you from doing so. If you have encountered this issue, which has delayed your work, and want to fix it, then you’ve come to the right place. We will discuss QuickBooks payroll error PS077 in great detail, along with its causes and resolutions that you can easily perform.

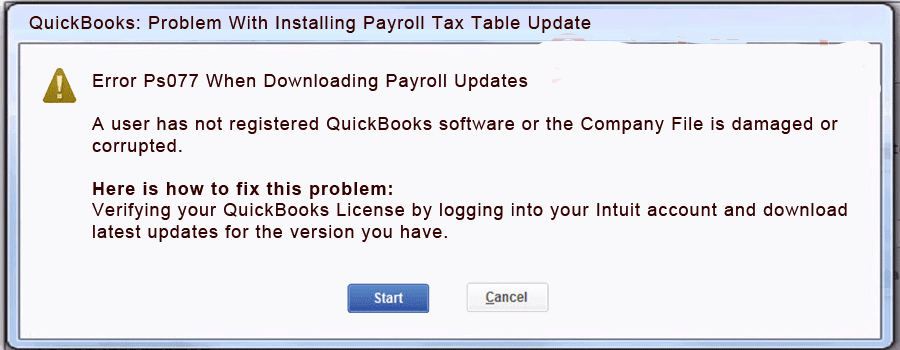

The following error message is displayed on your screen stating that:

“Error PS077: QuickBooks is having trouble installing your payroll tax table updates.”

The PS077 error in QuickBooks Desktop can delay your accounting tasks as you fail to update payroll tax tables. If you are looking for quick resolutions, dial 1.855.738.2784 to connect with our Accounting Helpline’s Experts.

Key Factors Leading to the QuickBooks Error PS077

The following reasons are some of the main contributors to the QuickBooks Payroll error PS077, which prevents the payroll tax tables from updating.

- There may be missing or damaged essential folder components/files, such as the CPS folder.

- You might have corrupted or damaged QuickBooks payroll tax tables in your application.

- The Windows Firewall settings are incorrect, which might be blocking the QB updates download.

- The QuickBooks company files won’t open due to damaged or corrupted data.

- You may have an outdated version of QB Enterprise.

- You might have entered incorrect or outdated billing details while downloading payroll updates.

- You might have misconfigured internet connection settings, leading to QuickBooks error PS077.

- QuickBooks installation on your device was improper or incomplete.

- You may have damaged program files on your system.

- The UAC settings are wrong or incorrect, leading to permission issues.

- You may have an inactive or expired payroll service subscription.

These are the main reasons why the QuickBooks payroll update error PS077 might have occurred. Let’s now examine some practical ways to address this problem.

Working Solutions to Resolve the QuickBooks Payroll Error PS077

Here are some practical fixes for QuickBooks error PS077 that will help you both fix and avoid it in the future.

Check Your Payroll Service Subscription

An expired or inactive subscription may cause the QuickBooks payroll update error PS077 and lead the procedure to fail. Therefore, you must take the following actions to make sure your payroll service subscription is active:

- Close all open company files on your system and restart the computer.

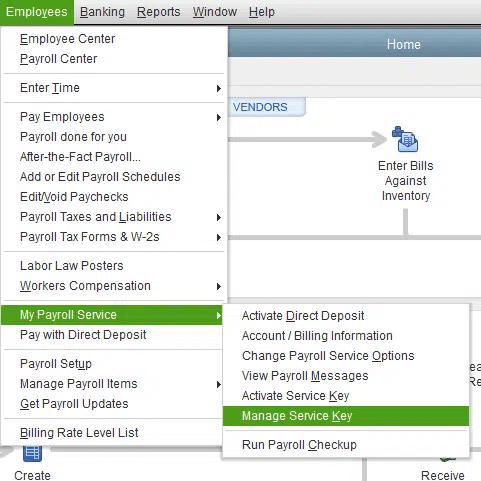

- Then head to QuickBooks and click on My Payroll Service from the Employees menu.

- Next, click on Manage Service Key to verify that your service name and status are correct and labeled as “Active“.

- Click on Edit and check the service key. If it’s incorrect, enter the right service key to proceed.

- Hit Next, untick the Open Payroll Setup checkbox, and then click Finish to download the whole payroll update.

If you continue to see the QuickBooks error PS077, then proceed to the following method for registering and updating QB Enterprise.

Register and Update the QuickBooks Desktop

The QuickBooks error code PS077 can be a result of an unregistered or outdated QB Enterprise version. You need to download the latest security and software improvements through the steps below.

- Press F2 to see the Product Information and see if it is labeled as “Activated” next to the license number.

- Consider registering the QBDT application in the following manner in case the “Activated” status is not displayed:

- Expand the QuickBooks Help menu and click on Activate QuickBooks Desktop.

- To confirm your information, input the Product and License Info after following the on-screen directions.

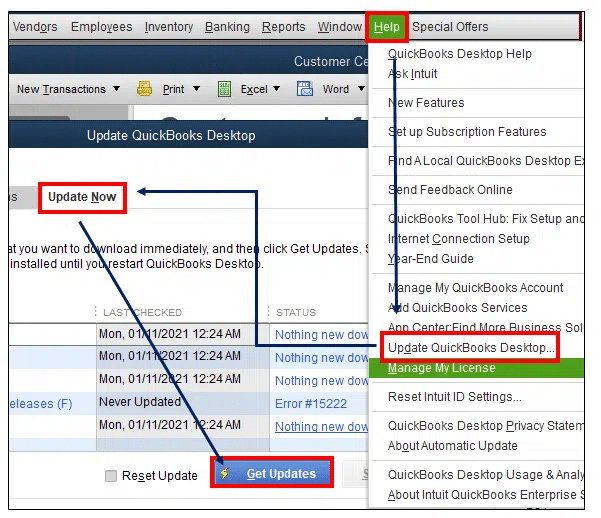

- Once you are done registering QuickBooks Enterprise, follow these steps to update it:

