Last Updated on August 20, 2025

Intuit offers an add-on service to the QuickBooks software called Payroll. It’s a subscription-based service, which makes managing tasks like sending paychecks, calculating and filing taxes, employee deductions, employee bonuses and benefits, and filing forms like W-4 much easier. To take advantage of this service, you need to first pay a subscription fee and then set it up on the QuickBooks platform you use, be it Online or Desktop. That’s where this blog comes in handy; we’ll cover how to set up payroll in QuickBooks (both Online and Desktop). So without further ado, let’s get started by first discussing what the QuickBooks Payroll service actually is.

Setting up payroll in QuickBooks can be a hassle. The setup needs to be accurate and free of mistakes in order for the payroll to work correctly. Contact our Accounting Helpline’s experts at 1.855.738.2784 to get immediate help and set up QuickBooks payroll and overcome any issues you may face promptly.

QuickBooks Payroll – A Comprehensive Explanation

The QuickBooks Payroll service can help your business manage the employee paycheck processes with great ease and accuracy, and ensure timely payments and tax filings. You can also customize the payroll to pay weekly, biweekly, monthly, and quarterly paychecks. The cost of the payroll subscription varies between the versions and the platform you might be using. QuickBooks Online also offers a free 30-day trial period for those interested in the payroll service. After activating the payroll subscription, all you need to do is set it up. Before we cover how to set up QuickBooks Payroll, let’s first discuss the different types of payroll services offered by Intuit.

Different Types of Payroll Services Offered By QuickBooks

Before we discuss how to set up payroll in QuickBooks, it’s important to know about the types of payroll services offered by QuickBooks across Online and Desktop, so you can choose your subscription wisely. Let’s first discuss QB Online.

QuickBooks Online Payroll

In QB Online, you have the option to select between Payroll Core + Simple Start, Payroll Core + Essentials, Payroll Premium + Plus, and Payroll Advanced. Let’s list the features you can avail for each down below:

- Payroll Core + Simple Start – By choosing this subscription, you can avail:

- Free onboarding session

- UNLIMITED invoices & quotes

- Automated Payroll

- Track income & expenses

- Snap & store receipts

- Track kilometres

- Connect your bank

- Track GST & e-lodge BAS

- Insights & reports

- Cash flow planner

- Phone & chat messaging support

- 250 Chart of Accounts

- Manage one user

- Payroll Core + Essentials – This includes all the benefits of the previous one, and:

- Manage three users

- Free data migration

- Manage suppliers & bills

- Multi-currency

- Set up recurring transactions

- Payroll Premium + Plus – This plan includes all the benefits of other subscriptions, with added benefits like:

- Manage five users

- Track inventory

- Manage projects

- Manage budgets

- Track 40 locations and classes

- Payroll Advanced – This is the most premium plan QuickBooks offers. This includes the features from previous versions, along with:

- Unlimited Chart of Accounts

- Manage 25 users

- Unlimited track locations and classes

- Data sync with Excel

- Customise role permissions

- Automate workflows

- Custom reporting fields

- Customise dashboards

- Backup & restore data

- Manage revenue recognition

This can help you choose your payroll plan in QuickBooks Online wisely before you set up the payroll service. Now, let’s proceed to QB Desktop.

QuickBooks Desktop Payroll

The QuickBooks Desktop Payroll Basic and Enhanced versions are no longer being offered for subscription. Instead, you can move to QB Payroll Enhanced or Enterprise for QBDT. Choose the plan according to your needs.

Now, let’s discuss how to set up payroll in QuickBooks for both Online and Desktop.

Set Up QuickBooks Payroll | A Step-by-step Guide

If you’re wondering how to set up payroll in QuickBooks, this section has it all for you. We’ll learn about the process to do so in depth for both Desktop and Online. So let’s talk about the method to set up payroll in QBO first.

QuickBooks Payroll Setup for Online

You can set up your QuickBooks Online Payroll service with the steps given to you below:

Firstly, start the Payroll setup

- Purchase a suitable Online Payroll subscription.

- Then, sign in to your QBO account as an admin.

