Last Updated on March 10, 2025

With a huge market for applications that can solve the payroll and tax needs of users, QuickBooks Payroll still dominates. Also, users can stay on track with the taxes with payroll tax table updates. It is during this operation that the user faces the QuickBooks Payroll Error PS032. It appears with the message: “QuickBooks having trouble installing payroll tax table updates.” Is this something that has constantly been bugging your Payroll tax table update process? Then how about using the expert-suggested methods to fix it?

Here’s a comprehensive blog detailing what QuickBooks Payroll error PS032 is and how you can fix it. You can also see the reasons and compare them with your system.

Use this blog to manually remove QuickBooks Payroll Error PS032. Or, for a more secure and efficient approach, let the Accounting Helpline payroll support team handle the task. Afterward, you just have to call the toll-free number 1.855.738.2784.

What is QuickBooks Payroll Error PS032?

QuickBooks Payroll error PS032 arises when you’re trying to install the update. The message says, “(PS032) QuickBooks is having trouble installing your payroll update.” Using the Help option in the error message may sometimes throw an error message that reads:

‘We couldn’t find that answer for you

Use the Back button to try again.’

Why are you Facing the Payroll Error PS032?

Remember that when you want to manually resolve an error in QuickBooks, such as QuickBooks Payroll error PS032, you must be well aware of its causes. So, keep this list of reasons with you to begin the process of successfully fixing the payroll update error:

- The present version of your payroll tax table file is corrupted.

- The components/ payroll folder may have invalid files, triggering error PS032.

- Your CPS folder might be damaged and cause QuickBooks error PS032.

- You may not be registered in QB, so you see the error PS032.

- The billing details for the Payroll subscription are inaccurate or outdated, which is a primary reason for QuickBooks payroll error PS032.

- Your company files are corrupted, or a chunk of data in the files is damaged.

- The software may have technical glitches, triggering QuickBooks Payroll error PS032.

- Your QB registration file might be damaged.

- It’s possible firewall restrictions have interrupted your connection.

Checklist before Fixing the Payroll Error PS032 in QuickBooks

You must remember certain points to ease the process of resolving Payroll Error PS032 in QuickBooks.

- You must be subscribed to the Payroll subscription.

- Your payroll account must contain up-to-date billing information, such as the credit card details for billing.

- Backing your QuickBooks company file is vital to safeguard your critical accounting data.

How to Troubleshoot QuickBooks Payroll Error PS032?

Our team of experts has shortlisted some highly favorable ways of fixing the Payroll Error PS032 in QuickBooks. Use the steps as they appear and successfully eliminate the error from your application.

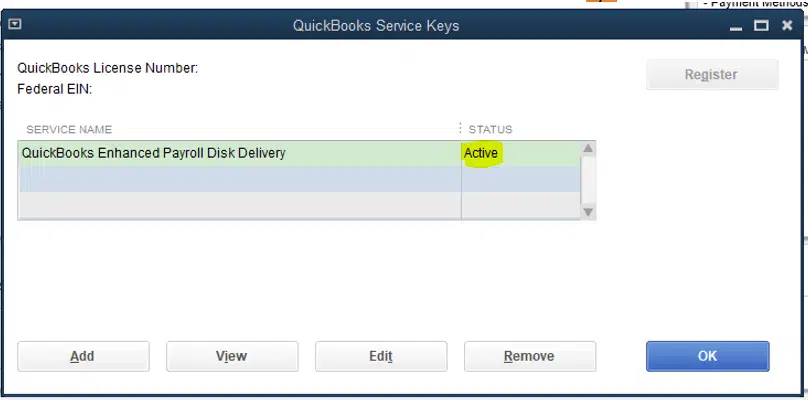

Method 1: Verify the Status of your Payroll Service Subscription

Facing a QuickBooks payroll update error PS032 can root from an inactive payroll service subscription; therefore, you must check if its status is currently active.

- First, you must close any application running on your system and restart it.

- Now, open QuickBooks.

- Select Employees and then My Payroll Service.

- Click on the Manage Service Key

- At this instance, review the Service Name and Status.

- The status must denote Active.

- Click on the Edit option to check the service key number.

- Add the valid service key number if the correct one isn’t entered.

- Choose Next and deselect the Open Payroll Setup

- Click on Finish, and you will get the complete payroll update soon after.

Method 2: Activate and Update QuickBooks Desktop

To make sure that your application has the latest security updates and the required improvements, we will guide you on how to activate and finally update the QuickBooks application. Upon completing this step, you can eliminate QuickBooks payroll error PS032.