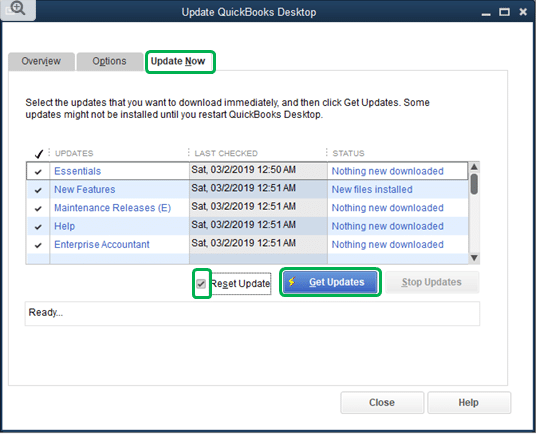

- Now tap on Update QuickBooks Desktop from the Help menu, and then hit Update Now.

- Hit Get Updates and reopen QB to install the updates by choosing Install Now.

- Click on Get Updates, then go to QB again and hit Install Now for loading updates.

- Now tap on Update QuickBooks Desktop from the Help menu, and then hit Update Now.

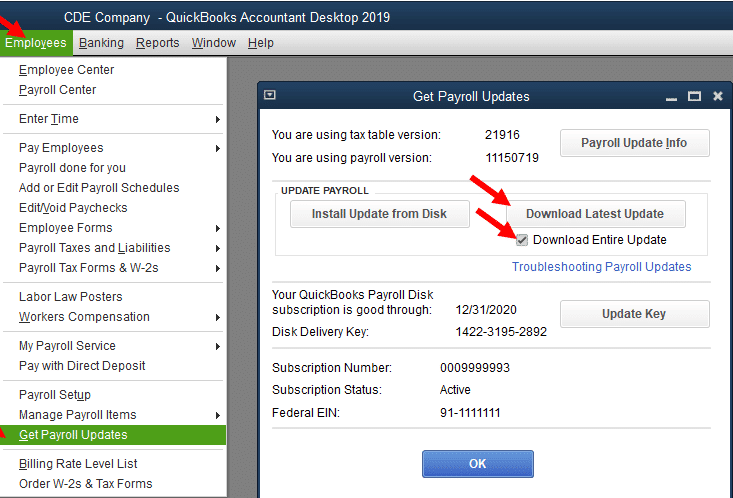

- Download the latest version of the QuickBooks payroll tax table now:

- Expand the Employees menu, click on Get Payroll Updates, and then press Download Entire Update.

- After selecting Update, the informational window will be displayed to indicate that the update was successful.

- Expand the Employees menu, click on Get Payroll Updates, and then press Download Entire Update.

If the update procedure fails to resolve the QB payroll error PS077 on your system, then you may proceed to Solution 3.

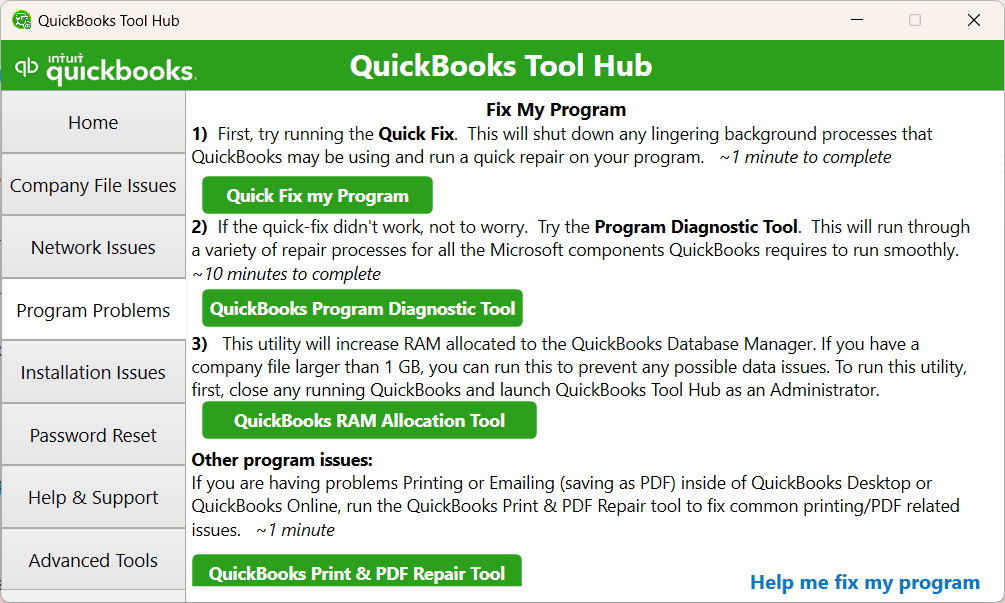

Launch Quick Fix My Program

General issues and errors can cause program troubles in QB. You can use the QuickBooks Tool Hub utilities to efficiently resolve such problems within the program and preserve your data. You can follow the steps outlined below for using the tool to troubleshoot the QuickBooks error PS077 easily:

- First of all, you have to download and install QuickBooks Tool Hub on your system.

- Go to the homepage of QB Tool Hub.

- On the left side, find the Program Problems section.

- Next, click on the green button for Quick Fix My Program.

- Finally, open QB Desktop and log into your company file.

