Last Updated on March 10, 2025

Often, you would need to print out your W3 forms, for instance, to send them to your accountant or to maintain your own records. However, this is done differently in QuickBooks Desktop and QuickBooks Online. This is what we are going to discuss in this blog.

Here, we will guide you step-by-step through printing W3 in QuickBooks Desktop and Online. We have curated separate sections for both QB Desktop and Online; therefore, navigate to the section for the QB product you use. Alright, then, let us dive into it.

Effective Steps to Print W2 and W3 from QuickBooks Online

You can print your W-2s on or after January 1 if your automated taxes and forms setting is turned off. However, if the settings are turned on, you can print your W-2s on or after January 15.

If You Have Automated Taxes and Forms Turned On

If the automated taxes and forms are turned on, Intuit pays and files the forms for you from Jan 16 to Jan 31. You can reprint these forms on plain paper from Jan 13.

Print W2s for the Current Year or 1 Year Prior

To print the W2 forms for the current year or one year prior, implement the following steps –

- Select Taxes, then click Payroll Tax, and select Filings.

- Select Resources, then click W-2s, and review the list of employees who opted for a printed copy.

- Remember, W-2 forms won’t print for employees who selected the paperless mode, and they can print their copy from QuickBooks Workforce if needed. If you want to change the chosen paper type, select Change Setting.

- Further, select View or Manage on the copy you need among the following –

- W-3 Summary Transmittal of Wage and Tax Statements

- W-2, Copies B, C & 2 (for employees)

- W-2, Copies A & D (for employers)

- Select View and Print, then click the Print icon on the Adobe Reader toolbar and select Print.

Note: If you’re printing the form because your employee lost it or didn’t get the original W-2, write “REISSUED STATEMENT” on the top of the form and ensure to include a copy of the W-2 instructions.

Print W2s for Previous Years

Go through the following steps to print W2 forms for employees in QuickBooks Online for previous years –

- Select Taxes, then click Payroll Tax, and select the Filings option.

- Select Resources, then click Archived forms and filings, and choose the date range you need.

- You can search for the needed forms, then select View on the W-2 or W-3 form you want to print.

- Finally, select the Print icon on the Reader toolbar, then click Print again.

If You Have Automated Taxes and Forms Turned Off

If the automated taxes and forms are turned off, you’ll have to print and mail the forms to your employees postmarked by Jan 31.

To print W3 in QuickBooks Online when the settings are off, perform the same steps mentioned above in the “If You Have Automated Taxes and Forms Turned On” section.

Note: Review your Form W-2 Print settings if your automated taxes and forms settings are off.

Once the process ends, you will be able to print the W2s and W3s successfully in QBO.

Practical Steps to Print W3 in QuickBooks Desktop

If you want to Print W3 in QuickBooks Desktop as well W2, go through the following detailed steps –

QuickBooks Desktop Payroll Assisted

You can Intuit payroll W2 and W3 forms in QuickBooks Desktop Payroll Assisted in the following manner –

Note: You can print your W2 forms in QBDT starting from January 10. If you chose Intuit Print, you only need to print your W-2s if your employee lost the form or didn’t get the original version.

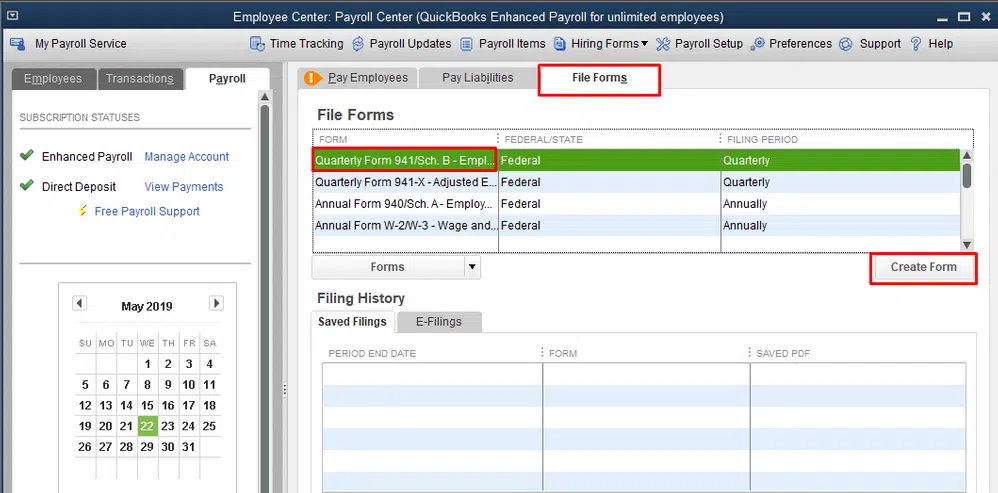

- Select the Employees section, then click Payroll Center, and go to the File Forms tab.