- First, double-click the QuickBooks Desktop icon to launch the application’s home screen.

- Now, use the F2 key to open the Product Information

- Next to the license number, you must see Activated. If it is not, then continue with the steps below.

- Go to the QuickBooks’s Help.

- Click on Activate QuickBooks Desktop.

- Check your details to register the application with the instructions on the screen.

- Close the QuickBooks application to restart your desktop.

- Use the Start menu to look for the QuickBooks Desktop icon.

- Right-click the icon and choose Run as administrator.

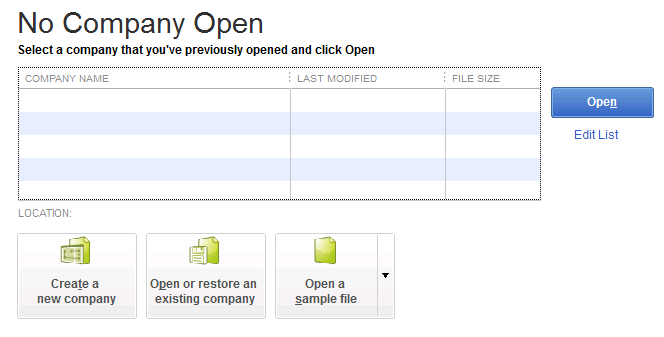

- You will be navigated to the No Company Open.

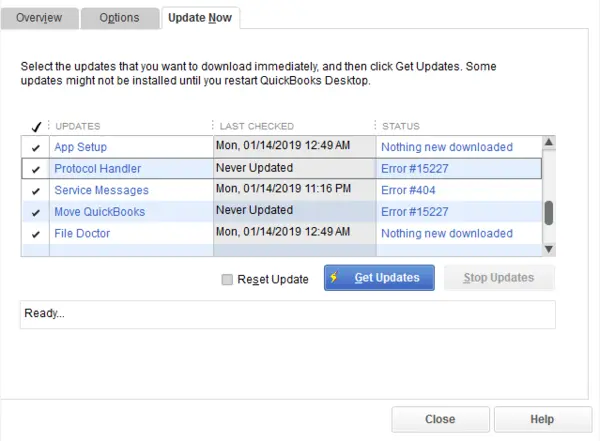

- Click on the Help menu and choose Update QuickBooks Desktop.

- Use the Options.

- Click on the Mark All option and then press Save.

- Now, you must go to the Update Now.

- Click on the Reset Updates checkbox and finally hit the Get Updates.

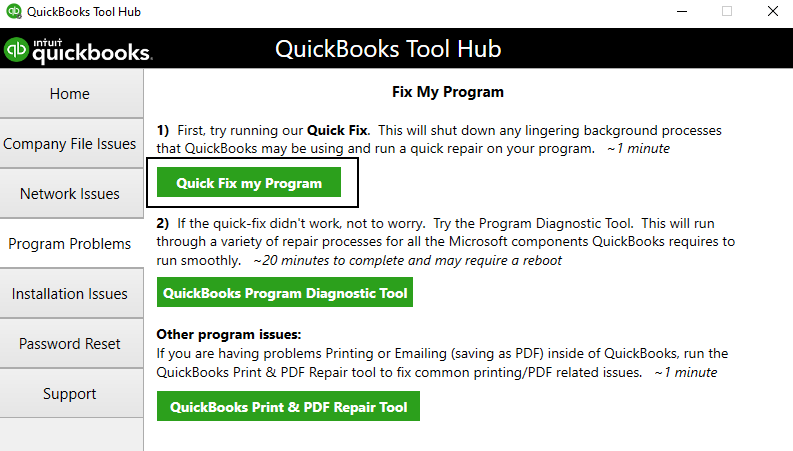

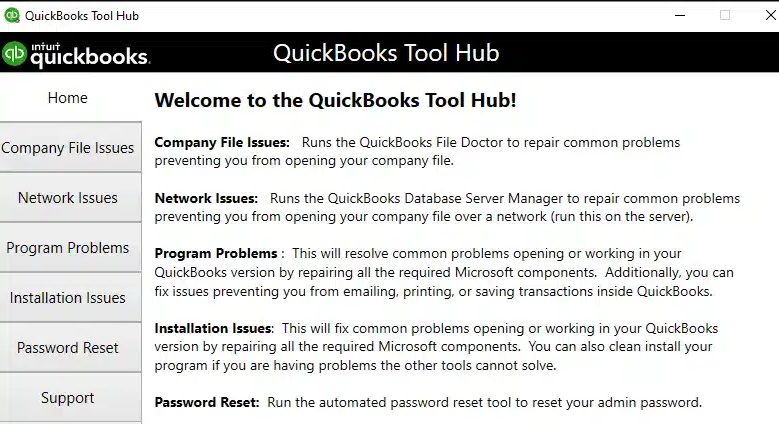

Method 3: Use the Quick Fix My Program Option in the Tool Hub

QuickBooks Tool Hub is an external tool that is used to help users eliminate common errors in the application. Tool Hub removes the need for external support, as some of the primary errors in the application can be handled using this tool. Now, to review any issues with QuickBooks that may be leading to QuickBooks payroll error PS032, use the Quick Fix My Program function of the Tool Hub.

