Last Updated on July 14, 2025

(EIN) Employer Identification Number, also known as Federal Employer Identification Number, is a unique 9-digit number allotted by the Internal Revenue Service (IRS) for identification purposes to businesses operating in the United States. A user might want to change EIN in QuickBooks if the business entity has been changed or an incorrect EIN has been entered by mistake.

Most of the QuickBooks users who require adding an EIN to their QuickBooks Payroll Subscription need some specific information, such as zip code, service key, and EIN. This article will guide you through each step of adding an EIN to the QuickBooks payroll account, along with some of the restrictions and requirements. For complete and in-depth information, follow the article till the end.

The following guide will help you change or edit the EIN in QuickBooks Desktop payroll. But if you are unwilling to undertake the steps by yourself or need help with other payroll-related issues, you can contact our Accounting Helpline’s support team at 1.855.738.2784 for immediate assistance.

Restrictions and Requirements for Adding EIN to QuickBooks Payroll 2017 and Earlier

- You will need the same device and the same QuickBooks Desktop payroll account if you want to process payroll for more than one company with only one payroll subscription.

- Do not use more than one company file under the same Employer Identification Number and the same QuickBooks Payroll account because QuickBooks Payroll is designed to hold only one company file for every EIN, and it might trigger errors.

- Payroll subscription information, like contact info and payroll admin, must be the same for every company you add under your payroll subscription.

- QuickBooks allows only a fixed number of companies to be added under your Payroll subscription. For example, if you have a subscription to QuickBooks Enhanced Payroll, then you can add up to 3 companies.

- Make sure you never share your service key with anyone, as it can reveal your payroll subscription account information to unknown users.

IMPORTANT: Make sure you have an active QuickBooks Desktop Payroll Subscription and the Most Recent Payroll Tax Tables before running the payroll for your employees

Important Points to Consider Before Changing the EIN in QuickBooks

As it is crucial to provide the IRS with the correct EIN, further in this article, we have listed detailed instructions to change the EIN, but before making any changes, ensure that –

- You have an active subscription to QuickBooks Payroll; otherwise, reactivate your subscription status as follows –

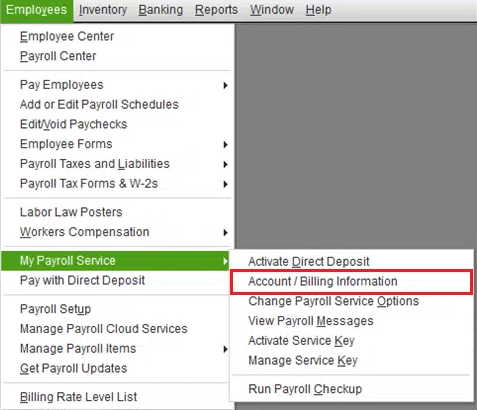

- Go to Employees, select My Payroll Service, then click Account/Billing Info and sign in using your Intuit Account login.

- Under Status, choose Re-subscribe, and follow the on-screen steps to reactivate the QB payroll service.

- Go to Employees, select My Payroll Service, then click Account/Billing Info and sign in using your Intuit Account login.

- You can also activate manual payroll from the Edit tab in QuickBooks Desktop to change the EIN.

- To process payroll for all users under one subscription, the user must use the same registered copy of QBDT on the same PC.

- QBDT payroll allows only one company data file per EIN; otherwise, it will give errors.

- The contact details and QB payroll admin should be the same for all companies under a single subscription.

- If you use Direct Deposit to pay your employees, you can have several companies with direct debit on the same payroll subscription.

- Each QBDT payroll service can add a limited number of companies to a single subscription, which depends on the company data files.

- Here is a list of the maximum number of EINs allowed as per the QB payroll service –

- QuickBooks Desktop Payroll Basic, Standard, or Enhanced allows a maximum of 3 EINs.

- QuickBooks Desktop Payroll Enhanced for Accountants allows a maximum of 50 EINs.

- QuickBooks Desktop Payroll Assisted – Each EIN is charged separately, and there are discounts for multiple companies.

Step-by-Step Method to Add EIN to QuickBooks Desktop

Add an EIN to the existing Payroll Subscription

Payroll account (For QB Desktop 2017 and Previous Versions)

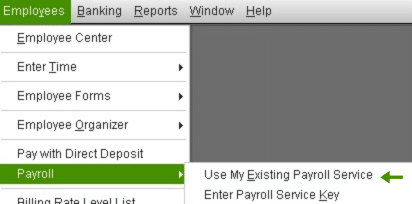

- Open QuickBooks, and under the Payroll tab, select Employees.

- Click Use My Existing Payroll Service.

- Now select Use Subscription Number X [Payroll Subscription Version] from the Identify Subscription option.

- In case you don’t find the option that shows you your subscription, then click Other: I have an existing subscription and a Zip Code, and enter the required information.

