Last Updated on March 10, 2025

The tool is important for any business, small one-person startup or giant corporation, to automate the payroll process and minimize errors while being tax-compliant. Of course, as with any software, issues will sometimes arise. But now, as much as knowing what troubleshooting common payroll problems entails is important, it is equally important to find expert support when such issues arise at the appropriate time to ensure your payroll system works as it should. Follow best practices, keep up with updates, and have QuickBooks Payroll Support to minimize the payroll problem and keep the employees paid on time and correctly.

However, even the best software sometimes develops certain problems, and sound knowledge of QuickBooks Payroll Support turns out to be the answer to dispel the issues right away. No matter how serious the problem at hand, whether it be payroll tax miscalculations, missing payroll transactions, or any other problem related to syncing with your bank and account management, QuickBooks Payroll Support is here to enable you to cross such problems wholeheartedly and keep your business running seamlessly.

Below, we outline common QuickBooks payroll issues our customers face, outline some detailed steps in troubleshooting these issues, and describe generally how you can get expert support when you need it. This post will let you know how you can maximize the potential of QuickBooks Payroll while minimizing payroll-related errors and delays.

The instructions and steps outlined in this blog will discuss the common payroll problems and how to address them. However, if you are facing some complex issues and need expert assistance in fixing them, you can contact our Accounting Helpline Payroll support team at 1.855.738.2784 to get immediate help in resolving payroll errors.

What is QuickBooks Payroll?

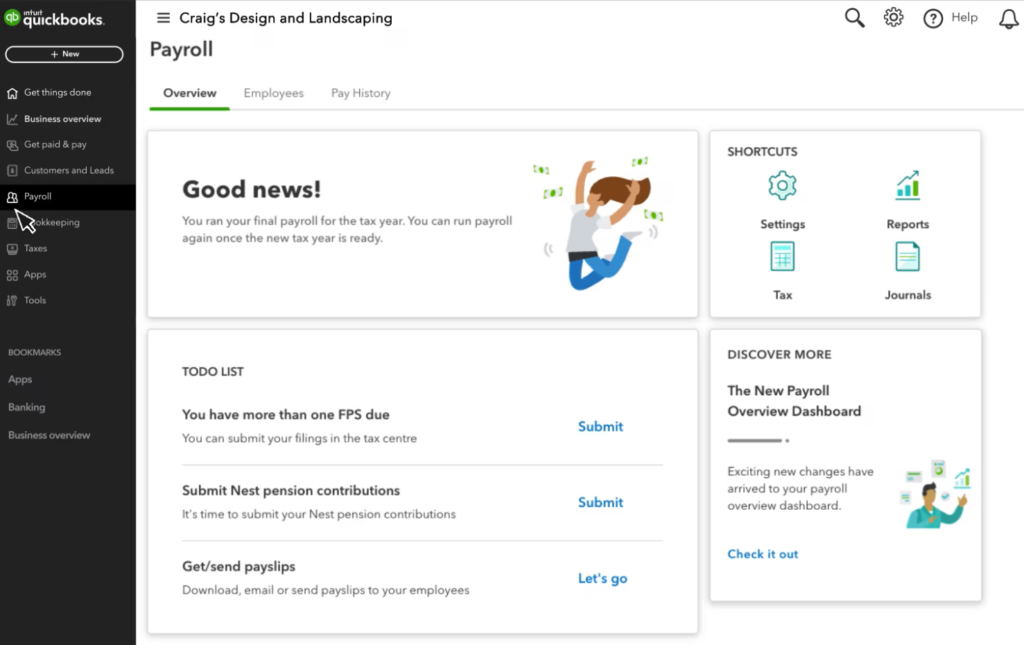

One of the most powerful payroll solutions launched in the world by Intuit is QuickBooks Payroll, which lets businesses automate their payrolls. Payroll management from QuickBooks Online and QuickBooks Desktop handles everything, from tax calculations and paycheck production to tax report filings, employee benefit administration, and the reporting you need.

There exist two major editions of QuickBooks Payroll, QuickBooks Online Payroll and QuickBooks Desktop Payroll, each with its feature specifics.

QuickBooks Desktop Payroll

QuickBooks Desktop Payroll would be a great option for companies that use QuickBooks Desktop. It is much more flexible and versatile and intended for larger companies with much more complex payroll needs, for example, processing payrolls from many locations or employees doing work outside another industry.

Key benefits of QuickBooks Desktop Payroll include

- This edition enables the customization of advanced payroll items, deductions, and benefits to cater to any business need.

- It has more detailed, more customizable payroll reports, which is really useful for companies to meet specific regulatory requirements or to track highly detailed payroll data.