- Navigate to the Payroll tab.

- Choose Overview.

- Then, hit the Get started option.

- Choose if you (or another person) have paid your employees in the current year.

- Now, choose the date for when you’ll start paying your employees through QBO Payroll.

- Type in your business address:

- Type in a physical address.

- Do not use a P.O. Box.

- The address you type in will be used to determine the tax responsibilities.

- Multiple work locations can be added later with employees.

- Type in a physical address.

- Then, enter your contact information for payroll:

- Enter your (or the person responsible for paying the employees) contact info.

- The contact number you enter will get important alerts and notifications from QuickBooks.

- Choose how you’ve run your payroll prior to QuickBooks:

- In some cases, you may be able to import your employee information and pay history.

- Otherwise, you would need to enter it manually.

Now, let’s proceed to setting up tasks in your QBO Payroll.

Add Your Team

In this step, you’ll add your employees to QuickBooks Online Payroll. However, you should have this information in hand before proceeding to add them:

- A completed W-4 form.

- Or any other equivalent forms if applicable.

- Hire date.

- Birth date.

- Pay rate.

- Any deductions from the paycheck, like:

- Insurance

- Retirement

- Wage garnishments

- Bank account and pay card info.

- Sick, vacation, or paid time off (PTO).

Now, proceed with the steps to add an employee to QB Online Payroll:

- Click on Add an employee.

- Enter the employee’s name and email address.

- If your employee wishes to enter their own personal, tax, and banking information:

- Click on Yes, allow the employee to enter their tax and banking info in Workforce.

- Your employees would receive an invitation email for QuickBooks Workforce.

- From there, your employee can enter:

- Address

- SSN (Social Security Number)

- W-4 form

- Banking Information

- Then, press Add employee.

- Click on Start or Edit to change or add any employee info:

- If your employee was self-set up in the previous step, you won’t be able to change some fields in:

- Personal Info

- Tax withholding

- Payment method cards

- To edit the above fields, you can turn off the Employee self-setup.

- If your employee was self-set up in the previous step, you won’t be able to change some fields in:

- Finally, click on Save after adding the required info.

The next step in setting up payroll is adding your tax info.

Add Your Tax Information

You would need to add your tax information for these fields while setting up the payroll:

- EIN – Employee Identification Number.

- State withholding/unemployment account numbers.

- Local tax withholding account numbers, if applicable.

- Tax deposit frequency:

- Federal, state, or local

- State tax rates:

- Unemployment

- Surcharges

- State disability

- Paid family leave

Now, let’s take a look at the steps to set up the option to file your payroll taxes.

- Click on Settings

- Choose Payroll Settings

- Go to the Taxes and forms section

- Select Edit

- Now, choose one of the following:

- Automate taxes and forms – Select this if you want QB to automatically file and pay your taxes.

- However, when you turn on the Auto-Pay/File option, you would need to self-process any owed taxes beforehand, or else it won’t process the future taxes automatically.

- I’ll initiate payments and filings using QuickBooks – Select this option for manual, but electronic payment of taxes in QuickBooks.

- I’ll pay and file the right agencies through their website or by mail. This option should be selected if you wish to pay the taxes manually outside of QuickBooks. However, you’d still be able to generate the payments and filings in QB.

- Automate taxes and forms – Select this if you want QB to automatically file and pay your taxes.

- Click on Save.

- Lastly, select Done.

We’re getting closer to solving your query of how to set up QuickBooks Payroll in the Online version. The next step would be to connect your bank with QBO Payroll.

Connect Your Bank Account with QuickBooks Online

You would need the following information before connecting your bank account with QuickBooks:

- Principal officer’s name.

- Home address.

- Social Security number.

- Birth date.

- Business bank account and routing number.

Now, follow these steps to connect your bank account in QuickBooks Online Payroll:

- Go to the Connect your bank section.

- Click on Let’s go.

- Then, press Get started.

- Navigate to the Business section.

- Hit Edit.

- Add any information that was missing, like your federal tax ID.

- Press Next.

- Now, add the following:

- Principal Officer name

- Address

- Date of birth

- Social Security number

- Select Next.