To see if the QuickBooks error PS077 has been resolved, try downloading the most recent payroll updates once more. If the problem still occurs in your situation, update QuickBooks by deleting the QB components as follows:

- Close all QuickBooks windows and navigate to C:\ProgramData\Intuit\QuickBooks XX\Components (XX is for your version of QB Desktop).

- Select the Components, choose the Delete button, and then Open QuickBooks Desktop.

- After choosing Update QuickBooks Desktop from the Help menu, click Update Now.

- Click the Get Updates button, check the Reset Update box, and then wait for the process to finish.

- Close QuickBooks after the download is complete, then reopen it.

Try to download the most recent QuickBooks tax table update. Run the QB install diagnostic tool in the following method if the PSXXX series error still prevents you from downloading the payroll updates.

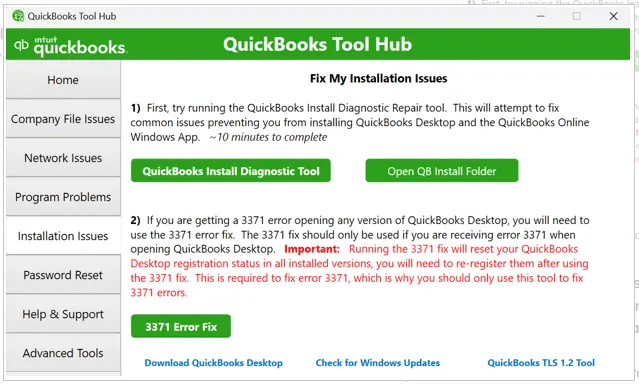

Run QuickBooks Install Diagnostic Tool

Use the QB install diagnostic tool with the steps outlined below to fix any installation problems with the application. This tool was developed by Intuit so that users can efficiently resolve installation issues. To use it, follow these steps and get rid of the QuickBooks error PS077:

- Open the QB Tool Hub on your application.

- Click on the tab for Installation issues.

- Select the QuickBooks Install Diagnostic Tool and launch it.

- Let the tool fix any installation problems.

- After finishing, restart your computer and open QBDT again.

If the QuickBooks payroll update error PS077 continues to hinder the updates, then you need to try the following resolution for using the file doctor tool on QB Enterprise.

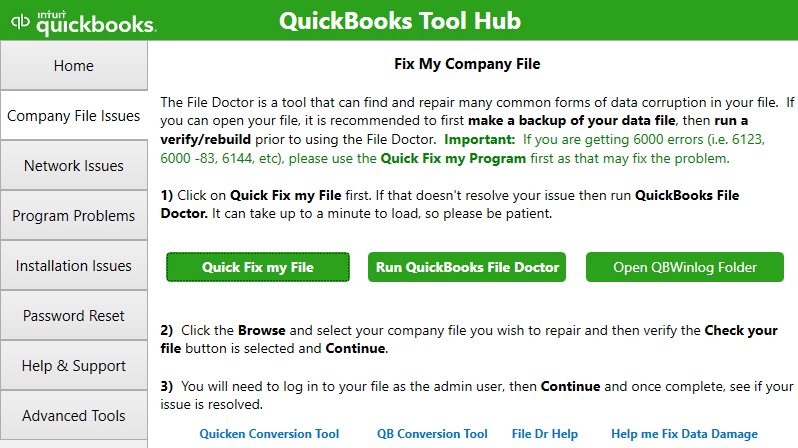

Use the QuickBooks File Doctor Tool

A damaged or corrupted company file can often lead to issues like QuickBooks error PS077. To resolve this problem, you can consider using the QB File Doctor tool to repair any damaged data file by following the process outlined below:

- Open the Company File Issues section in the QuickBooks Tool Hub.

- Find the Run QB File Doctor Tool option, which may take a few minutes to open.

Note: Sometimes, the tool may fail to open; therefore, you need to search for QuickBooks Desktop File Doctor manually and then open it. - Now, choose your company file from the dropdown menu or click Browse to find it.

- Tick the Check your File and Network checkbox and tap Continue.

- Enter the QuickBooks admin password and let the tool run.

- Once done, hit Next. Then, open your company file and check for damages.

If your QuickBooks File Doctor is not working, then go through this article to troubleshoot it. After completing this procedure, check to see if the QuickBooks error PS077 has been fixed. You can add QB Firewall exceptions with the following resolution if the error continues.

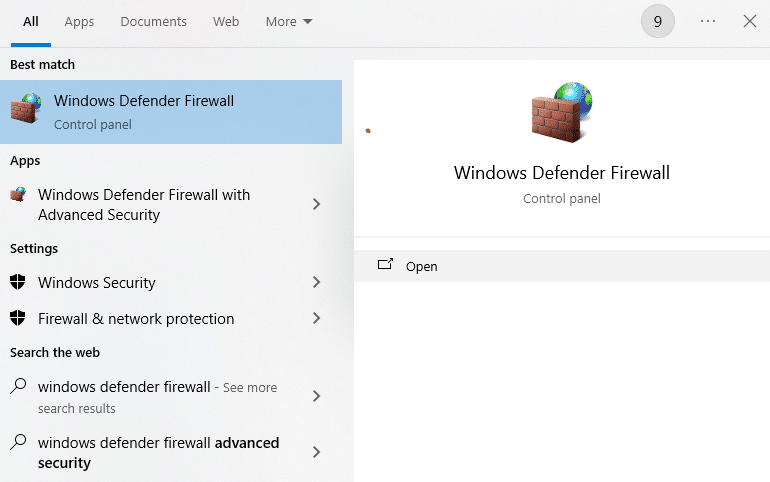

Add Exception for QuickBooks in Firewall Ports

Try manually adding QB port exceptions in the firewall if the QuickBooks File Doctor tool fails to fix the network problems and prevent QuickBooks payroll error PS077. Follow the instructions below for adding Firewall exceptions for QuickBooks to ensure uninterrupted operation.

