Last Updated on March 12, 2025

Evolving every now and then, QuickBooks has excelled in meeting the needs of its customers, and QuickBooks Enhanced Payroll for Accountants was introduced for best possible use of QuickBooks. The payroll feature of QuickBooks is itself an outstanding feature using which the users can take care of their wages and salaries, invoices and paychecks printing. Starting 2020, QuickBooks came up with the QB enhanced payroll for accountants. Intuit® enhanced payroll for accountants came into being with the motive to provide the QB users an easy platform to handle their company’s Payroll and additionally the tax requirements.

Accounting Helpline’s Payroll Support is Just a Phone Call Away to Answer all your Queries Related to Enhanced Payroll for Accountant. Call 1.855.738.2784 and Get Immediate Assistance

Intuit Enhanced Payroll for Accountants – Overview

There have been multiple editions of Payroll already existing with QuickBooks, but QuickBooks Payroll enhanced for accountants is superior of them all.

The blog covers the features of Payroll enhanced for accountants, characteristics, and how to make the best of it to smoothly taking care of the entire payroll process. The enhanced version might be overwhelming and talking to the Accounting Helpline customer service at 1.855.738.2784 can clear up your doubts regarding this feature.

Features Incorporated into QB Enhanced Payroll

Every advancement in the QuickBooks has worked to make a better interface and smooth user experience. Similarly, QB enhanced payroll for accountants has been offering various advantages; some of these are listed below:

- Print Paychecks, Pay Cards, and Direct Deposit for employee’s salaries.

- On-time filing as well as payment of the taxes.

- Simplified Online payment and tools for filing taxes.

- Simple integration with QuickBooks Accounting software

Moving on to the Features that are incorporated with Intuit® QuickBooks desktop enhanced payroll for accountants:

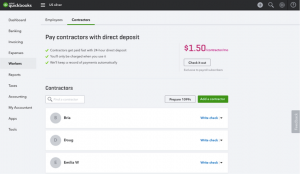

Direct Deposit Feature

The hassle of printing or emailing checks is removed with the QuickBooks Direct Deposit feature provided by QuickBooks Enhanced Payroll for accountants.

The salaries can be directly paid to the employees, which is advantageous for employees as well as business owners. The payroll also takes into consideration the part payment which can be done by Direct Deposit and another half with checks or pay cards.

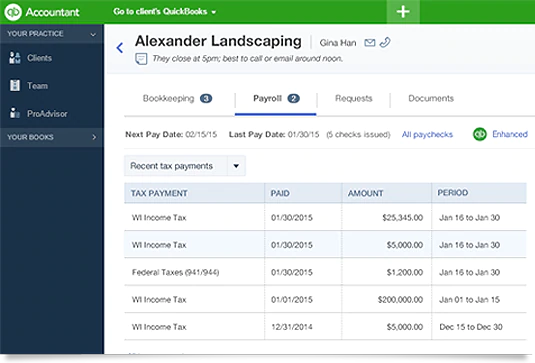

Reporting and Monitoring

With the use of the Enhanced Payroll tool, reporting and monitoring task such as exporting reports to tax liabilities and period comparison has become easier.

Other benefits that are linked to monitoring and reporting involve:

- Quicker expense analysis and payroll activity report.

- QuickBooks payroll enhanced for accountants can be customised as per the needs of the user.

- Reports can be saved in multiple formats as per the requirement such as PDF, Word, and Excel.

- The introduction of Employee overview screens option makes it easier to keep a check on the individual, rate, and deduction data.

- State, Federal, and Local reports are now easy to view with Enhanced payroll software for accountants.

- Once the user creates e-payment or prepares returns, the user attains compliance report without any extra charges.

Integration/Import and Export

QuickBooks Enhanced Payroll for Accountants includes additional integratable modules for 401(k) management, health-care plans and worker’s comp along with the tight integration with QuickBooks, which includes direct links to GL, AP, and other components.

The QuickBooks enhanced payroll for accountants gives an option to import and export data in different formats such as Excel or CSV. By the usage of the mapping option, a user can easily import data from different systems.

Self-Service Advantages

Not much-known feature of QuickBooks payroll enhanced for accountants, also called View My Paycheck. The W-2 employees are given the authentication to log in and view/print their paycheck information which could be initially done only by the admin.

Summary and Pricing Reports

Now that there is a direct integration option, QB enhanced payroll for accountants offers more capacity and a streamlined work process. In order to go for QuickBooks enhanced payroll for accountants, it is required to have a 2009 or higher version of QuickBooks software. The program costs $374, and direct deposit costs $1.25 per employee check.

Support and Assistance

It is possible for users to find a need for content-sensitive assistance by making use of right-click menus. Additional support using live chat makes it easier for the user to contact the support team and submit their queries. With an online client network, FAQs, documentation the choice of this system is a great one.

Which one to go for: Enhanced Payroll for Accountants vs. Full Service Payroll quickbooks ?

The Full-service option is a suitable choice for businesses that plan to process their payroll but want that their taxes and payroll tax returns get filed for them. Intuit® will e-file and e-pay federal, state taxes, quarterly and annual payroll tax returns, including year-end processing of W-2s. On the other hand, Enhanced payroll for accountants is ideal for those clients who want to process their payroll, as well as e-file and e-pay federal, state taxes, and quarterly and annual payroll tax returns, including year-end processing of W-2s. It should be kept in mind that your clients will have to set this up themselves. For check stubs and W-2s to be accurate, they will need to be careful with the setup.

Full service is pretty inexpensive. With enhanced, Yes, you will get the emails that tell you to process the tax forms and take the necessary steps. But with full service, you don’t have to worry about making sure you pay these payments on time as they’re automatically done for you. The task of making payroll tax payments and payroll tax return filings is put on the Intuit®. This aids the client to be compliant, reduces the cost of penalties, and provides them the ability to focus on running the business without taking the headache of data entry and time-consuming management to properly handle payroll and consequently the taxes. The price depends on the chosen version of QuickBooks and the user requirements.

Common Queries that Pop up Related to QuickBooks Payroll Enhanced for Accountants

How much is QuickBooks Enhanced Payroll for Accountants?

The Enhanced Desktop Payroll for Accountants allows you to have up to 50 EINs on one account and doesn’t have the $2.00 per check charge which is common to the other versions.

Do I need QuickBooks Enhanced Payroll?

Enhanced payroll for accountants is good for you, if you want to process payroll on your own, as well as e-file and e-pay federal, state taxes, quarterly and annual payroll tax returns, including year-end processing of W-2s.

Is Direct Deposit Free with QuickBooks Enhanced Payroll for Accountants?

The hassle of printing or emailing checks is removed with the Direct Deposit feature provided by QuickBooks Enhanced Payroll for accountants.

Advanced Support with Intuit® Enhanced Payroll for Accountants

Though every advancement made into QuickBooks application is for much better user experience, the choice of options increases at the same time. This leaves the user overwhelmed, but by getting in touch with Accounting Helpline’s payroll customer service at 1.855.738.2784 users can avail the help of professional executives.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.