Last Updated on September 19, 2025

Many companies use QB applications to maintain and perform various tasks for running their business. Although the software is simple to use, you may sometimes run into unexpected errors and issues. For instance, if you run into the QuickBooks error 3030, then you may experience that you are unable to sync the QB Desktop and the company file. It is a configuration glitch of the company file in your system, which can disrupt your workflow and ultimately delay operations.

In this guide, we will explore the root causes that lead to error 3030 in QB Desktop and provide you with proven-to-work solutions for resolving this issue.

Error code 3030 in QuickBooks may prove stubborn to resolve. If you want a quick resolution and assistance to fix it, then connect with an Accounting Helpline’s expert. Dial 1.855.738.2784 today!

Understanding the QuickBooks Error 3030

The QB Enterprise gets the latest updates and features frequently to enhance the workflow and productivity while ensuring an easier interface for the users. Consequently, a few issues occur due to internal glitches or improper installation of the application. Similarly, the QuickBooks error message 3030 occurs when you lose access to the data file and states the following message:

“QB Sync Manager was unable to sync successfully”.

In this blog, we will discuss the sync manager setup error in great detail, along with proven solutions to get rid of error 3030 in QB Desktop.

What are the Key Reasons Behind the QuickBooks Error 3030?

The following reasons are some of the key factors that cause the QuickBooks configuration error 3030, which leads to synchronization failure with the company file.

- The sync settings in QB Desktop might be misconfigured.

- You might have a weak internet connection that leads to a failed connection between the QB and the Intuit Sync Manager, which leads to this issue.

- The configuration or the component files for QB programs might have been damaged or corrupted.

- You might have accidentally deleted the essential configuration/ component files that are crucial for the sync manager in QB.

- There could be an improper or partial installation of the QBDT application, which leads to the failure in syncing the company file.

- You may be using an outdated version of QuickBooks Enterprise or Desktop that does not have the latest updates, features, and more.

The above-mentioned factors are the primary causes that result in QuickBooks error code 3030. Now we are going to look at some of the working solutions that can solve this problem effectively.

3 Proven Solutions to Get Rid of QuickBooks Error 3030

We have listed a few working methods that will help you fix the QB configuration error 3030 in both the Desktop and Enterprise applications. With the following techniques, you can run both applications as an administrator to sync the application and the company file:

Try Alternate Ways to Access the QuickBooks and the Company File

The QuickBooks error 3030 may be a result of underlying issues. To troubleshoot, we can access the QBDT and company file through different methods. You can follow this process to do so and avoid any problems.

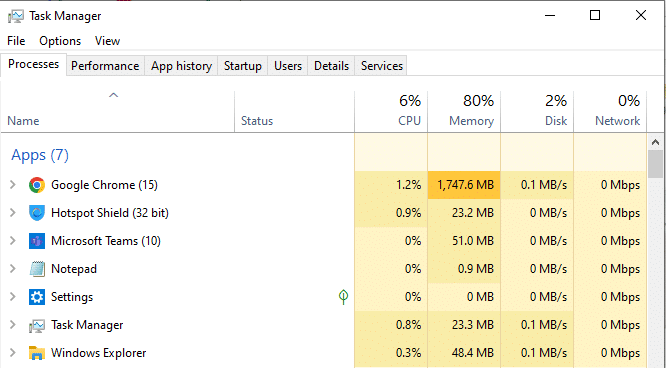

- Turn on your computer system and press the Ctrl + Shift + Esc keys together.

- The Task Manager window will be launched on your screen.

- Click on the Processes tab from the top bar, as shown below.

- You will see all the active processes for QuickBooks, Intuit, QB, and more.

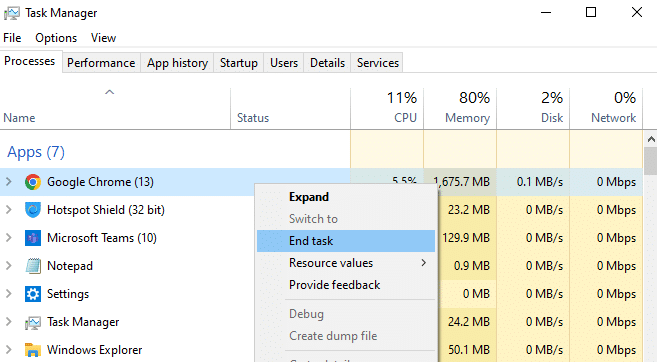

- Once you locate the said activities, right-click on each of them and select ‘End Task’ from the menu.

- Now, go back to the Windows homescreen and find the QuickBooks shortcut.

- Press down the Ctrl key on your keyboard and double-tap the QuickBooks icon.