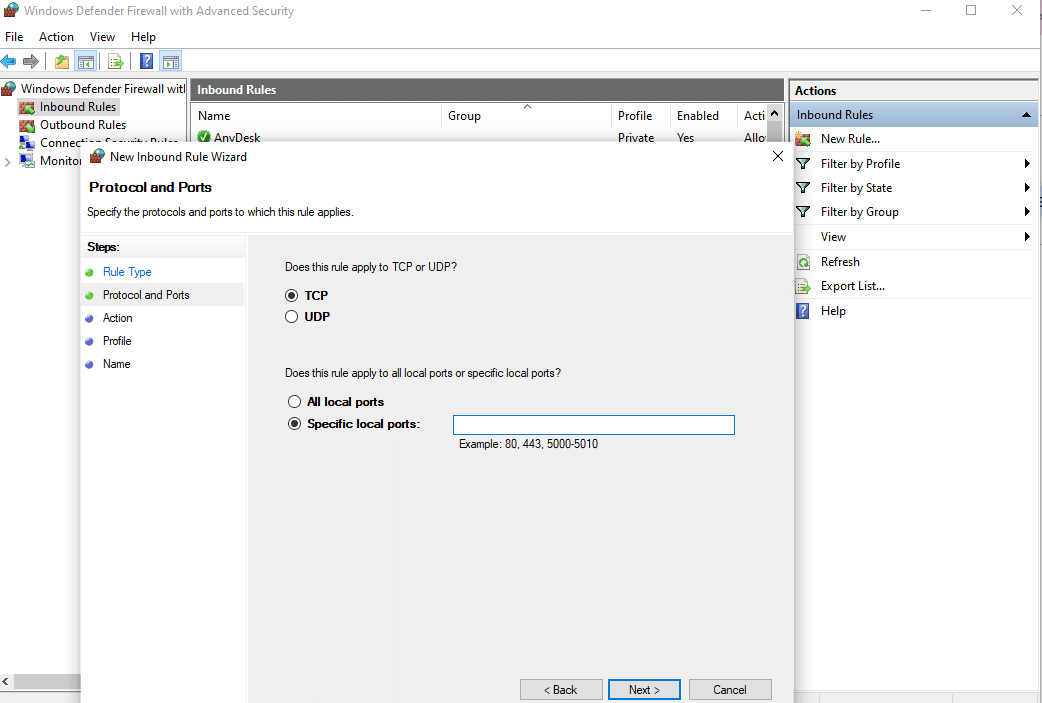

- Hit the Windows key to open the Start menu and type in “Windows Defender Firewall” in the search box.

- Open it, then select Advanced options from the left panel, as shown below.

- Next, click on Inbound Rules and proceed with the New Rule button.

- Then, select Port and tap Next.

- Next, choose the TCP option and type in the ports that are necessary for the version of QuickBooks you are using.

- If you have several versions, then you must add ports for each version, as indicated below.

- QuickBooks Desktop 2020 and later: 8019, XXXXX. (XXXXX is the assigned port number found in QuickBooks Database Server Manager)

- QuickBooks Desktop 2019: 8019, XXXXX.

- QuickBooks Desktop 2018: 8019, 56728, 55378-55382

- QuickBooks Desktop 2017: 8019, 56727, 55373-55377

- QuickBooks Desktop 2016: 8019, 56726, 55368-55372

- QuickBooks Desktop 2015: 8019, 56725, 55363-55367

- QuickBooks Desktop 2019 and newer versions use Dynamic Port Number, which can be found with the steps below.

- Select QuickBooks Database Server Manager from the Start menu and navigate to the Port Monitor.

- Locate the version of QB you are currently using, note down the port number next to it, and then add it to the list of Windows Firewall port exceptions.

Note: In order to modify the dynamic port number that has been assigned, click on Renew, navigate to the Scan Folders section, and click Scan Now. With this, the Windows firewall permissions will be reset, but keep in mind that QB 2019 and later versions are the only ones that allow port renewal.

- After that, hit Next and select Allow the Connection.

- Make sure that every profile’s box is checked, then click Next.

- Enter a name for the new exception rule that you created, such as “QBPorts(Year)”, then hit Finish.

- To create Outbound Rules, simply follow the same procedures from Advanced Settings.

Once this procedure is finished, check to see if the QuickBooks error PS077 has been fixed by launching the QBDT application over the network or in multi-user mode. If not, you may need to set a Windows Firewall exception for QuickBooks executable files. To do that, you can go through the following method.

Firewall Exclusion for QuickBooks .exe Files

Since the executable files (.exe) are necessary to complete a number of operations and prevent QB error PS077, you must use the following procedure to create a Windows Firewall exception for QuickBooks executable files.

- Click the search box on the Windows Start menu.

- Launch “Windows Defender Firewall” by typing it in.

- From the left panel, select Advanced settings.

- Locate and select the Inbound Rules tab, then choose New Rule.

- Select the Program, then click Next.

- Locate This Program Path, click it, and choose Browse.

- Press Next after choosing one of the executable files from the table below.

- After that, choose Allow the Connection and press Next to proceed.

- Make sure all profiles are checked in the prompt window that appears, then click Next.

- Give the new rule a name, such as “QBFirewallException(name.exe)” and press Finish.

- Follow the same steps to create Outbound Rules from the Advanced Settings instead of Inbound Rules.