- Close your QuickBooks application and open the web browser.

- Download and install the recent version of the Tool Hub from Intuit’s website.

- You will be prompted to select a location to save the download file of Tool Hub. We suggest choosing an easy-to-find location on your systems, such as the downloads folder or your computer’s desktop.

- Once the file is downloaded, open your chosen location in the above steep.

- Double-click the file to initiate the installation of the Tool Hub. Click on the Agree to Terms and Conditions

- Double-click the Tool Hub icon on your desktop to open it.

- From the Tool Hub, click on Program Problems.

- Choose Quick Fix My Program and let the tool run to fix issues in QuickBooks Desktop.

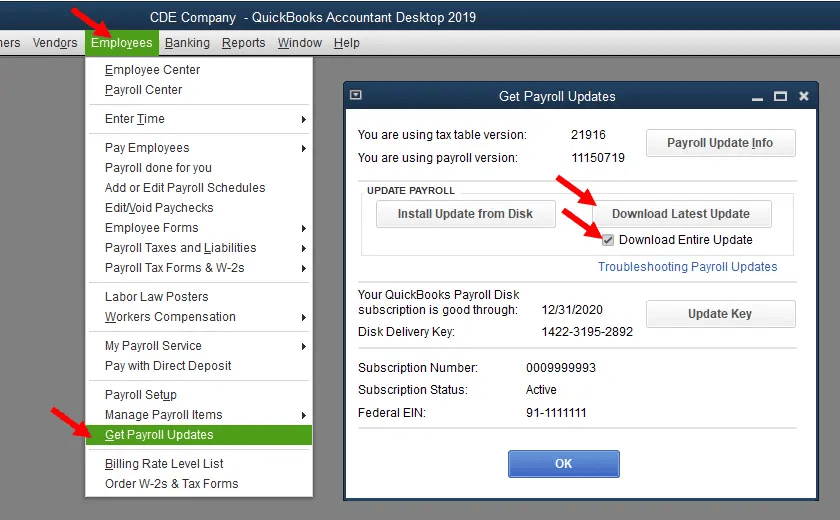

Method 4: Manually get the latest Payroll Tax Table Updates

An outdated tax table can cause multiple issues in QuickBooks Payroll, and it is always wise to stay current with these. Since you cannot update the Payroll tax table automatically, we suggest using the manual method.

Note: Also, from January 2021, updating your tax tables via CD is not possible; hence, you can only use the online URL for the same.

- Open QuickBooks and click on Employees.

- You must use the Get Payroll Updates.

- Click on the Download Entire Update.

- Choose the Download Latest Update.

- An information window will update you when the payroll tax table gets updated.

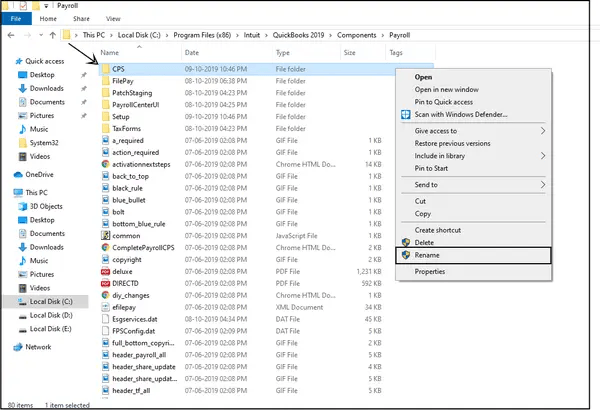

Method 5: Rename the CPS Folder

Renaming the CPS folder may help with QuickBooks error PS032:

- To open File Explorer, press the Windows key and E

- Select “This PC” from the options.

- Locate “Local Disk C” and open it.

- Navigate to “Program Files (x86)” within the Intuit folder.

- Access the QuickBooks Desktop folder that corresponds to your current version.

- Click “Components” inside, then proceed to the “Payroll” folder.