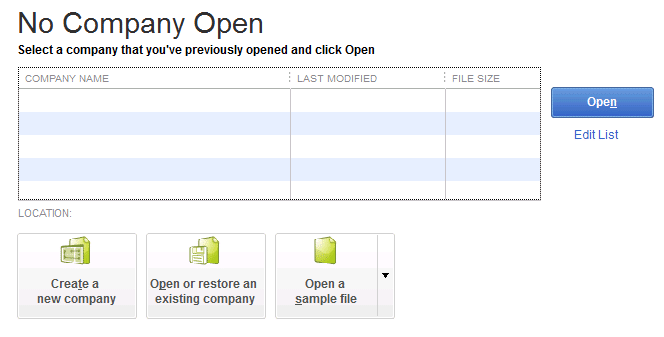

- Let go of the Ctrl key only after the No Company Open window appears on your screen.

- Now, find and select your company file to open from the No Company Open window.

- Hold down the Alt key and then hit the Open button.

- Release the Alt key only after you see the Login screen.

- Enter the username and password to log in as an admin.

- Press the Alt key until a blank screen is displayed on your computer.

By carrying out the steps given above, you will be able to open the QB application and the company file, which may help get rid of QuickBooks error 3030. If you failed to resolve the error with this method, then proceed to the following method and repair the QB application through Windows.

Repair the QB Application with Windows Built-in Feature

It is crucial to ensure that the QB application does not have any issues that may lead to the QuickBooks error message 3030. You can use the repair feature, which is built into the Windows operating system, in the following manner:

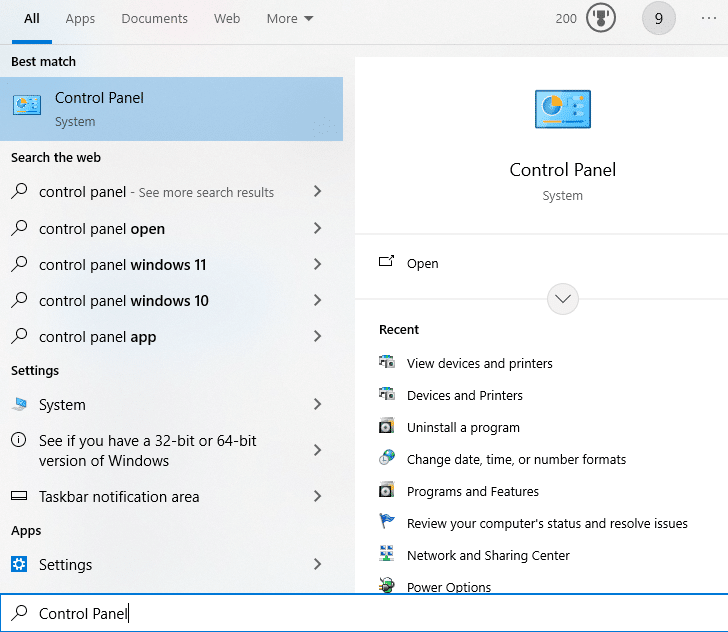

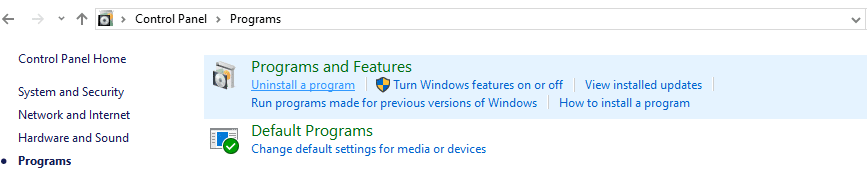

- Press the Windows key to open the Start menu and type ‘Control Panel’ in the search bar.

- Head to the Programs section and click on the Programs and Features option.

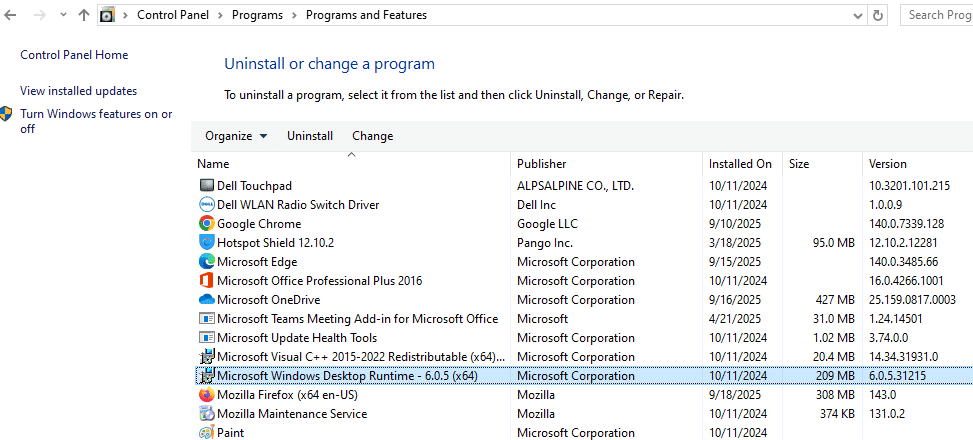

- A list of applications will appear in the Programs and Features window.