You can add QuickBooks Firewall exceptions by using the names of executable files and the path to their location on your device to prevent QB error PS077, which is tabulated below.

| Executable files | Location |

| AutoBackupExe.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| Dbmlsync.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| DBManagerExe.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| FileManagement.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| FileMovementExe.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| QuickBooksMessaging.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| QBW32.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| QBDBMgrN.exe | C:\Program Files\Intuit\QuickBooks YEAR |

| QBServerUtilityMgr.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBCFMonitorService.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBLaunch.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBUpdate.exe | C:\Program Files\Common Files\Intuit\QuickBooks\QBUpdate |

| IntuitSyncManager.exe | C:\Program Files\Common Files\Intuit\Sync |

| OnlineBackup.exe | C:\Program Files\QuickBooks Online Backup |

Note: If you use a 64-bit Operating system, then the Program Files (x86) will be visible on your screen.

Repair the QuickBooks Program

Update issues may result from problems with the QB program. You can resolve the QuickBooks error PS077 by taking the steps below to do a quick program repair.

- Close all ongoing programs and restart your computer.

- Follow the steps below to back up the QuickBooks Enterprise company file:

- Expand the File menu, and click on BackUp Company.

- And then, tap on the Create Local Backup button.

- Tap on Local Backup in the window, then hit Next, followed by Browse in the Local Backup Only tab.

- Now specify a location to save the backup file, then click OK.

- Then, tap on the Save it Now button and hit Next to save the backup file.

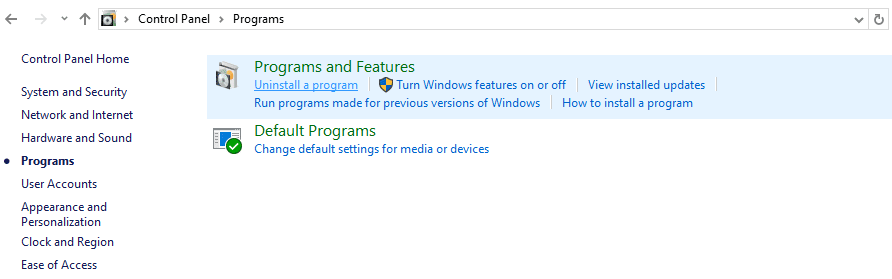

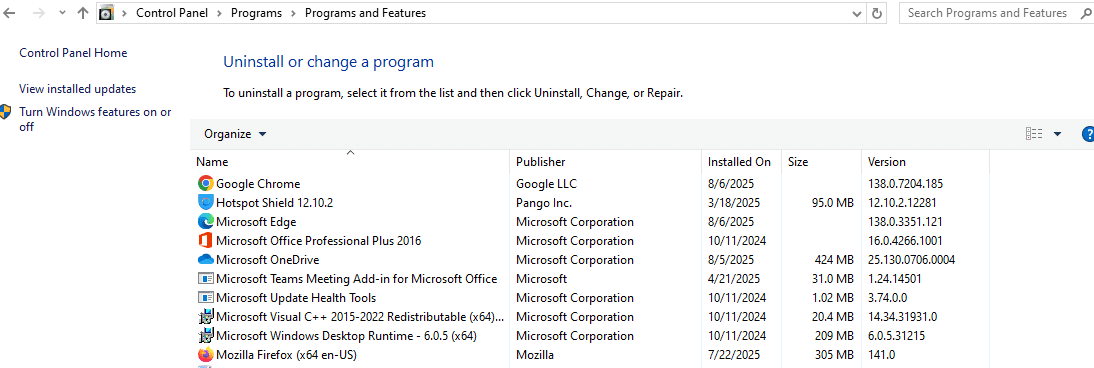

- Click Programs and Features after choosing the Control Panel from the Start menu.

- Head to the Windows Start menu, open the Control Panel, and go to Programs.

- Click on Programs and Features or Uninstall a Program, and you will see the list of programs.

- Next, find and select the QuickBooks program, and hit Uninstall/Change.

- Select Continue, and finally, click Next.

- Select Repair and click Next, then let the program repair process finish.

- Once done, hit Finish, reboot your system, and open QB Desktop.

Once these steps are finished, download the most recent payroll tax table to reset updates to ensure accuracy of the data. Now, verify if the QuickBooks payroll error PS077 persists, then go to the following method.

Rename the CPS Folder

QuickBooks error PS077 may be caused by a damaged CPS folder or folder components. To resolve it, follow the steps below and rename the folder.

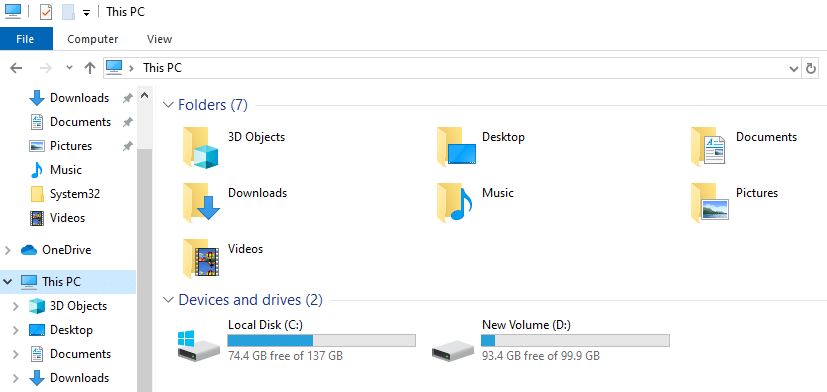

- Hit the Windows + E keys to launch the file explorer.

- Tap on either “This PC or My PC” option from the left panel.

- Open the Local Disk (C:), as shown in the image above.

- Now, find the Program Files (x86) folder.

- Then, open the QuickBooks Desktop folder of your version.

- Head to the Payroll folder and go to Components.

- Open the CPS folder menu and select Rename.