- QuickBooks Desktop Payroll is not web-based. This means that even if a business is not connected with a very bad internet connection, it can use QuickBooks Payroll without an internet connection since it does not require direct internet connectivity.

QuickBooks online payroll

QuickBooks online payroll is online and hence available to a small or medium-sized business from any internet-linked computer or device. It is thereby best suited for small to medium-sized businesses that already use QuickBooks online accounting and may wish to have the payroll system built right into QuickBooks online.

The key benefits of QuickBooks Online Payroll include

- Cloud access – This provides access to the payroll data from anywhere, irrespective of whether it is an office or on-the-go basis and with any device.

- Automatic tax updates – Payroll tax rates would be automatically updated in the payroll software and transmitted down to keep track of compliance without having to manually update those tax rates.

- Easy integration – This payroll software integrates directly with QuickBooks Online accounting software. It allows easy management of users’ finances.

- Mobile friendly – It’s cloud-based, so you can do payroll from a phone or tablet. This makes it excellent for companies with telecommuters or locations in different parts of the country.

The QuickBooks Payroll products, two versions of which are now under review, provide for automatic payroll tax calculations, e-filing for tax forms, direct deposit payments, and detailed payroll reports.

Key Features of QuickBooks Payroll

The value that could be drawn out from using QuickBooks Payroll is exponentially improved by making a deeper dive into key features that it offers to businesses. These are the features that help businesses save time, minimize error risks, and smooth out the entire payroll process.

Automatic Payroll Tax Calculations

The most frustrating part of payroll is applying the correct rate of taxes since tax laws are always modified every so often. QuickBooks Payroll automates this process because it automatically updates the rates of payroll taxes and applies the correct ones with each payroll cycle. It covers:

- The software calculates Social Security, Medicare, and federal income taxes.

- It automatically applies state income taxes, unemployment taxes, and other withholdings that are state-specific.

- In case local taxes exist, say city or county taxes, QuickBooks Payroll ensures proper application.

As it continuously monitors all the tax laws and applies the correct rate automatically, QuickBooks Payroll significantly reduces the prospects of any human error and assures accurate tax filing.

Tax Filing and Reporting

While it could take forever and is rather error-prone if you do it by hand, that’s exactly what QuickBooks Payroll will do for you. The application automatically produces tax forms, including W-2, 1099, and 941, as well as hundreds of others, and gives you a chance to file electronically with the IRS and state agencies. This will save businesses:

- With QuickBooks, businesses would be able to meet tax deadlines. This would help reduce late filing penalties.

- QuickBooks Payroll has preset reports, such as payroll summary and tax liability reports, hence facilitating easier tax filing because all details will be combined in one report.

Direct deposit

Pay staff through direct deposit. This way, you avoid paper checks and chances of error through writing checks. Direct deposit ensures:

- Employees receive their pay on time without having to wait for the check to clear.

- Direct Deposit saves paper checks from having to be printed and distributed. Thus, this again saves a huge amount of time and resources.

Employee benefits management

Another complex area in payroll is employee benefits, health insurance, retirement plans, and PTO. QuickBooks Payroll reduces this complexity by allowing benefits to be added automatically during a payroll run, meaning that all payroll deductions associated with each employee are applied and up-to-date.

Comprehensive Payroll Reports

There are many QuickBooks Payroll reports through which a business owner can track payroll expenses, verify what the employees have earned, and present an open book of account. Some of these reports are as follows:

- The total payroll expenses for each pay period.

- A report of pay, tax, and deductions for each employee.

- Monitor your tax liabilities to keep your business on track with the law.

These features will always make sure that business owners have the most accurate, up-to-date payroll data.

Common payroll problems in QuickBooks and how to fix them

Despite all these advanced features, QuickBooks payroll is sometimes plagued by problems. Below are some of the most common payroll problems users face, as well as detailed solutions on how to fix them.

Error Payroll Tax Calculation

Payroll tax calculation is one of the errors found in most QuickBooks Payroll users. Wrong tax calculations are likely to attract fines and penalties from the IRS or other state tax authorities because of overpayment or underpayment of taxes.

- To update the payroll tax tables, QuickBooks automatically updates its tax tables. But if your calculations in payroll taxes are incorrect, check that you may be making use of updated payroll tax tables by checking updates from the help menu.

- A real-time error in any employee’s tax information, such as details on the W-4 form or an improper filing status, causes payroll tax miscalculations. Review each employee’s tax profile for accuracy and currency.

- QuickBooks will pick up most of your state and local taxes unless you have employees scattered across several jurisdictions. Check to see if there might be any applicable tax rules that you could have overlooked.