- Right-click on the “CPS” folder and choose “Rename.” Enter a new name for the folder, and press the Enter key to affirm the change.

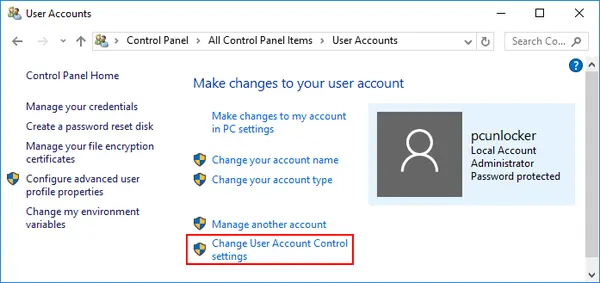

Method 6: Turn Off User Account Control (UAC)

Disabling User Account Control may help resolve QuickBooks Payroll error PS032:

- Press the Windows

- Input Control Panel.

- Hit Enter to launch it.

- Locate User Account Control in the Control Panel.

- Shift the slider to “Never Notify.”

- Restart your computer.

Method 7: Delete the .ecml File

If your QuickBooks registration is damaged, delete the .ecml file to resolve the PS032 error:

Step 1: Close QuickBooks Desktop and End Processes

- Close QuickBooks Desktop and make sure there are no QuickBooks processes running.

- Access Task Manager by pressing Ctrl + Shift + Esc.

- Go to the “Processes” tab.

- Click on the “Process Name” header to sort processes alphabetically.

- Look for all instances of “EXE” and select them, then click “EndTask.”

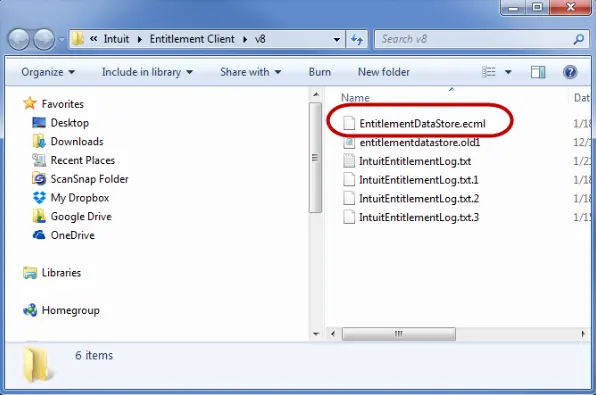

Step 2: Open the Entitlement Data Folder

- Press Windows+ R to access the Run.

- Type “C:\ProgramData\Intuit\Entitlement Client\v8″ (or v6)and press Enter. (This path is the same for all QuickBooks Desktop versions.)

- Right-click the “ecml” file and select “Delete.”

- Confirm the deletion by clicking “Yes.”

Step 3: Register the Software

- Open your QuickBooks company file.

- Follow the on-screen commands to register the software.

- Once registration is complete, enter your updated payroll service key.