- Rename it to CPSOLD, then hit Enter.

- Create a new CPS folder and head back to the QBDT program.

- Finally, download the most recent payroll tax table update.

Next, see if you can successfully run the payroll and tax table updates. If not, and the QuickBooks payroll update error PS077 still occurs, then go through the following troubleshooting guide.

Correct the Credit Card Information for Billing

You must make sure that the credit card information and billing information are correct and accurate. Payroll updates error PS077 QuickBooks Desktop may be a result of inaccurate billing information, which can be resolved by taking the following actions:

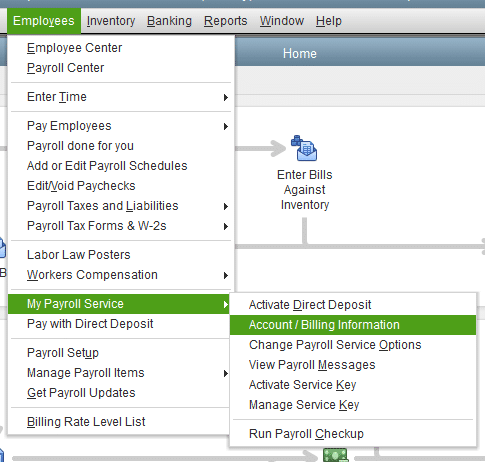

- Open QuickBooks Enterprise, tap on the Employees menu, and click on the My Payroll Service button.

- Select Account/Billing Info, then enter the QuickBooks admin password to access your Intuit account.

- Now, tap on Billing Details. If no information is shown on your screen, then you are not the current billing contact. Then change the billing contract or holder’s name to fix this.

- Finally, hit Edit Billing Info, type in the updated billing details, and then choose I Agree.

If you are still unable to fix the QuickBooks error PS077 after updating QB payroll, then proceed to the next step.

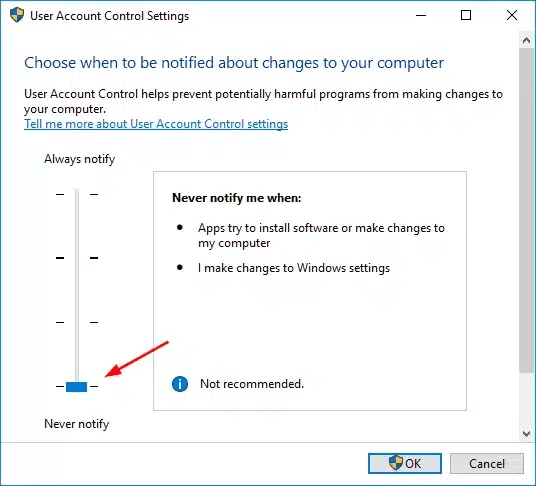

Turn off the UAC Settings from the Control Panel

Although the User Account Control (UAC) settings provide enhanced user security, they may prevent programs from being updated and cause errors like PS077 QuickBooks Desktop. To turn off the UAC settings on your computer, follow these steps.

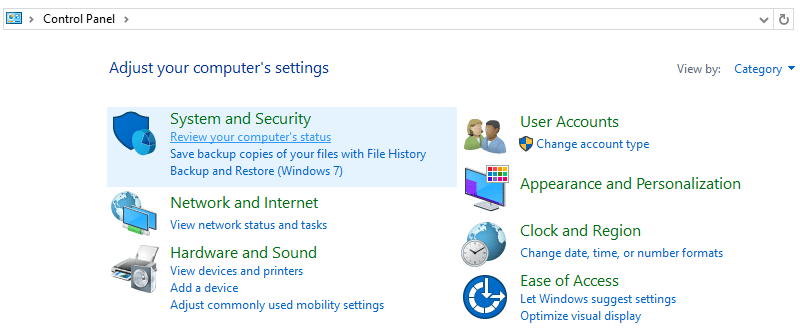

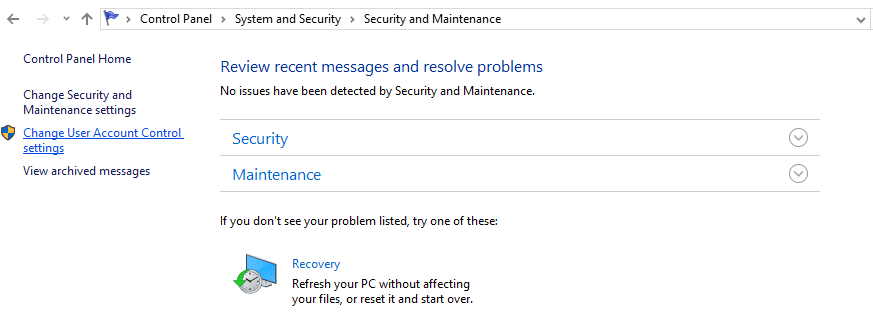

- Using the search box on the taskbar, launch the Control Panel.

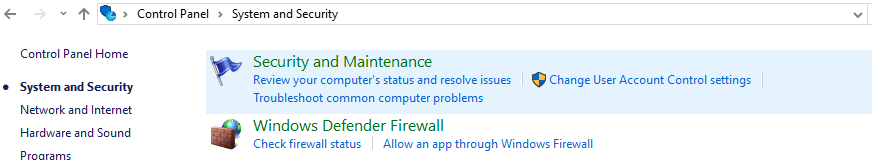

- Head to the System and Security section.

- Go under the Security and Maintenance tab.

- Locate and click on Change User Account Control settings from the left panel.

- Type in the administrator password and select “Yes”.

- Move the slider to the bottom towards Never Notify as shown below.

- Lastly, hit OK and save the settings, then run QuickBooks payroll updates.

