Last Updated on October 14, 2025

If you want to know how to Reactivate Payroll Subscription QuickBooks Desktop, you are at the right place.

Managing employee payroll and doing accounting tasks are two major day-to-day financial tasks. If not for the advanced software available today, it would be pretty overwhelming for the accountants and businesses. But the QuickBooks Payroll service is a great way to overcome this issue. It offers features like calculating employee earnings, deducting payroll taxes at both federal and state levels, disbursing salaries, and maintaining financial records.

You can subscribe to QuickBooks Payroll to efficiently manage these tasks and your business. However, the subscription is only valid for a year, after which you need to renew it. Always remember to reactivate payroll subscription QuickBooks Desktop before it expires. If you fail to renew it, your accounting tasks may be delayed, disrupting productivity. In this article, let’s look at the process of renewing the QB payroll subscription across desktop and online versions.

Looking to reactivate QuickBooks Payroll without going through complex procedures? We have got you covered. Dial 1.855.738.2784 today and get Accounting Helpline’s experts to assist you with renewal.

Why Should You Reactivate Payroll Subscription QuickBooks Desktop?

There are many reasons to renew a QuickBooks Payroll subscription after it has reached its validity. Some of the top factors are listed here:

- With the QB payroll, you will not need to calculate the federal, state, and local taxes manually.

- The payroll feature can perform deductions and tax withholdings according to the ongoing laws and regulations.

- Employees can access all the pay stubs and W-2s online through a secure website.

- You can use the direct deposit feature that transfers paychecks directly into the bank accounts of employees.

- With QuickBooks payroll, you can easily file the payroll taxes online to the IRS and the state agencies.

- The feature enables the integration of time-tracking tools to generate payrolls for employees based on their working hours.

- It will update you about the new regulations and policies regarding payroll to prevent potential penalties.

- You can generate payroll reports to evaluate recent trends and labor costs affecting your business.

These various benefits make it necessary to reactivate payroll subscription QuickBooks Desktop and help you save time and money.

Simple Ways To Carry Out QuickBooks Payroll Subscription Renewal

With the methods outlined below, you can reactivate QuickBooks Payroll across different versions, such as Desktop and Online.

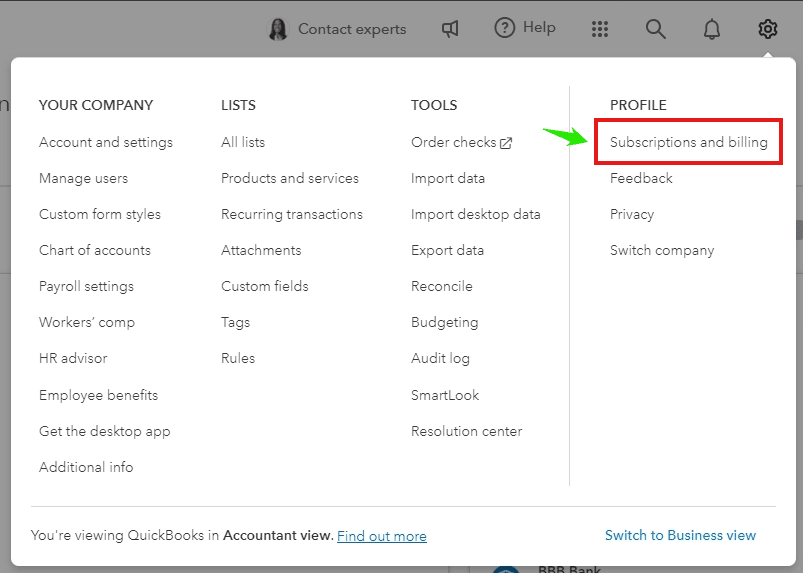

How to Reactivate QuickBooks Online Payroll

You can carry out these steps to renew the payroll subscription in QBO:

- Open your web browser.

- Head to QuickBooks Online.

- Expand the Settings menu.

- Click on Subscriptions and billing.

- Select Resubscribe for payroll.

- Review the subscription summary.

- Enter your payment details.

- Choose a payment method.

- Once you are done, hit Resubscribe.

The QBO payroll will be reactivated immediately, and you can utilize all its features and tools. Look through the following method for the desktop version.

Steps to Reactivate Payroll Subscription QuickBooks Desktop

In this segment, we have provided you with alternative ways to renew the payroll subscription in QB Desktop.

QuickBooks Desktop Payroll Assisted

If you are looking to reactivate the QB Desktop Payroll Assisted, then you will have to contact an Accounting Helpline’s expert.