- Select View/Print Forms & W-2s, then enter your payroll PIN, and select OK.

- Select the W-2s tab, then choose the year, and select all or individual employees.

- Now, select the Open/Save Selected button and select the applicable reason for printing the W-2s.

- Finally, select File on Adobe Reader and click Print.

Note: If you’re reprinting because your employee lost the form or didn’t receive the original, write “REISSUED STATEMENT” on the top of the form and add a copy of the W-2 instructions.

What If You Print the W3 Form Yourself?

From January 31st, those who print and mail the forms themselves can send the W-3 form to the employees. After that, you must get the requirements ready, like purchasing W-2 paper, in order to print the forms correctly.

After you have the print paper ready, you can continue printing the W3 form in QuickBooks Desktop for the previous/current year by using the steps mentioned above.

QuickBooks Desktop Payroll Enhanced and Standard

If you wish to learn how to generate W3 in QuickBooks Desktop Payroll Enhanced and Standard versions, follow the steps below –

- Firstly, ensure to update QuickBooks Desktop and have the latest payroll tax table updates installed.

- Open the Employees dropdown menu, select Payroll Tax Forms & W-2s, then click Process Payroll Forms.

- From the File Forms tab, elect Annual Form W-2/W-3 – Wage and Tax Statement/ Transmittal, and click Create Form.

- Select all or individual employees to file, then enter the year, and select OK.

- Select all or individual employees to print and click Review/Edit to review each W-2. The reviewed W-2 forms will have a checkmark in the Reviewed column.

- Finally, select Submit Form and follow the on-screen steps to print and file the forms.

Note: If you’re printing W2/W3 again because your employee lost or didn’t get the original form, write “REISSUED STATEMENT” on the top and include a copy of the W-2 instructions.

After completing the steps, you will be able to print W2 and W3 successfully in QuickBooks Desktop.

Steps to Print a Copy of the W-3 Form Information

While you Print W3 in QuickBooks, you might need a copy of W3. If you choose to file your W2s manually, you need to file W3 along with a copy of W2. If you want to print a copy of the W3 info, you can get a report and fill it manually in the following manner –

QuickBooks Online Payroll

To get the report with your W3 info in the QBO payroll, follow the steps below –

- Select Reports, Standard, then select Payroll and click Payroll Tax and Wage Summary.

- Ensure the date range spans an entire calendar year and select Run Report.

- Select the drop-down box titled Share, click Printer Friendly, and select Print.

QuickBooks Desktop Payroll

Follow the steps mentioned below to print the report with the W3 info in the QBDT payroll –

- Select Reports, click Employees & Payroll, and select Payroll Summary.

- Ensure your date range spans an entire calendar year, and click Print.

Note: You can reference the Total column on the far right side to get W-3 totals.

Intuit Online Payroll

If you use Intuit Online Payroll, use the steps given below to print the report with the W3 info –

- Select Reports, click Tax and Wage Summary, and ensure the date range covers an entire calendar year.

- Select Run Report and click the Printer-Friendly Version link at the top of the table.

- Select Print in the pop-up window that displays your report and open the Share drop-down.

- Select Printer Friendly and click Print in the pop-up window that shows your report.

Once the process ends, check the prints to ensure they are printed correctly.

Conclusion

We hope this detailed guide helps you successfully print W3 in QuickBooks Desktop & Online versions. However, if these steps don’t work or you are facing issues in the printing process, you can reach out to Accounting Helpline expert team for direct guidance.

FAQs

Where can I find saved tax forms in QuickBooks?

If you want to find the previously filed tax forms, QuickBooks saves them as archived forms. To access these forms, go to Taxes and select Payroll Tax. Then select the Filing tab, click Resources, and choose Archived Forms and Filings.

Can you reprint a W2 form in QuickBooks?

Yes, you can print your W2s again in QuickBooks. To reprint, sign in to workforce.intuit.com and go to the Documents section. Then select the W2 copy or document you wish to view/download, and click Print.

How can I view or print W2 forms using the QuickBooks Workforce app?

You can view or print your W2s using QuickBooks Workforce in the following manner –

Firstly, select Taxes, then click More, and select W-2s.

Further, click Download and select the W-2 form you want to view or print.

Note: To go paperless, select Go Paperless from the “Ditch the snail mail!” section.

What is the checklist required to create W2 forms for employees?

The checklist for gathering information while creating W2 forms for employees includes the following –

1. Employee’s full (legal) names.

2. Social Security Numbers.

3. Mailing addresses.

4. Total earnings.

5. Federal and state withholding amounts.

6. Social security and medicare wages.

7. Other plans, like dependent care benefits.

8. Local tax info, including withheld wages and taxes.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.