- Click Next in the Add Company Information screen to enter your EIN.

- Now, get a print by clicking the Print button or get back to the Desktop by selecting the Return to QuickBooks Desktop button.

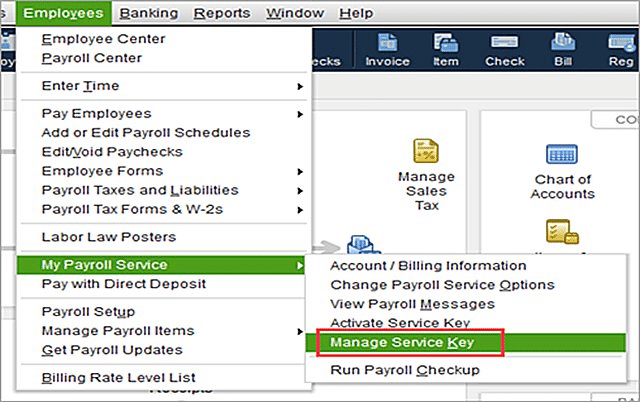

- Now, for the Service Key activation, click My Payroll Services under the Employees tab and then click Manage Service Key.

- Click View, and QuickBooks will show the new Service Key with Active Status.

If you have an updated version of QuickBooks Payroll, 2018 or 2019, then you can get in touch with us at Accounting Helpline’s Payroll Support Number 1.855.738.2784 to add your company to QuickBooks Payroll or your QB Payroll account. You can also call us if you are facing any issues while adding or changing EIN in QuickBooks payroll account; our certified payroll experts are always ready to assist you and are available 24/7 for continuous support.

How to Change Employer Identification Number with the Internal Revenue System

Before changing your EIN with the IRS, it is important to know about it in detail. You can go through the PDF file (Employer Identification Number—Understanding your EIN) issued by the Internal Revenue Service. If the ownership of your business changes, then you might need to apply for a new EIN.

How to Change EIN in QuickBooks Desktop Payroll Service

You can update your EIN in QuickBooks Desktop payroll by following the steps below, depending on your payroll service –

Note: If you don’t know your payroll service, open QBDT as a payroll admin and select Employees. Then, click Payroll Center and check the Subscription Status from the Payroll tab.

QuickBooks Desktop Payroll Assisted

If you use QuickBooks Desktop Payroll Assisted, follow the steps below to change the EIN in QuickBooks –

Update your Company’s Legal Name

To update your company’s legal name, download the Assisted Legal Name Change form, fill in the information, print it, and upload your completed form or send it to accountmaintenance@intuit.com.

Update your Federal EIN

Now, you can update your EIN in QuickBooks Desktop Payroll Assisted in the following manner –

- Download, fill out, and sign the Entity change packet, and prepare the supporting documents listed in it.

- Now, email the completed packet along with the supporting documents to EntityChanges@intuit.com, and once the documents are received, you will be notified via email. The notification can take around 3-5 banking days.

QuickBooks Desktop Payroll Basic, Standard, or Enhanced

Implement the steps given below to update your EIN in QuickBooks Desktop Payroll Basic, Standard, or Enhanced versions –

Update your Company’s Legal Name

Firstly, you must update the company’s legal name by using the following steps –

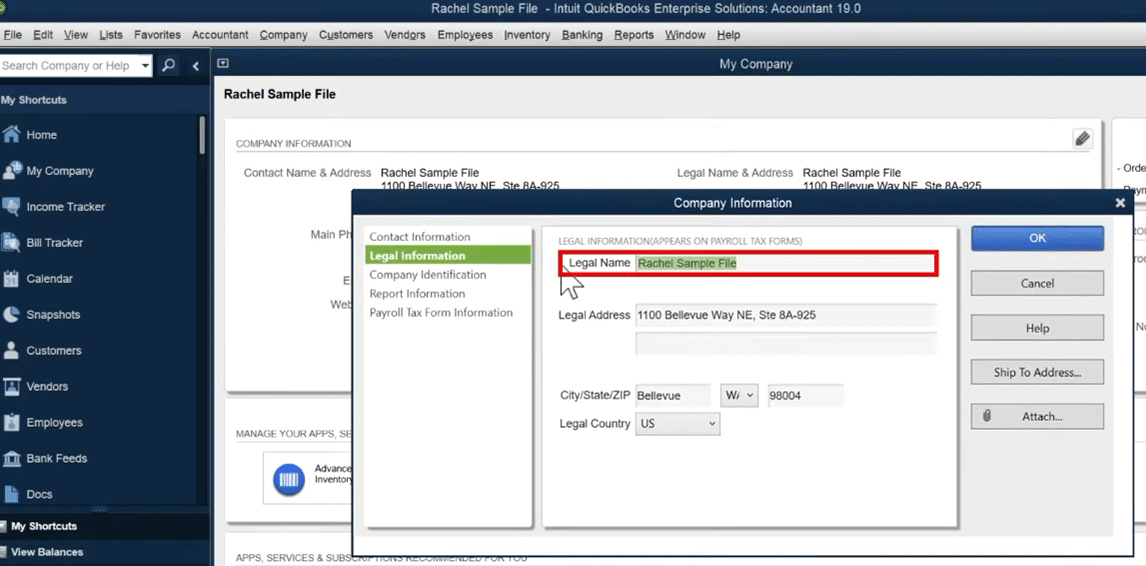

- Go to the Company tab, select My Company, and click the Edit icon.