QuickBooks Desktop Payroll Enhanced, or Basic

Here are some simple methods for QuickBooks Enhanced Payroll subscription renewal for the Desktop version.

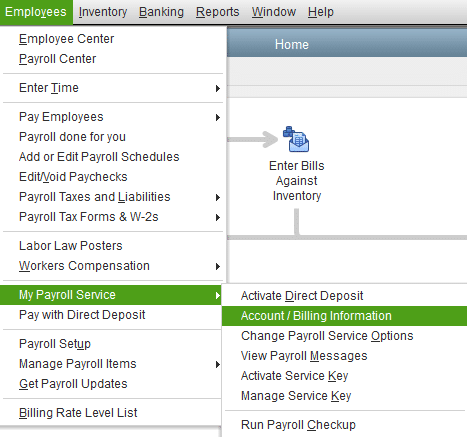

Method 1: Reactivating Payroll Through Your Company File

An easy and straightforward method to reactivate the QBDT payroll directly through the company file.

- Open QuickBooks Desktop.

- Expand the Employees menu.

- Tap on ‘My Payroll Service’.

- Then, press Account/Billing Info.

- Sign in to your Intuit Account.

- You will see the QuickBooks Account page.

- Check the Service status.

- Hit the Resubscribe button.

- Follow the instructions to reactivate.

Method 2: Reactivate the QB Payroll Through Your Intuit Account

You can utilize your preferred web browser to reactivate payroll subscription QuickBooks Desktop through your Intuit account.

- Launch a browser.

- Log in to your Intuit account.

- Navigate to Service status.

- Hit the ‘Resubscribe’ button.

- Follow the instructions on the screen.

Note: The reactivation of your payroll subscription may take up to 24 hours to complete fully. The subscription will be marked as ‘Active’ once reactivation is complete.

Method 3: Reactivate Payroll Subscription via Cancellation Email

You likely received a cancellation email from QuickBooks when your subscription expired. You can reactivate payroll directly through that email.

- Open your email inbox.

- Head to the subscription cancellation email.

- Find the Resubscribe button.

- You will be redirected to the Intuit website.

- Enter your Intuit account login details.

- Complete the payment to renew.

- Tap Save and hit Continue.

- Verify the details.

- Confirm the payment information.

- A reactivation link will be sent via email.

- Tap on the reactivation link.

Once you successfully reactivate payroll subscription QuickBooks Desktop via email, a message will appear on your screen. When you see the ‘Your Subscription has been Reactivated’ message, hit OK.

Here’s How You can review your QuickBooks Payroll Data after Reactivation

Once you return to the payroll service, you may need to set up payroll all over again. Payroll data, including employee information and tax setup, also needs a thorough review after you renew QuickBooks Payroll subscription.

Review the QuickBooks Online Payroll Data

Follow the steps outlined below to review the payroll data in QBO.

- Open a web browser.

- Head to QB Online.

- Log in to your account.

- Expand the Payroll menu.

- Click on the Employees option.

- Review each employee.

- Verify information such as deductions, W-4, sick/vacation, and other relevant details.

- Navigate to Settings.

- Select the Payroll Settings.

- Confirm your tax rates.

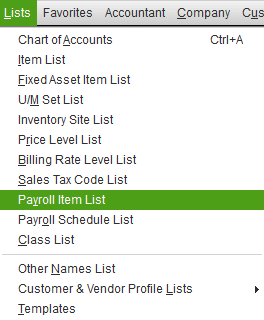

Steps to Review QuickBooks Desktop Payroll Data

Take these steps to verify the payroll data in QBDT.

- Open the QB Desktop program.

- Expand the Employees menu.

- Tap on the Employees Center button.

- Click on the Employees tab.

- Review information for each employee.

- Verify deductions, W-4, sick/vacation, etc.

- Now, select the Lists menu.

- Choose the Payroll Item List option.

- Confirm your tax payroll items.

Once you are done with this process, you can move on to utilize the payroll feature. In case you find the QuickBooks reactivate subscription not working, you can refer to this article to resolve it.