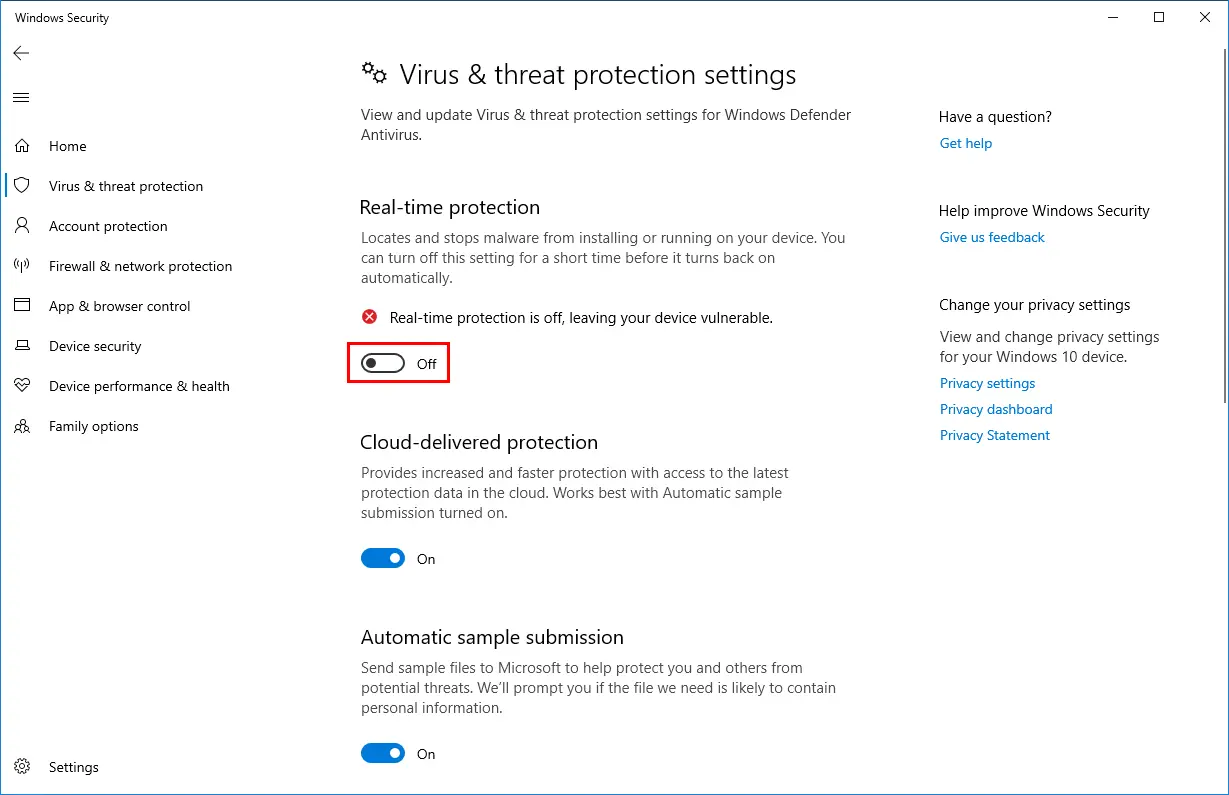

Method 8: Turn Off your Antivirus Briefly

Sometimes, your firewall may restrict connection to the servers for QuickBooks Payroll updates. Turning off the antivirus and firewall settings will remove the blockages so you can update. Then, turn it back on.

You must be able to navigate the QuickBooks Payroll error PS032 with this guide. However, you may need to dive deeper to fix it if you still face it. Instead of taking the risk of tampering with the payroll data, let the experts handle it from here. Call the Accounting Helpline support team at 1.855.738.2784, and you will be free of error with their expertise.

FAQs

What does QuickBooks Payroll error PS032 mean?

QuickBooks Payroll error PS032 is an error code that typically arises when you try to download the latest payroll updates, but the software encounters an issue. This error can obstruct you from updating your payroll tax tables and can be caused by various factors. A damaged QuickBooks registration file, incorrect billing details, etc., may trigger this error. Resolving it will require verifying your billing details, updating QB and tax tables, and following other solutions in the blog.

Why do I encounter QuickBooks Payroll error PS032?

QuickBooks Payroll error PS032 appears for the following reasons:

– Your current payroll tax table file is compromised.

– The components within the payroll folder could contain incorrect files, leading to PS032 errors.

– PS032 errors can occur due to potential damage in your CPS folder within QuickBooks.

– PS032 errors may arise if your QuickBooks registration is incomplete.

– Outdated or inaccurate billing information for your Payroll subscription is critical to QuickBooks payroll error PS032.

– Data corruption within your company files or damage to some of your data can lead to this issue.

– Technical glitches within the software can trigger the QuickBooks Payroll error PS032.

– Damage to your QuickBooks registration file might be a contributing factor.

– Connectivity problems caused by firewall restrictions could be interrupting your connection.

When does QuickBooks Payroll error PS032 arise?

QuickBooks Payroll error PS032 appears in the following scenarios:

– When you update QB Payroll.

– When your payroll tax table file is corrupt.

– When the CPS folder is damaged.

– When technical glitches arise in the software.

– When you have inaccurate billing information.

– When QB registration is incomplete.

– When components in the payroll folder are damaged or files are invalid.

– When firewall obstructions arise.

– When a company file is corrupted.

How do I resolve QuickBooks Payroll error PS032?

QuickBooks Payroll error PS032 can be resolved through the following solutions:

– Ensure your payroll service subscription is active.

– Your QB Desktop should be activated and updated.

– Utilize the Quick Fix My Program from the tool hub.

– Receive the latest payroll tax table updates.

– Change the name of the CPS folder.

– Disable User Account Control.

– Erase the .ecml file.

– Disable your antivirus.

What are the signs of QuickBooks Payroll error PS032?

The following signs and symptoms may arise for QB error PS032:

– You may receive an error message or code (PS032) when downloading or installing payroll updates.

– The error typically occurs when you’re trying to update your payroll tax tables, and you might notice that these updates are not being installed successfully.

– You might experience freezes or crashes in QuickBooks when performing payroll-related tasks.

– The error can lead to delays or incomplete processing of your company’s payroll, affecting your employees’ paychecks.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.