- Then, click the Add new bank account option.

- Search for the name of your bank.

- Enter your online banking user ID and password.

- Or, select Enter bank info manually.

- Enter your account and routing number.

- Hit Save.

- Finally, click on Accept and Submit.

Performing these steps would set up QuickBooks Payroll for the Online version.

QuickBooks Payroll Setup for Desktop

After you have purchased the QB Desktop payroll plan according to your needs, the next step should be to activate your Payroll in the QuickBooks application.

Activate the QuickBooks Desktop Payroll Subscription

After buying the payroll plan, you’ll receive a 16-digit service key by email. You have to enter it in QBDT to activate payroll. Follow these steps to do so:

If you have purchased payroll online:

- Open the QBDT app.

- Navigate to the Employees menu.

- Click on Payroll.

- Then, press Enter Payroll Service Key.

- Select Add.

- Now, enter your 16-digit service key.

- Click Next, followed by Finish.

- Lastly, just wait for the tax table to download.

If you have purchased payroll from a store:

- Launch the QuickBooks Desktop app.

- Go to the Employees menu.

- Click on Payroll.

- Now, press Install Payroll from the Box.

- In the Payroll Activation page, enter the Payroll License and Product Information.

- You can find both the license and product information on a yellow sticker on the CD folder inside the box.

- Hit Continue.

- Follow the on-screen instructions to set up payroll.

- Enter your service key.

The next step after this should be to add your employees to your payroll.

Add Employees to Your Desktop Payroll

To add your employees to the QuickBooks Desktop Payroll, you need to have these details with you:

- A completed W-4 form.

- Hire date.

- Birth date.

- Pay rate.

- Paycheck deductions such as:

- Contributions to insurance

- Retirement

- Wage garnishments

- Direct deposit info if applicable.

- Bank account or pay card info

- Sick, vacation, and PTO accrual rates and balance.

After you have this information, adding an employee to your payroll becomes much easier with these steps:

- Open your QBDT app.

- Now, go to the Employees menu.

- Then, click on the Employee Center option.

- Press New Employee.

- Enter the required information.

- Click on OK.

Now, let’s proceed to setting up company contributions in QBDT payroll.

Set Up Company Contributions in Payroll

For this, you can select from an existing preset list, including pay items, retirement deductions, and insurance benefits, or you can also set up customer items. You can also add the provided benefits, like paid vacation and sick time off, if applicable. After setting up the payroll items, you can just press the Assign to employees button to apply them to all the employees.

Set Up Taxes in QBDT Payroll

For setting up taxes in payroll in QB Desktop, you’ll first need the following information:

- Employer Identification Number (FEIN).

- State withholding account number.

- And/or Unemployment account number.

- Federal and state deposit frequencies.

- State tax rates:

- Unemployment

- Surcharges

- State disability

- Paid family leave

- Other such rates

Enter this information for setting up taxes in QB Desktop. This completes the query of how to set up payroll in QuickBooks. However, you can also use a manual version of QB Payroll, which is free to use. So let’s discuss how to set up manual payroll in the next section.

How to Set Up QuickBooks Payroll Manual in the Desktop Application?