An Overview Table for Reactivate Payroll Subscription QuickBooks Desktop

Tabulated below is a summary of the blog that provides a concise overview of essential information regarding the procedure of QuickBooks Payroll subscription renewal.

| Importance of renewal | Calculate the federal, state, and local taxes automatically, perform deductions and tax withholdings based on ongoing laws and regulations, provide online access to all pay stubs and W-2s through a secure website for employees, utilize the direct deposit feature to transfer paychecks directly into the bank accounts, and file payroll taxes online to the IRS and the state agencies. Integrate time-tracking tools to generate payrolls for employees based on working hours, adopt new regulations and policies regarding payroll to prevent potential penalties, and create payroll reports to review the recent trends and labor costs of your business. |

| Process to reactivate QuickBooks Payroll in Online | Open QBO, click on Settings, then go to Subscriptions and Billing, and select Resubscribe. Review the subscription summary, enter your payment details, complete the payment, and then press Resubscribe. |

| Methods to reactivate payroll subscription QuickBooks Desktop | QuickBooks Enhanced Payroll subscription renewal, Assisted and Basic. Reactivate through the company file, Intuit account, or by the subscription cancellation email. |

| Review QBO payroll data | Log in to the QB Online account, click on the Payroll menu, select Employees, then review information such as deductions, W-4, sick/vacation, etc, for each employee. Now, navigate to Settings, open Payroll Settings to confirm your tax rates. |

| Review QBDT payroll data | Open QBDT, select the Employees menu, and then go to the Employees Center. Tap on the Employees tab and review information, including deductions, W-4, sick/vacation, etc., for each employee. Then, expand the Lists menu, click on Payroll Item List, and confirm your tax payroll items. |

Bringing It All Together

In order to ensure continued access to QuickBooks Payroll along with its features and tools, you must renew it. It not only helps in calculating paychecks and disbursing salaries but also ensures compliance with new payroll regulations and files taxes to the IRS and state agencies. We have outlined the procedure to Reactivate Payroll Subscription QuickBooks Desktop, which can be carried out easily. Additionally, we explored a few key points revolving around the renewal process that are easy to miss. It is easy to renew a QuickBooks Payroll subscription, but the technical unfamiliarity can be overwhelming. Therefore, you can connect with our Accounting Helpline’s experts by dialing 1.855.738.2784 to get quick resolutions to your queries.

FAQs

How do I reactivate my QuickBooks Payroll subscription?

There are various methods to reactivate payroll subscription QuickBooks Desktop, depending on your version of software. If you are using QBO, you can renew the payroll subscription by heading to Settings, opening Subscriptions and Billing, and pressing Resubscribe. You will have to review the subscription summary, verify your payment details and method, and then proceed. But for the desktop version, there are different methods for Enhanced, Assisted, and Basic Payroll. You can proceed to QuickBooks Enhanced Payroll subscription renewal through the company file, through the Intuit account, or simply go to the reactivate link on the subscription cancellation email.

What happens when my QuickBooks Payroll Subscription expires?

When your QuickBooks Payroll Subscription expires, you will lose access to all the features and tools that it offers. You will not be able to use it for calculating pay, processing direct deposits, and tax calculations. You can still view the past data and records of your business and company, but you can not make any changes or updates to the data unless you reactivate payroll subscription QuickBooks Desktop. Moreover, the bank syncing will stop working, you won’t receive any future updates for payroll, and you will no longer get any customer support from Intuit.

How do I verify Payroll Data in QuickBooks Desktop?

Once you successfully reactivate payroll subscription QuickBooks Desktop, you can move on to verify the payroll data. In order to do so, you will first have to launch the QBDT program, then expand the Employees menu, and go to the Employees Center. There, you have to click on the Employees tab and review the information, such as deductions, W-4, sick/vacation, etc., for each employee. Once done, select the Lists menu and hit the Payroll Item List option, where you can verify your tax payroll items.

Why should I renew my QuickBooks Payroll subscription?

There are many reasons to reactivate payroll subscription QuickBooks Desktop, as it offers numerous features and tools. Some significant points to renewing the subscription are automatically calculating the federal, state, and local taxes, performing deductions and tax withholdings based on ongoing laws and regulations. Providing online access for all pay stubs and W-2s through a secure website to employees, and the direct deposit feature to transfer paychecks directly into the bank accounts of employees. Moreover, it can file payroll taxes online with the IRS and state agencies, and integrate time-tracking tools to generate employee payroll based on working hours.

Related Posts-

Learn How to Send Pay Stubs in QuickBooks

The Progressive Guide to Change QuickBooks License Number

QuickBooks Cloud Hosting | Its Advantages & Features

QuickBooks Error H101 | 8 Proven Methods to Resolve It

QuickBooks Print and PDF Repair Tool: How to Fix Print Problems

Is Your QuickBooks Update Stuck? Know How to Fix It!

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.