- Scroll down and find the QuickBooks Desktop in the list.

- Once found, click on the application to select it.

- You will get the options to Uninstall or Change in the top bar.

- Click on either option, and you get the Repair or Remove option.

- Then, choose Repair and follow the given instructions.

- Once done, exit the window and restart your computer.

Finally, try to sync your company file to verify whether the QuickBooks error 3030 has been eliminated.

Update Your QuickBooks Application

If you run into QuickBooks configuration error 3030, you should check for and update to the latest version. Using outdated software can often cause errors and problems due to a lack of new features. Refer to this guide for how to update QB Desktop with a simple and easy process.

QuickBooks error 3030 should be resolved after updating QB Desktop. Moreover, you should consider upgrading to the latest version of QB Enterprise.

A Quickview Table for QuickBooks Error Code 3030

Tabulated below is a summary of the blog that provides a concise overview of the QB error 3030:

| Error code | QuickBooks Error 3030 |

| Error message | QB Sync Manager was unable to sync successfully |

| Its causes | There might be incorrectly configured sync settings for QuickBooks, and the internet may not be able to support a connection between QB and the Intuit sync manager, the version of QB Enterprise you are using is outdated and lacks new features, you may have damaged or corrupted component files for QuickBooks Desktop, the configuration/ component files which are necessary to use QB sync manager may have been deleted accidentally, the QBDT application failed to install properly or has a partial installation. |

| Troubleshooting methods | Access the QuickBooks Enterprise and the company file through alternate ways, or use the Windows built-in repair feature to fix issues with the QB application, and update to the latest version of the QB Desktop that is available. |

Bringing It All Together

The QuickBooks error 3030 can prevent you from syncing your application and the company file. We have listed out various methods for resolving this error to seamlessly sync with the Intuit sync manager. The key factors for causing the QB error code 3030 on your system include misconfigured sync settings, a weak internet connection, damaged or corrupted component files, or improper installation.

Resolving the error 3030 in QuickBooks Enterprise all by yourself might be challenging. But our experts are here to assist you. Dial 1.855.738.2784 to speak with an Accounting Helpline’s expert and get help for your problem.

FAQs

What is error code 3030 in QuickBooks?

You can see the QuickBooks error 3030 when the Intuit sync manager fails to sync the data between QB and the company file. It can often show up due to incorrect sync settings, a weak internet connection, or third-party programs in the background that cause interference. You can try different ways to access the QB Desktop and the company file to fix this error.

How do I fix a QuickBooks error 3030?

If you want to know how to fix QuickBooks error 3030, then you can try the following methods. You can start by installing the QB Tool Hub to run the Quick Fix my Program on your application. Secondly, make sure that the QBDT application is up-to-date to the latest available version, along with the company file. Lastly, you can try to sync your data again or modify the sync settings for your company file. Alternatively, you can use the Windows built-in repair tool to repair the QB application.

What is Intuit Sync Manager?

The Intuit Sync Manager was a desktop application developed by Intuit to support the exchange of data between the company file and the QuickBooks program. This tool was used to facilitate syncing of data to the Intuit cloud for the desktop database. Now, the Intuit Sync Manager has been discontinued, as the QuickBooks Web Connector was developed by Intuit, which was an enhanced version of the sync manager, but does not require the installation of a desktop application and works as a cloud-based program.

Why is QuickBooks not syncing the company file?

When you run into the QuickBooks not syncing company file issue, it can occur due to the QB error 3030. This issue arises due to multiple reasons, some of which are misconfigured sync settings in QB Desktop or an unstable internet that fails to support a connection between the QB application and the Intuit Sync Manager. Moreover, if you are using an outdated version of the program or the QuickBooks component files have been damaged, then it can lead to this error as well.

Related Posts-

Fix QuickBooks Error PS033 With Pro-Recommended Techniques

QuickBooks Payroll not Working? Here’s How to Fix it

All About QuickBooks Payroll Subscription: You Must Know

QuickBooks Multi-User Mode Not Working: Fix Connection & Access Issues

How to End QuickBooks Error 15103 Completely?

Fix QuickBooks Error 557 While Payroll Update and Submission

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.