Last Updated on July 7, 2025

Have you ever seen QuickBooks Error PS060 while working with payroll services? It is among the PSXXX series errors in QuickBooks software. The message displayed by the error PS060 in QuickBooks is ‘Current Enhanced Payroll Service is Unavailable.’ The error PS060 in QuickBooks is triggered by an expired payroll subscription or an outdated QuickBooks version. You can get rid of this payroll error by verifying the payment information, updating the payroll services and QuickBooks, and correctly configuring the internet settings. Once you fix the error, you can start using the QuickBooks desktop smoothly without any errors.

QuickBooks error PS060 can be challenging to tackle, especially if you do not have a person with a technical background. However, there’s nothing to worry about, as our experts are available for your assistance around the clock. Dial our Helpline Number 1.855.738.2784 anytime and get your issues resolved instantly.

What is QuickBooks Error PS060?

QuickBooks error PS060 is related to a payroll subscription, and it arises because of an expired payroll subscription or internet connectivity issues. This is an error from the QuickBooks PSXXX series. Error PS060 affects online payroll services and displays a message saying, “payroll service is currently unavailable.” There could be several reasons that might cause the PSXXX series of errors.

Causes of QuickBooks Error PS060

There is no specific cause that triggers this QuickBooks PSXXX series error. There is more than one reason that may ultimately result in QuickBooks error code PS060. To repair this error, we need to understand the cause of the error. The common causes of the PS060 error in QuickBooks are mentioned below:

- There might be a server problem on Intuit’s end.

- There might be an outdated payroll service.

- There might be a connection blockage from the third-party software.

- There might be a failure to auto-renew your payroll subscription due to incorrect credit card information.

These are some of the common causes of payroll error PS060 in QuickBooks Desktop. Before talking about the troubleshooting steps, you must know about certain things that are to be kept in mind before starting the troubleshooting steps.

Points to Know Before Resolving Payroll Error PS060 in QuickBooks

There are certain things that you must keep in mind before resolving the QuickBooks error PS060. The important points are listed below:

- Make sure you have access to the internet.

- You must use QuickBooks in Single-User mode while updating QuickBooks Desktop and payroll.

- Your Payroll subscription must be active.

- Ensure that the date and time displayed by your computer are correct and that Microsoft Edge is set as your default internet browser.

Now, you are good to go to know about the methods to fix the PS060 error.

How to Fix QuickBooks Error PS060?

Resolving the payroll-related error is important to continue working in QuickBooks. In this section, we will talk about the methods to fix the PS060 error in QuickBooks. The common solutions that you can follow to fix this payroll error are:

- Changing Billing and Subscription Settings

- Checking the Payroll Subscription

- Updating the QuickBooks Payroll Resources

- Updating QuickBooks to the Latest Version

- Verifying Credit Card Information in QuickBooks

- Flushing DNS Using the Command Prompt

- Repairing the QuickBooks Application

These are some of the common methods to troubleshoot the QuickBooks error PS060 in a short and crisp way. Let’s now look at the above-mentioned solutions in brief for better clarity.

Solution 1: Changing Billing and Subscription Settings

Sometimes, you might need to tweak some subscription settings or billing settings in QuickBooks to resolve the error PS060. Here are the steps for reviewing and changing the settings:

- First, open the My Account section in QuickBooks.

- Choose the company you wish to make edits or changes to.

- Proceed to the Billing Section and click on the Edit option.

- Check the information and make changes if required.

- Click Save and Close to update the payment details.

- Check that billing details are correct by viewing a preview of the same.

- Lastly, click on Save Changes and log out.

Now, you can restart the QuickBooks application and check if the payroll error PS060 is still present there. If it is still there, you can move to the next solution.

Solution 2: Checking the Payroll Subscription

An outdated payroll subscription can also be the reason for QuickBooks error PS060. You need to check the validity status of the payroll with the help of the following steps:

- You need to close all your company files and restart your computer.