- Now, select Legal information, enter the new legal business name, and click OK.

Update Your Federal EIN

Now, update the Federal EIN in QBDT payroll by going through the following steps –

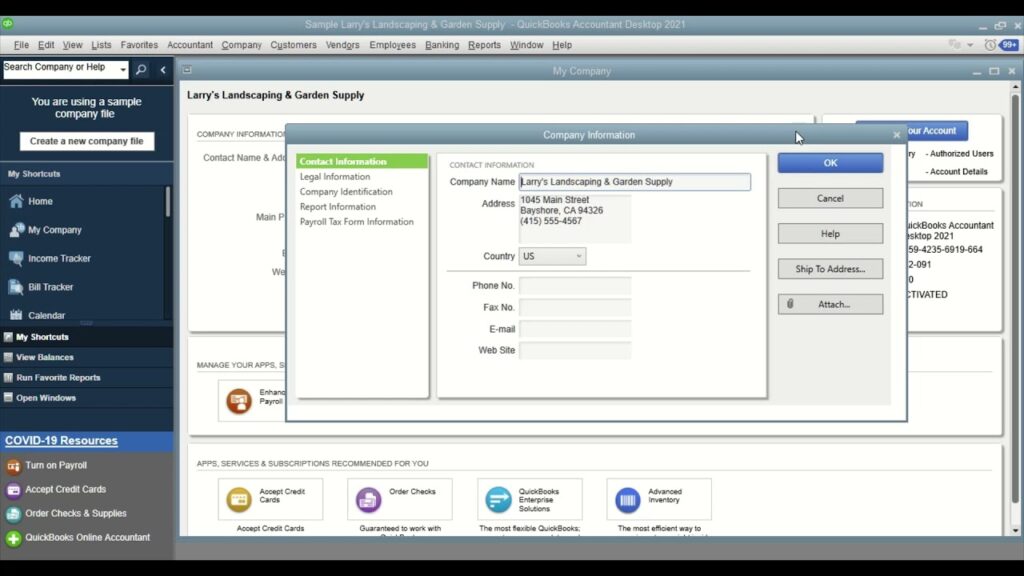

- Go to the Company menu, select My Company, and open the Company Information window.

- Select Edit, then from the left menu, click the Company Identification option.

- Now, open the Federal Employer Identification No. Field, enter the new EIN, and click OK.

After the process ends, your EIN will be changed, and you can rerun the payroll service with the updated Employee Identification Number.

Conclusion

You can follow the steps provided in this blog to change the EIN in the QuickBooks Desktop payroll. However, if these steps don’t work and you are unable to update your EIN, you might need professional help. You can contact our Accounting Helpline’s expert team at 1.855.738.2784 to get immediate assistance with the EIN and other payroll issues.

FAQs

Why do you need to change your Employee Identification Number?

Businesses usually require a new and updated EIN when their ownership or structure has changed. For instance, if you change a sole proprietorship to a partnership, you have to change your EIN. A new EIN is also required if you exit a business and open another one.

How can I apply for an EIN, and what information is required?

You can obtain an EIN by filling out an SS-4 form and submitting your application to the IRS. The information required in the SS-4 form includes legal name, taxpayer identification number, business type, details, and the reason for the EIN application.

How can I change my EIN in QuickBooks Online?

To update or change your EIN in QuickBooks Online, follow the steps given below:

– Go to the Settings tab, select Account and Settings, and click the Company option.

– Now, click Edit to edit the section you want to update, then click Save and Done.

Note: If you can’t edit the company or legal name or EIN, or encounter error -7000, you must change your company info in your payments and payroll accounts.

Where can I find my EIN in QuickBooks payroll?

To find your Employee Identification number, go to the Company menu and select My Company. Then, choose Company Identification from the left tab and find your Federal EIN.

Related Posts-

How To Fix QuickBooks Error PS038? Easiest Method

The Guide You Need to Fix QuickBooks Direct Deposit Issues

Fix QuickBooks Error 1601: Problem with Windows Installer

A Comprehensive Guide to the QuickBooks Migration Tool for Data Transferring

Comprehending the QuickBooks Error 15276 With Causes & Solutions

How to Fix QuickBooks Error Code H202: Definition, Symptoms, Causes, & Solutions

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.