Last Updated on July 7, 2025

As a business owner, you know it is important to pay your employees on time. QuickBooks offers a feature that simplifies your payroll process and allows you to deposit funds directly into your employees’ accounts. However, you might face QuickBooks direct deposit issues in doing so, which can be frustrating for both you and your employees.

There are many such problems. It’s important that you address these issues on time, as they can result in your payments getting delayed or canceled. Through the help of this blog, we’ll explain to you how to address various problems you might face with direct deposits.

It’s essential to resolve QuickBooks direct deposit issues promptly, as they can delay paychecks and significantly hinder your workflow. To address them, speak to our Accounting Helpline’s experts today at 1.855.738.2784!

What are QuickBooks Direct Deposit Issues?

First, let’s take a look at QuickBooks direct deposit issues.

QuickBooks offers a service, “direct deposit,” through which you can transfer payments directly into your employees’ bank accounts. This eliminates the trouble of printing or writing paychecks and saves you valuable time. However, due to some issues with QB direct deposit, the payments can get delayed or might not go through at all. So it’s important to fix these issues on time.

Now that we understand what direct deposit issues are, let’s see the potential causes for QuickBooks’ failed direct deposit.

Possible Reasons for QuickBooks Direct Deposit Error

Before discussing specific issues, if your direct deposit failed in QuickBooks, it can be due to the following reasons:

- You have not set up your direct deposit correctly.

- The QuickBooks Payroll subscription you have is not active.

- You’re not using up-to-date QB and QB Payroll versions.

- Your company bank account has not been verified or linked.

- The employee bank details you have entered are inaccurate.

- You don’t have a stable internet connection.

- You’re not logged into QuickBooks as an Admin.

Before exploring specific issues, let’s first navigate through patching some of the general errors that can cause your DD to fail with the help of our Accounting Helpline’s experts.

General Methods to Fix if QuickBooks Failed Direct Deposit

We have mentioned below fixes for some of the general reasons you may face direct deposit errors. First, let’s start with setting up your QuickBooks direct deposit the correct way:

1. Setting Up QuickBooks Direct Deposit the Correct Way

You might be facing QuickBooks direct deposit issues due to an improper setup. Let’s first make sure that this feature is activated in your QB payroll with the following steps:

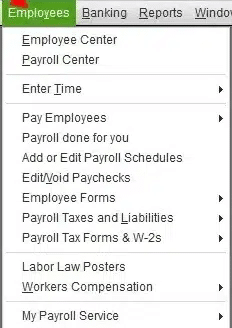

- Navigate to the Employees section in QuickBooks Payroll.

- Select Employee Center and open the employee list.

- Double-click on the employee’s name for whom you have to set up direct deposit.

- Now, select the Payroll Info tab.

- Now, under the Direct Deposit button, choose Direct Deposit.

- Now, press Use Direct Deposit.

- You will get a choice to deposit the paycheck in more than one account.

- Choose accordingly.

- Enter your employee bank details, such as bank name, account number, and routing number.

- Enter the type of account.

- Press OK.

This should set up your QuickBooks direct deposit correctly. Do this for all your employees, and your issue should be fixed. Let’s move on to the next method.

2. Update Your QuickBooks Application and Payroll

The reason you might be facing QuickBooks direct deposit issues is due to an outdated version of the QuickBooks software. It’s important to update both QuickBooks Desktop and QuickBooks Payroll to their latest version to avoid facing this problem.

3. Verify Your Bank Account Info to Activate Direct Deposit

One of the reasons for a QuickBooks direct deposit error is that your bank account is not verified by Intuit. After you connect your account to Intuit, it will make two withdrawals of less than $1.00 to verify it within 2-3 banking days.

Once you have the transaction amount ready, follow the steps below:

- Open QuickBooks.

- Sign in to your Admin account.

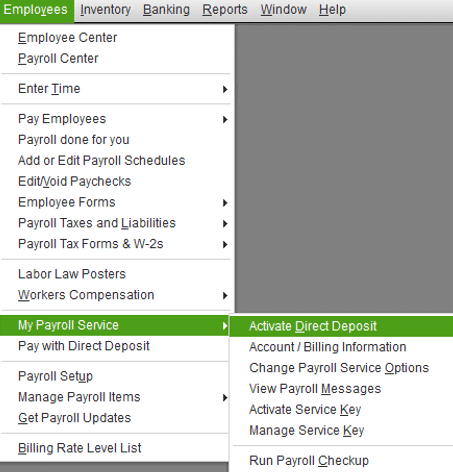

- Navigate to the Employees section.

- Select My Payroll Service.