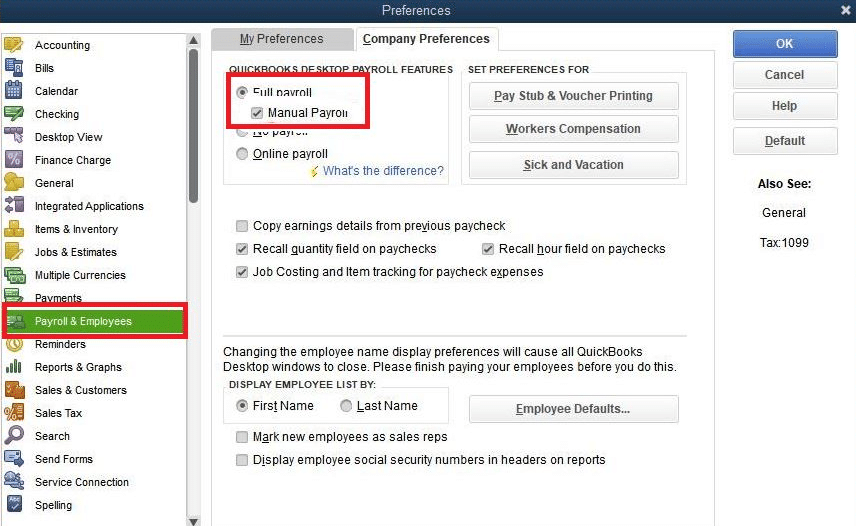

You can perform the detailed steps mentioned below to Set Up Manual Payroll in QuickBooks Desktop:

- Open the QuickBooks Desktop application, and under the Edit tab, click Preferences.

- From the left side panel, select Payroll and Employees and click the Company Preferences tab, and make sure that the Full Payroll and Manual Payroll options are checked under the QuickBooks Desktop Payroll Features section.

- Now, in the Get payday peace of mind window, click on Next.

- Follow it up by pressing Activate in the confirmation screen.

- Hit OK and apply the changes.

- Lastly, select OK again to exit the window.

Once done, you will have a Set Up Manual Payroll in QuickBooks Desktop, which is ready to perform the critical business operations.

Steps to Perform If the Manual Payroll Option Isn’t Available

Sometimes, you might face issues while setting up manual payroll in QB. If you can’t see the manual payroll option or the button is grayed out, perform the following troubleshooting steps –

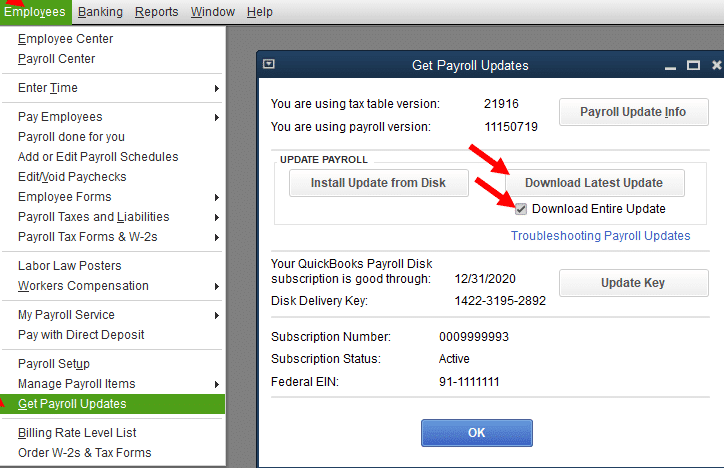

Step 1 – Update QuickBooks and the Payroll Tax Tables

Firstly, you must ensure your QuickBooks and payroll tax tables are updated. Download and install the latest QuickBooks Desktop updates, then download the tax table updates as follows –

- Open QBDT, move to the Employees menu, and select the Get Payroll Updates option.

- Then, select Download Entire Update, click Update, and wait for the informational windows to appear.

After the update is complete, rerun QuickBooks and check if you can set up manual payroll. If the option is still unavailable, move to the next step.

Step 2 – Disable Your Internet Connection

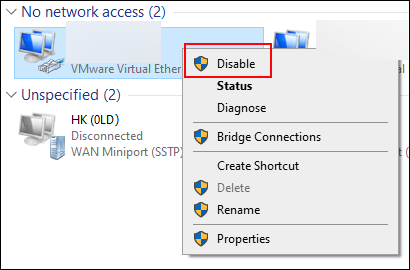

You can perform a counter-intuitive step by disabling the internet connection before searching for the manual payroll as follows –

- Disable the Internet connection on your computer and open QB Desktop’s Help menu.

- Search for “manual payroll“; it will show the local (not Internet) copy of the “Calculate payroll taxes manually” article, which includes the “manual payroll calculations setting” link, which links to an “Are you sure?” Help page.

- You will see a QBP Desktop message that Manual Payroll has been enabled, then go to the Edit tab.

- Select Preferences, click Payroll, select Company, and you’ll see the (unclickable) checkbox available.

If you still can’t see the option available, move to the next troubleshooting step.