- QuickBooks provides the user with a Tax Troubleshooter that can assist with the identification and resolution of the payroll tax calculation issue. Run the troubleshooter if you have established the cause.

- If you cannot rectify this issue yourself, it is possible to call the number for communication with QuickBooks payroll support, which, with full analysis, will guarantee that taxes in the future are calculated accurately.

Missing Payroll Transactions

Sometimes, there are missing payroll transactions, which means the employees did not receive their pay or that your payroll was not updated. Mostly, this happens due to incomplete payroll processing or incorrect data entry.

- Look at the payroll summary, payroll detail, and employee earnings reports. If it was actually processed, then it would be on another report or maybe with different data.

- Make sure each and every payroll step is completed. That may mean that you did not check hours worked or didn’t verify employee information before processing payroll. The system probably didn’t record that transaction.

- You can miss some transactions if the data related to a particular employee’s hours, pay rate, or benefits is incorrect or incomplete. So, make sure that all data are correct before running payroll.

- If it was partial Payroll, you should re-run payroll for the period so that all the posted transactions are included.

- If you cannot find the lost transaction, reach out to the QuickBooks Desktop Payroll Support Phone Number so they can track down the problem and adjust accordingly.

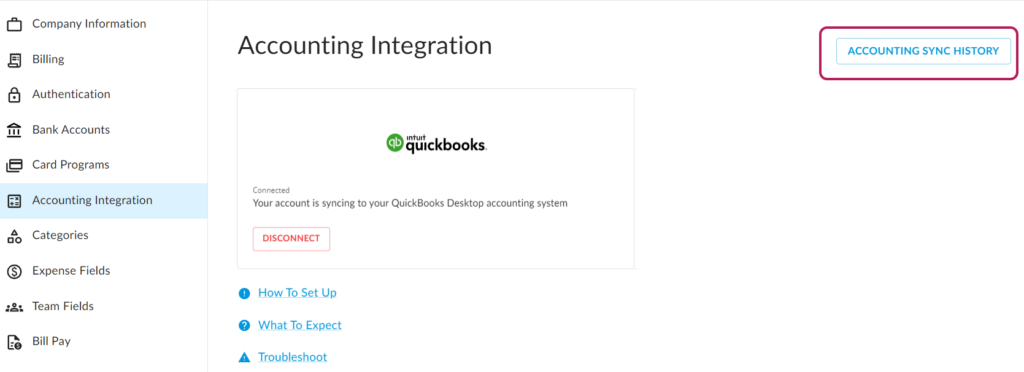

Trouble with Bank Account Sync

In case QuickBooks Payroll is having some trouble syncing with your bank account, you may end up receiving direct deposit payments late in your payroll or totally fail to do so. Problems regarding your bank account may also affect your payroll account by developing a mismatch in your payroll report.

- Make sure you have the right information for your bank account, such as the routing number, account number, and name of your bank, because it may have been entered wrongly into QuickBooks Payroll.

- Sometimes, QuickBooks loses connection with your bank. It may reconnect sometimes if you simply disconnect and reconnect the bank account. Sometimes, there is not enough money in the business account to finish the payroll. If your business account balance is not sufficient, then QuickBooks cannot process payroll.

- If everything is correctly set up, QuickBooks should be able to log in to your bank account and update the feed.

Failed Payroll Updates

QuickBooks releases frequent updates in order to stay up to date with tax laws and to maintain smooth functionality. In case such updates fail, there may be trouble in payroll processing.

- So, if automatic updates are not working properly, you can also check the application manually by opening QuickBooks, accessing the help menu, and then clicking on Check for Updates.

- First, make sure that your operating system and QuickBooks version should be updated to the latest released version.

- You will do this by right-clicking on the icon and running it as administrator so the application can download updates. Sometimes, a dumb internet connection may prevent quickBooks from updating. Its proper internet should be in place before trying to update it again.

- In case the updates fail to install for any reason, QuickBooks Payroll Support will walk you through the troubleshooting process and will get you up to the latest release.

How to reach the QuickBooks Payroll Support Number

Whenever you cannot solve a payroll problem by yourself, you should contact the QuickBooks Payroll Support Number. QuickBooks offers its users a number of varied ways to contact it in case of help:

Dialing QuickBooks Payroll Support Number on a Phone Call

You can directly call the QuickBooks Payroll Support Number at 1-800-446-8848. You may also call our Accounting Helpline Payroll Support Number at 1.855.738.2784. Once you provide your business details and explain the problem, a payroll expert will solve the problem for you.

Live Chat and Online Support

If you don’t want to make calls, you may use live chat through QuickBooks. Visit the QuickBooks website and seek to have real-time discussions with an expert who shall find a solution to your payroll issues.