Once the updates are finished, repeat this process and move the slider back towards Always notify to enable UAC settings. If the QuickBooks error PS077 still occurs, then you can resolve it by following the method below to repair the damaged QB data.

Verify and Rebuild the Data File

A primary cause of QuickBooks payroll error PS077 could be that you have a corrupted or damaged data file. To fix this problem, verify and rebuild the data file using the procedures listed below.

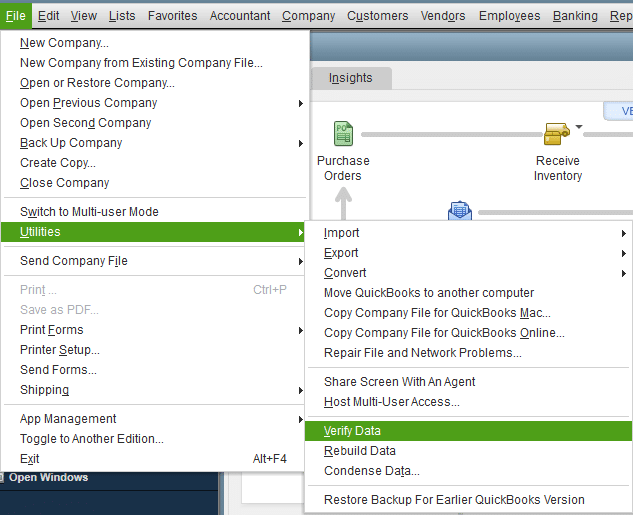

Verify the Company File:

You can use the Verify Data utility on QuickBooks Desktop by following these steps:

- Expand the Files menu on the QBDT homepage.

- Find the Utilities option and click on it.

- Hit Verify Data now.

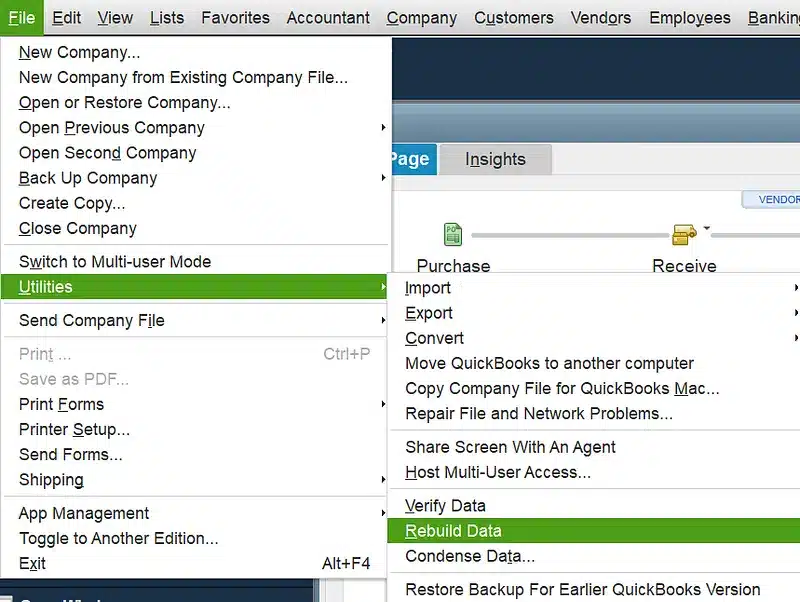

Rebuild the Company File:

Before you commence rebuilding the data file, make sure that you back up the company file. To rebuild your data file in QBDT, follow these steps.

- On the QuickBooks homescreen, select the Files menu.

- Choose and expand the Utilities menu.

- Lastly, select Rebuild Data.

After that, verify your data file once more to check for any additional damage. Is QuickBooks rebuilding the data file stuck? Use this guide to troubleshoot it. Try reinstalling the QBDT completely by following the next step if the QuickBooks error PS077 continues.

Reinstall the QuickBooks Desktop

An incomplete or incorrect installation of QB Enterprise may be the cause of the PS077 error in QuickBooks Desktop. Thus, to reinstall the QBDT program, take the actions listed below:

- Type in “Control Panel” in the search box on the taskbar, as shown below.

- Head to the Programs section in the Control Panel.

- Now you can click on “Uninstall a Program” or “Programs and Features“.

- Next, find and select the QuickBooks Desktop from the applications list.

- To remove the program from your device, choose “Uninstall“.

- Next, you can download and install the latest QuickBooks version.

- Lastly, set up the QB Desktop program.

Alternatively, you can use the QuickBooks clean install tool with this guide to get rid of QB payroll update error PS077, without impacting your data. If the error still occurs, then access it with a new Windows admin account.

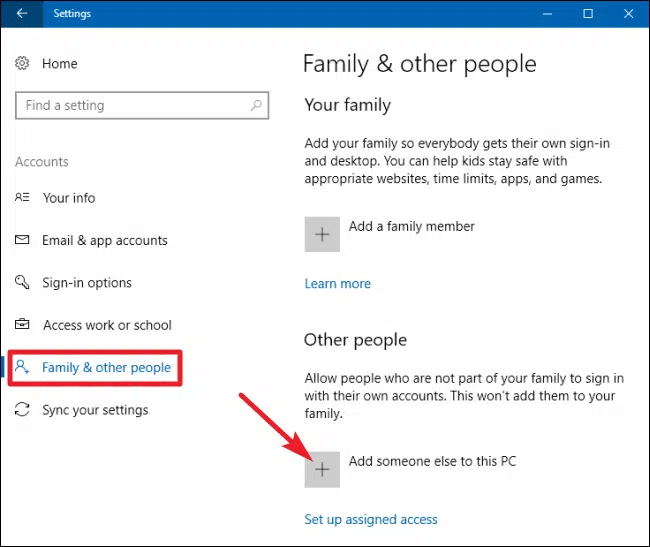

Create a New Windows Administrator

We will now examine whether a corrupted Windows user profile was the cause of QuickBooks error PS077. Create a new Windows administrator account by following the instructions below, then use that account to run the QB payroll update.