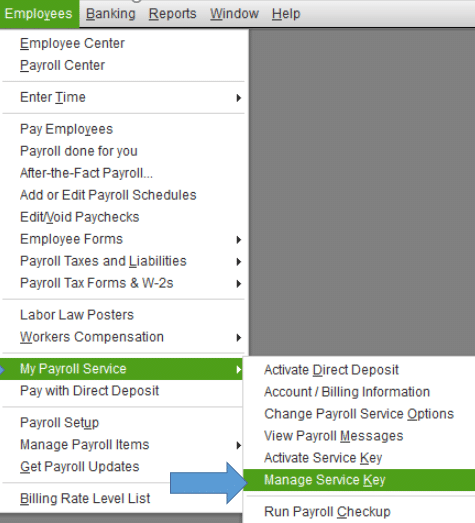

Step 3 – Remove the Payroll Service Key from the File

You can try removing the payroll service key to ensure the manual payroll option is available. The service key is likely preventing you from switching to QuickBooks Manual Payroll.

- Backup your company file first, then go to the Employees menu.

- Go to My Payroll Service, select Manage Service Key, and highlight your payroll subscription.

- Click Remove or press ALT + 0 (zero), and proceed with Yes to confirm.

After removing, check the Preferences again to ensure the Manual payroll option is available.

Conclusion

In this blog, we discussed how to set up payroll in QuickBooks Online and Desktop, along with the steps you need to do so. Moreover, we also discussed how to set up manual payroll in QuickBooks if you don’t want to purchase a subscription for it. Adding to it, also mentioned above are some of the troubleshooting methods if you don’t see the setup manual payroll option. If you face any trouble in setting up your Payroll in QuickBooks, feel free to contact our Accounting Helpline’s experts at 1.855.738.2784, who are here to guide you with every step.

FAQs

What are some common challenges with QB manual payroll?

Although maintaining manual payroll comes with many benefits, it also has some challenges as it is a time-consuming and laborious process. Manual payroll can lead to a higher risk of computing errors, and it lacks legal compliance support.

How do I enter a manual payroll paycheck in QuickBooks?

You can enter a manual payroll check in QuickBooks by implementing the following steps:

– Select Payroll & Employees, then go to the Company Preferences tab and select QuickBooks Payroll Features.

– Select the Full Payroll and Manual Payroll checkboxes, then in the Get Payday peace of mind window, click Next.

– Finally, select Activate in the confirmation screen and click OK.

Can I do manual payroll in QuickBooks Online?

In QuickBooks Online, the ability to do manual payroll is unavailable. QuickBooks Payroll is a separate service that provides payroll processing features, including recording and printing payroll checks, managing payroll tasks, calculating payroll taxes, and issuing paychecks within QuickBooks Online.

However, you can track your payroll paychecks manually as journal entries in the following manner:

– Click the Gear icon, select Chart of Accounts, and click the New button.

– In the Account window, select the Account and Detail Type, enter the Name and Description, and hit Save and Close.

What are the steps to Set Up Manual Payroll in QuickBooks?

You can manually do payroll in QuickBooks in the following manner:

– Gather your tax information and have your employees fill out the 1.855.738.2784 declaration form.

– Determine a payroll calendar, calculate gross pay, and withhold income taxes.

– Now, pay payroll taxes, then file and report your payroll.

– Lastly, keep well-maintained payroll records that are organized and accurate.

How to turn off payroll in QuickBooks Desktop?

Follow the steps below to turn off payroll in QBDT:

– Browse to Employees > Payroll Center

– In the Payroll tab, press Cancel Service

– Follow the on-screen instructions to complete the process.

Related Posts-

Fixing the QuickBooks Problem With Multi-User Hosting Setup

QuickBooks Multi-User Setup – Benefits, Precautions & Limitations

How to Troubleshoot Error 213 in QuickBooks Desktop

QuickBooks Error 6123, 0- Fix with Expert Guide

QuickBooks Error 6210, 0 | Detailed Troubleshooting Steps

QuickBooks Status Code 3170 | Reasons and Solutions

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.