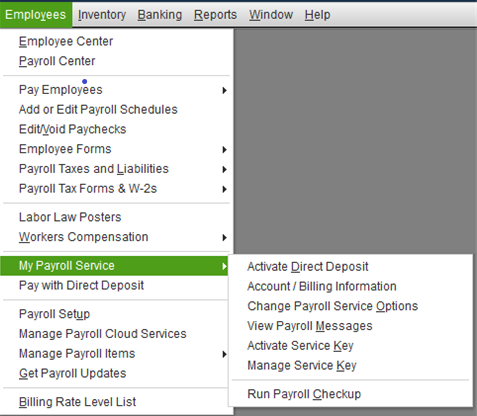

- Then, open QuickBooks, go to Employees, select My Payroll Service, and then select Manage Service Key.

- Your Service Name and Status must be correct and Active.

- Now, you need to select Edit and verify the service key number. If it is incorrect, enter the correct service key.

- Finally, select Next, uncheck the Open Payroll Setup box, and then select Finish. This will help you download the entire payroll update.

If you are still not able to fix the payroll error PS060 in QuickBooks Desktop, you can proceed to the next solution for resolution.

Solution 3: Updating the QuickBooks Payroll Resources

Sometimes, it happens that the current version gets outdated, and the payroll services in QuickBooks stop working, and this can cause the payroll error PS060. In this case, you need to update the QB resources to the latest versions. The steps for the same are outlined below:

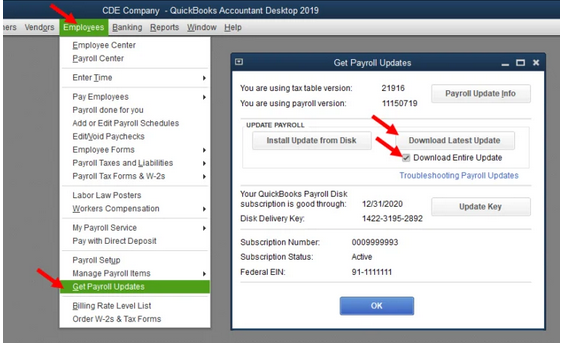

- Launch QuickBooks and explore new QuickBooks updates.

- Choose the correct updates to install and click on get updates.

- You need to restart QuickBooks and check for payroll tax table updates.

- Now, you need to select the proper update method and wait for the download to be completed.

- Lastly, verify the updates and perform a test run to check for errors.

This was the approach in case your payroll services are not updated to the latest version. This can help in the resolution of the QuickBooks payroll error PS060.

Solution 4: Updating QuickBooks to the Latest Version

This option is your best bet to remove payroll error PS060 in QuickBooks if nothing else works. All you have to do is keep the license, product, and such essential information handy. Also, make backups of your important QB files, company files, data files, etc.

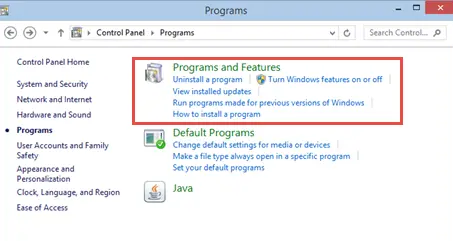

- After doing so, go to the Control Panel > Programs and Features > Uninstall a program > QuickBooks option.

- Follow the prompts on the screen asking for your permission and confirmation of this decision.

- Once done, clear your space, junk files, temporary files, and folders from your computer.

- After all this happens, you are now ready to reinstall QB in your system. Simply go to Intuit’s website and enable the download and installation of the application.

In this way, you can resolve the QuickBooks error PS060 by uninstalling and reinstalling the updated version of QuickBooks Desktop. You can move to the next solution if this does not work out.

Solution 5: Checking for Internet Connectivity Issues

You need to check the internet connectivity settings if you are constantly facing payroll error PS060 in QuickBooks. Here are the steps to verify the Internet settings in QuickBooks:

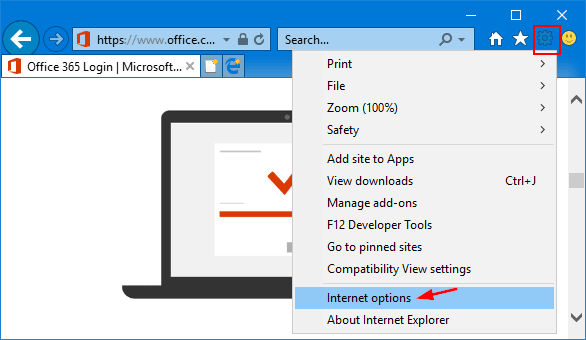

- Begin the process by opening the default web browser and visiting a secure website.