- Press Activate Direct Deposit.

- Sign in to your Intuit account.

- Enter the debit amount twice.

- Press Verify.

- Enter your payroll PIN.

- Select Submit.

- Click OK.

However, if you don’t see the Activate Direct Deposit option, follow the steps below:

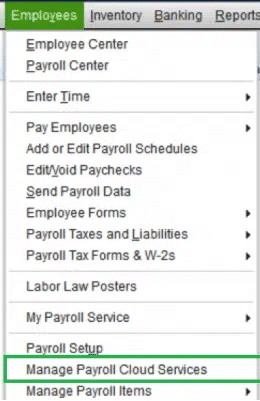

- Open the Employees tab.

- Click on Manage Payroll Cloud Services.

- Let it load completely.

- Close it.

Finally, follow the steps above again to verify your bank account. Once your account gets verified, you’ll be able to pay your employees using direct deposit.

4. Activate QuickBooks Direct Deposit

You can also be facing errors if your direct deposit is not active. So, make sure that your QB direct deposit is active.

Implementing these solutions should fix the general errors you might face while using QuickBooks direct deposit.

Various QuickBooks Direct Deposit Issues: How to Address Them

Now that we have fixed the general errors, let’s move on to the specific issues you can encounter while using QB direct deposit.

Scenario 1: Your Direct Deposit is Taking Too Long

If your direct deposit is taking too long, first contact the employee’s bank account and check the payroll status, then do the following before moving on to the steps:

- Check if your payday falls on a federal holiday.

- Check your direct deposit lead time.

If any of the above-mentioned is the cause of the issue, wait for the DD to get processed in a few business days; if not, continue with the steps below:

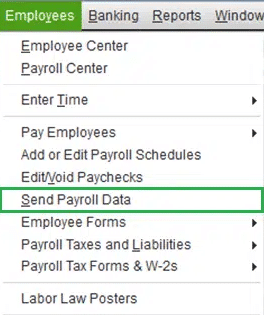

- Open the Employees menu.

- Select Send Payroll Data.

- In the Items Received section, look for the payroll data confirmation.

- Select the payroll confirmation you want to see.

- Press View to see the confirmation details.

After verifying, talk to your bank representative. They can let you know the reason behind the delayed QB direct deposit and can tell you when the payroll will be posted.

Scenario 2: Trouble Creating a Direct Deposit in QuickBooks for the First Time

If you’re creating a direct deposit for the first time, you can face some QuickBooks direct deposit issues and receive an error message such as:

“XX’s check will not be directly deposited because the first set of paychecks is still in the process of completion. You will need to issue manual checks for the net amount calculated for this employee.”

This error can be easily resolved by the steps provided below:

- Delete all of your direct deposit paychecks.

- Create all the direct deposit paychecks again.

- Finally, approve all the direct deposit paychecks.

(Note: This is only applicable for the users who are creating direct deposit in QuickBooks for the first time.)

This should fix your issue. Now, let’s look at another direct deposit issue you may encounter.

Scenario 3: Error – “Problem creating request file. We tried to send your…”

Sometimes, you might run into this error message when sending direct deposits:

“Problem creating request file. We tried to send your payroll information, but the transmission failed.”

To fix this, follow the steps below:

- Run QuickBooks as an Admin.

- Now, switch to Single-user mode from the File menu at the top bar.

- Manually verify your Employee Information from the Employee Center.

- Ensure that the employees’ names don’t consist of any special characters or double spaces.

- To check the payroll connection, send a zero paycheck with the following steps:

- Click on Employees.

- Select Send Payroll Data.

- Ensure you’re not sending any paychecks in Items to Send.

- Click Send.

- Now, enter your DD PIN.

- A confirmation message would tell you that your payroll session was successful.

This should fix this problem.

Scenario 4: Your QuickBooks Direct Deposit Might Not Be Going Through

If your QuickBooks direct deposit is not going through, one of the following could be the possible reasons:

- You submitted your direct deposit payroll after 5 PM PST.

- Your employee’s bank account information is not correct.

- Your employee’s bank account might be facing problems.

Once you get rid of these issues, the settlement is done in 2-3 business days. If it takes any longer, contact the bank for further assistance.

Scenario 5: Your Direct Deposit has Been Made With Incorrect Account Information

One of the QuickBooks direct deposit issues can be that your direct deposit has been made to an employee with incorrect banking details. You can be dealing with two different scenarios in this problem. Let’s discuss both, one at a time:

- The Account/Routing Number is Incorrect.

- Speak to the bank to check the status of the said account:

- If the account you directly deposited to is live, you have to immediately start a direct deposit reversal.