- Log in to your system as an existing user and go to Settings.

- Head to Accounts and locate “Other user” or “Family & other people“.

- Next, select “Add account” or “Add someone else to this PC” under the Other people section.

- Next, a Microsoft account sign-in window will open, and locate “I don’t have this person’s sign-in information” underneath it.

- Then, select “Add a user without a Microsoft account“.

- Provide a username and password for the account and hit Next.

Note: You might be required to add a password hint or enter an answer to a security question of your choice. - Click on the newly created account and open the “Change account type” dropdown.

- Select “Administrator” in the dropdown and tap “OK“.

- Finally, you can sign out of the old user account and sign in with the new administrator account.

Log out of the current user after creating the new Windows admin user account. Try updating the payroll tax table and see whether the new admin user causes the QB payroll error PS077. If it does, then refer to the following resolution.

Rename QBWUSER.ini and EntitlementDataStore.ecml Files

When you encounter the QuickBooks error PS077, the issue may lie with the QBWUSER.ini or EntitlementDataStore.ecml files. You can follow the process below to rename these files and continue to update the QB payroll tax table.

- Open the File Explorer and locate the QBWUSER.ini file.

- Select the file and click on Rename.

- Add ‘.old’ at the end of the file name and hit Save.

- Similarly, locate and rename the EntitlementDataStore.ecml file.

- Once done, go to QBDT and open your company file.

- Create a copy of the company file and store it in a local folder.

- Then, open the copied file in File Explorer.

Verify whether the file opens without any error, or the PS077 error in QuickBooks Desktop occurs again.

Quickview Table for QuickBooks Error PS077

Tabulated below is a concise overview of the QuickBooks payroll error PS077 that occurs during update payroll and tax tables updates:

| Error message | “QuickBooks Error PS077: QuickBooks is having trouble installing your payroll tax table updates.” |

| Its causes | Missing or damaged CPS files, corrupted QuickBooks payroll tax tables, incorrect Windows Firewall settings, QB company files won’t open, outdated version of QB Desktop, inaccurate or outdated billing details, misconfigured internet connection settings, improper installation of QB or damaged program files, incorrect UAC settings, inactive or expired payroll service subscription. |

| Troubleshooting methods | Review your subscription for payroll service, register QuickBooks Desktop and update it, use the Quick Fix My Program tool, launch the QuickBooks Install Diagnostic tool, run the QB File Doctor utility, add Firewall exception for QuickBooks ports, create Firewall exclusions for QuickBooks .exe files, run repairs on QuickBooks application, change CPS Folder name, update the credit card details for billing, turn off UAC settings, run the verify and rebuild data utility, reinstall the QB Desktop entirely, add a new Windows administrator account, change the QBWUSER.ini and EntitlementDataStore.ecml file names, or use the QuickBooks Clean Install Tool. |

| Tools required | QuickBooks Install Diagnostic Tool, QuickBooks File Doctor Tool, QuickBooks Clean Install Tool, Quick Fix My Program, and Verify and Rebuild Utility. |

The Bottom Line

In this blog, we have discussed the factors that can lead to QuickBooks error PS077, so that you can identify the root cause of why you are unable to update payroll and tax tables. You can take precautions by looking through the leading factors to prevent the QB payroll error PS077 from occurring on your device. Additionally, there are various solutions in the blog that will help you resolve this error seamlessly.

Are you experiencing technical issues while fixing the QuickBooks error PS077? Our specialists are here to guide you. Dial 1.855.738.2784 and speak with an Accounting Helpline’s expert to get back on track for updating tax tables and payroll.

Frequently Asked Questions (FAQs)

What is error code PS077 in QuickBooks?

QuickBooks error PS077 is a part of the PSXXX error series that occurs when you are updating payroll and tax tables on your device. This error prevents you from updating to the latest version of payroll or tax tables, which can hinder your work and accounting tasks. It can occur due to many reasons, which include both internal issues of QB Desktop and external issues of your computer system, or other applications.

Why do I get QuickBooks payroll error PS077?

As mentioned above, numerous key factors can lead you to the QuickBooks payroll update error PS077. Some of these reasons include damaged CPS files on your computer, corrupted tax tables in QB payroll, the Windows Firewall settings may be incorrect, the company files fail to open, you might have an outdated version of QuickBooks Enterprise, the billing details are wrong, program or installation files are damaged, the payroll service subscription may be inactive or expired.

How to eliminate QuickBooks error PS077?

You can try several solutions to get rid of the QuickBooks payroll error PS077, such as checking your payroll service subscription, registering the QuickBooks Desktop and updating it, using the Quick Fix My Program tool, running the QuickBooks Install Diagnostic tool, or repairing the company file with the QB File Doctor tool. You can also try adding a Firewall exception for QuickBooks ports or creating Firewall exclusions for QuickBooks .exe files. You can repair the QuickBooks application through the control panel, rename the CPS folder on your device, and perform other troubleshooting steps.

Related Posts-

Comprehending the QuickBooks Error 15276 With Causes & Solutions

What Steps to Follow When QuickBooks Won’t Open

Fix QuickBooks Error 3371 status code 11118/11104/1 With Hustle Free

How to Fix Payroll Error 40003 QuickBooks Desktop in Windows 11

Guide to Fix QBCFMonitorService Not Running On This Computer

QuickBooks Error H202 in Multi-User & Solutions to Fix it

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.