- If you get to the site successfully, then proceed to the following steps.

- In case the problem is faced while accessing the site, then verify the Internet settings for any misconfiguration.

- Make sure to configure the date and time correctly on the device.

- Now, open the web browser and choose the tools tab.

- Also, select the internet options from here.

- You will then be required to click on the option reset/restore default under the advanced menu.

- The final action is to click on apply and then hit the OK tab.

These steps will help you verify and correct the Internet security settings in QuickBooks to resolve the payroll error PS060. If the error is still there, you can proceed to the next solution.

Solution 6: Verifying Credit Card Information in QuickBooks

You also need to verify the payment sources, like credit card information, to rectify the payroll error PS060. Here are the steps to verify the Credit Card information in QuickBooks Desktop and QuickBooks Online.

For QuickBooks Desktop

The steps to verify the credit card information for QuickBooks Desktop are as follows:

- Open QuickBooks Desktop, and from the Product & Services window, click the payroll service you are using.

- Under the Billing Information tab, click Edit, which is next to your Payment Method.

- Enter the Correct Payment Details and click Save and Close.

- Make sure to verify all the payroll subscription information.

For QuickBooks Online

The steps to verify the credit card information for QuickBooks Online are as follows:

- Click the Gear icon at the top and select Account and Settings.

- Hit the Billing & Subscription option.

- Click Edit under the Payment Method tab.

- Now edit your credit card information and click Save Changes.

These are the steps to verify and edit your payment sources to fix the possibility of the error PS060 in QuickBooks. Let’s move on to the other solutions.

Solution 7: Flushing DNS Using the Command Prompt

Sometimes, flushing off the DNS settings using the command prompt might help in the resolution of the QuickBooks error PS060. Here are the steps to flush the DNS settings:

- Press Windows + letter R together.

- Once the Run window appears, type cmd in the text box.

- Press Enter, and in the black color command prompt window, type ipconfig/flushdns.

- Press Enter and try to open payroll once again.

If you get the same Payroll Update Error PS060, then follow the next troubleshooting solution.

Solution 8: Repairing the QuickBooks Application

You can also try repairing the QuickBooks software to fix the payroll error PS060 in QuickBooks. Here are the steps to repair the QuickBooks application:

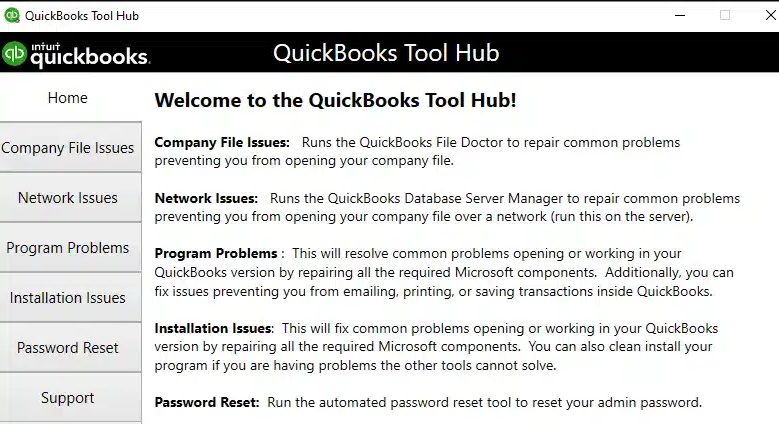

- Click here and download QuickBooks Tool Hub.

- Now go to the downloads folder and run the QuickBooksToolHub.exe file.

- Agree to the terms and conditions presented by the software installer.

- Run it from the Start menu or use the desktop icon.