- If the account is closed or non-existent, speak to the bank to see if the payroll is rejected.

- Speak to the bank to check the status of the said account:

(Note: In case your payroll was rejected, the bank would send you a notice through Intuit. If you don’t receive any, call the bank to recover the funds.)

- The Account in Which The Direct Deposit Was Made Belongs to Another Employee

- Speak to the owner of the account the money was debited to, and initiate a refund through an internal agreement.

- Change the direct deposit bank account of your employee.

Scenario 6: The QB Direct Deposit Didn’t Reach The Employee

In the variety of QuickBooks direct deposit issues, one you may encounter is that the DD didn’t reach your employee. To fix this, follow the mentioned methods:

- Check and Verify Your Employee’s Direct Deposit Info:

- Open QBDT.

- Click on Employees and select the Employee list.

- Double-click on the employee name whose information you want to verify/change.

- Press Payroll Info.

- Click Direct Deposit.

- Check, and if necessary, update the Routing and Account number.

- Finally, click OK.

- Manually Make a Deposit in QBDT:

- Navigate to the Banking menu.

- Click Make Deposit.

- In the Deposit list, select the bank account to which you want to transfer the funds.

- In Date, select the date when the rejected funds were returned to your account.

- In the Received From section, select QuickBooks Payroll Service.

- In the From Account section, enter the Direct Deposit Liabilities account.

- In Memo, write your employee’s name.

- Enter the rejected direct deposit amount in the Amount Field.

- Skip Check No.

- Choose the method of payment.

- Choose a class if you use Class Tracking.

- Press Save & Close.

- Check the Direct Deposit Liabilities balance to verify the corrected information.

This should fix the issue if the DD doesn’t reach the employee.

Fixing Direct Deposit Issues in QuickBooks – A Quick View

Below is a concise summary of this blog in a tabulated format.

| QuickBooks direct deposit issues | Often, when you send a direct deposit, it either gets delayed or rejected due to certain reasons, or it can’t go through |

| What causes these issues? | You have not set up your direct deposit correctly, don’t have an active QuickBooks Payroll subscription, or you’re not using up-to-date QB and QB Payroll versions. Additionally, your company bank account might not have been verified or linked, your employee bank details are inaccurate, or you don’t have a stable internet connection. Also, you might not be logged into QuickBooks as an admin. |

| How to fix them? | Set up direct deposits correctly. Update your QB application. Update your QB Payroll. Verify your banking information. Verify your employee’s banking information. Ensure you have activated QuickBooks direct deposit. Check if your payday falls on a federal holiday. |

Let’s Recap

Through the means of this blog, we explained to you what QuickBooks direct deposit issues are. Moreover, we provided you with a guide to fix all the general and specific errors you might face while using direct deposit in QB Payroll. If somehow you’re unable to troubleshoot any of the errors yourself, feel free to speak to our Accounting Helpline’s experts today at 1.855.738.2784.

FAQs

How to Correct a Direct Deposit Paycheck in QuickBooks Desktop?

If you want to correct a paycheck in QuickBooks Desktop, you have to first check the payroll status of it. If it’s not offloaded yet, you have to first cancel the wrong paycheck and then create a new one that is correct.

How to Reverse a Direct Deposit in QuickBooks?

To request a DD reversal in QB, you have to ensure that it’s done within five business days from the payday. However, the retrieval of funds is not ensured. To request a direct deposit reversal in QuickBooks, you have to pay a $75 fee. To do that, you have to open the Direct Deposit Reversal Form, select Add Request, enter the required information, and press Save.

How Long Does Intuit Direct Deposit Take?

The direct deposit time in QB depends on your chosen QB Payroll plan and the funding time. It can be deposited on the same day or a few business days, depending on your plan and funding time. Some users can have a 5-day lead time, while others with subscriptions like QB Payroll Assisted can enjoy 1-day processing.

Does QuickBooks Payroll Do Direct Deposit?

Yes, QuickBooks Payroll does provide direct deposit, which means you don’t have to go through the trouble of manually writing or printing paychecks and can deposit the paycheck directly into your employees’ accounts.

Related Posts-

Powerful Methods to Overcome QuickBooks Payroll Error PS036

Effectively Troubleshooting the QuickBooks Status Error Code 5528

How to Fix QuickBooks Error Code H202: Definition, Symptoms, Causes, & Solutions

Fix QuickBooks Error 1601: Problem with Windows Installer

How to Fix QuickBooks Script Error- An Error has Occurred

How To Fix QuickBooks Error PS038? Easiest Method

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.