QuickBooks Payroll Community

The QuickBooks Payroll Community is one of the best online sources where users share their solutions and questions to help people resolve their issues. Also, it’s a great source that can be used to find answers to recurring issues and some great hints from other QuickBooks users.

Best Practices to Avoid Payroll Problems

QuickBooks Payroll may be a strong tool, but practices can avoid payroll problems. With these hints, you will be on your way to running payroll like smooth sailing:

- Processing automatic payroll for those recurring payments ensures that paychecks get in the mail on time without manually processing each payroll run.

- Updating regularly makes sure that you have payroll software with the latest tax regulations and features.

- Make sure you double-check that all information, whether on pay rates, tax, or employee benefits, does not default in any aspect of payroll information.

- Periodically backup your payroll data in case of loss to recover it shortly in case of technical problems.

- Reconcile payables and bank accounts with some frequency to catch errors and correct them right away so that your records are clean.

Conclusion

QuickBooks Payroll is an important tool, even for a one-man start-up or large company, to automate payroll services, minimize errors, and stay abreast of tax compliance issues. Of course, sometimes there are issues with the application, just like any other program. But just as important as knowing what troubleshooting common payroll problems entails, it’s also finding expert support when such issues arise at the appropriate time to ensure your payroll system works as it should. By following best practices, keeping up with updates, and having QuickBooks Payroll Support, you can minimize the payroll problem and keep your employees paid on time and correctly.

If you hit roadblocks, the good news is that you can use QuickBooks Payroll Support to get back on track. That includes QuickBooks Desktop Payroll Support phone support, live chat, and even the QuickBooks Payroll Community, which only requires a few clicks from expert assistance.

FAQs

What should I do if QuickBooks Payroll is not calculating taxes correctly?

To clear problems like erroneous tax calculations produced in QuickBooks Payroll, start off by making sure that payroll tax tables are up-to-date so that you can easily find the tools to do it on your part in QuickBooks and do that manually. More than anything, make sure every single W-4 or detailed filing status information about employees is correct before referring problems to the tax troubleshooter in QuickBooks payroll or speaking to their support team regarding any complications.

How can I fix missing payroll transactions in QuickBooks?

Missing payroll transactions most often occur due to payroll not being processed or keyed into incorrectly. Again, review the payroll summary, payroll detail, and employee earnings reports to ensure payroll was processed. Verify that all employee hours worked, pay rates, benefits, and input of all other elements are accurate before payroll is processed. If the problem remains, contact QuickBooks Payroll Support for help.

How do I resolve bank account syncing issues with QuickBooks Payroll?

If the QuickBooks Payroll’s synchronization with your bank account is not working, make sure the routing number, account number, and bank name are written correctly when you fill up your account details into bank account information. When the connection is lost, try to disconnect and reconnect. Make sure you have enough business account funds to process payroll. If not, contact the QuickBooks Payroll Support.

Why aren’t QuickBooks Payroll updates installed correctly?

Installation failures may occur due to an outdated operating system, internet connection problems, or other technical faults. First, ensure that the operating system and QuickBooks version installed are updated. In case the automatic update is not working, you can check manually by searching for updates in the help menu. If this is also not effective, you should seek QuickBooks Payroll Support for guidance.

How can I contact QuickBooks Payroll Support?

To instantly access a payroll expert for consultation, one needs to call QuickBooks Payroll Support at 1-800-446-8848.

You get real-time support from a QuickBooks pro through the live chat on QuickBooks’ website.

QuickBooks Payroll Community is an online gathering that gives you answers, the chance to ask questions, and engages in discussions about issues with other users.

What are the best practices to avoid payroll issues in QuickBooks?

Avoid common payroll problems in QuickBooks by following:

– Use automatic payroll for recurring payments to ensure timely and accurate paychecks.

– Update regularly for compliance with the latest tax laws in QuickBooks.

– Check employee information twice, such as tax rates, benefits, pay rates, etc., for no error at all.

– Set a regular backup of payroll data to avoid data loss.

– Bank accounts and payroll data reconciliation on a regular basis help detect and correct errors early.

Can QuickBooks Payroll help with employee benefits management?

Yes, QuickBooks payroll automatically in each payroll runs benefits for employees like health insurance retirement plans and PTO benefits. While automatically applying all the deductions, it keeps your payroll data accurate and updated.

What should I do if QuickBooks Payroll is not processing my payroll on time?

If the QuickBooks Payroll is not processed on time, then problems could exist in your bank account or tax information or perhaps some updates pending for the software. Then, verify all the payroll processing steps and all the employees’ information. Call QuickBooks Payroll Support if issues continue for fast resolution.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.