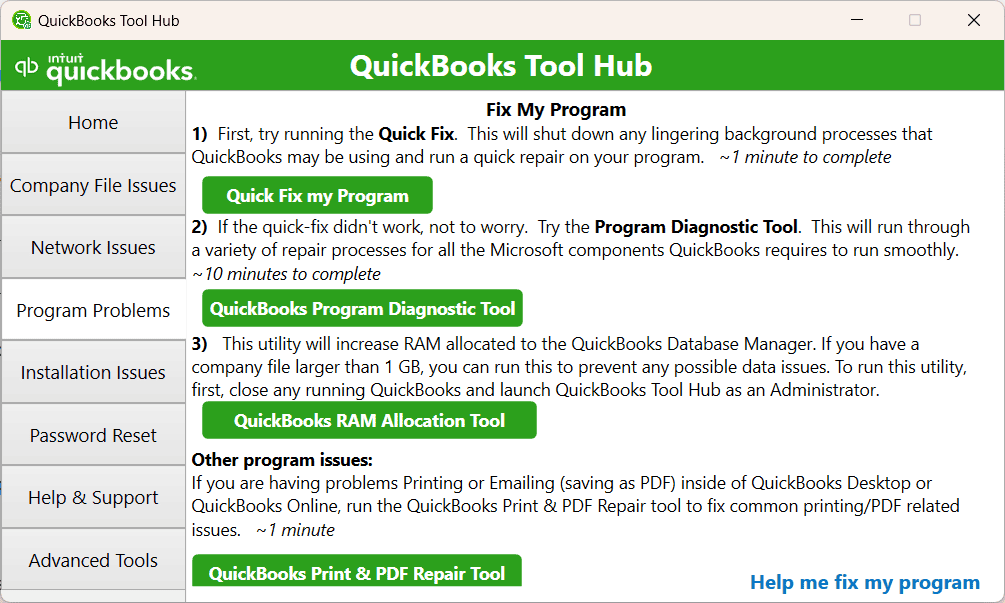

- Select the Program Installation Issues tab and click Quick Fix My Program Tool.

- Let the tool run and repair general issues with the QuickBooks installation.

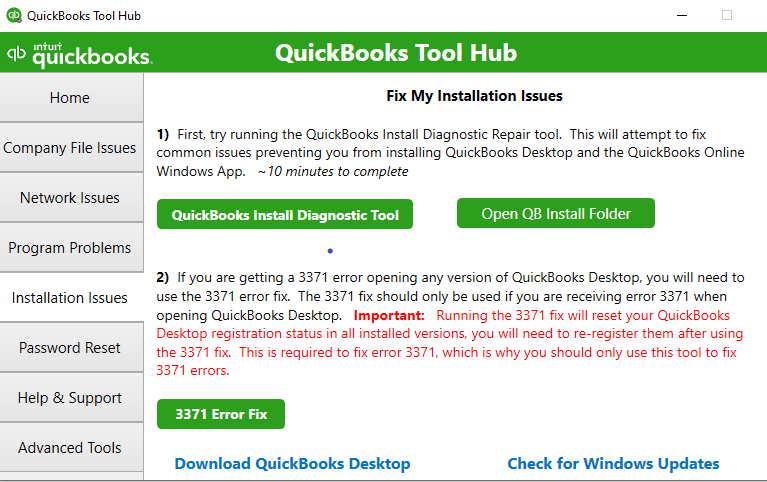

- Now run the QuickBooks Install Diagnostic Tool from the same window in Tool Hub.

- Let it repair the complex installation issues.

Now, try to open QuickBooks and check for payroll issues in it to see if this helps resolve QuickBooks error PS060.

Wrapping It Up!

In case while following the troubleshooting steps, if you encounter another error or still can’t update payroll because of QuickBooks error PS060, we suggest you dial Error Support Number 1.855.738.2784. Our Payroll Experts use advanced tools that detect the exact cause of the error and can provide you an instant solution to update payroll without any errors.

FAQs

How do I fix error PS060 in QuickBooks Desktop?

To fix the payroll error PS060 in QuickBooks, you need to change the billing and subscription details, verify the payroll subscription, update payroll services, fix the internet connectivity issues, and update the QuickBooks version.

What are the causes of QuickBooks error PS060?

The common causes of error PS060 are incorrect payroll subscriptions, QuickBooks Desktop not being up to date, and not having the current security and software updates or the critical QuickBooks folders, such as the CPS folder, may be corrupted or damaged.

What is QuickBooks error PS060?

QuickBooks error PS060 suggests a difficulty with your payroll subscription. Usually, your present updated payroll service is not available, most likely caused by corrupted billing details or an outdated payroll subscription.

What are the PSXXX series errors in QuickBooks?

In QuickBooks, “PSXXX” series errors generally point to payroll-related errors while attempting to download payroll updates, usually the result of an internet connection, firewall configuration, or a corrupted file in the QuickBooks payroll system.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.