Last Updated on March 10, 2025

Direct deposit is the most convenient way to pay your employees, with numerous benefits like paperless transactions and same-day deposits, and there is no need to visit the bank. If you are a QuickBooks user using payroll direct deposit to pay your employees, then at times, you might need to change the bank account from which the funds are deducted to pay your employees. With QuickBooks Desktop Payroll Enhanced, Standard, or Basic version, you can quickly Bank Account Change Form QuickBooks Desktop by following a simple four-step method that we have mentioned in our article. Similarly, if you are a QBO user, you can edit the bank account in the application by reading the information below. Just follow the complete article and learn how to Bank Account Change Form QuickBooks Desktop.

If you need help Bank Account Change Form QuickBooks, then this article is gonna help you find the right steps. However, if you don’t want to change the account yourself or need a faster alternative, you can call our Accounting Helpline’s experts at 1.855.738.2784 to get going with the direct deposit bank account changes.

Why Should You Change Your Direct Deposit Bank Account in QuickBooks?

Change direct deposit bank account or adding a new one may become necessary due to several reasons, like switching to a new financial institution, needing better service terms, or enhanced security.

- Changing your payroll bank account to a new financial institution allows you to get new and improved financial services and potential cost savings.

- Updating the bank account details enhances security measures, which safeguard your financial transactions.

- This adjustment ensures that your bank account information is current and accurate, which is essential for seamless payroll processing in QuickBooks.

- It also lets you match your banking needs with the most suitable provider and use updated features and technologies.

Steps to Change Direct Deposit Bank Account in QuickBooks

Before Bank Account Change Form QuickBooks, make sure that you have an active QuickBooks payroll subscription, a direct deposit PIN that you use to run payroll, and the most updated payroll tax tables. If you are having any issues updating payroll, then you can follow our article on Fix QuickBooks Payroll Update Error 15270 for detailed troubleshooting instructions.

Step 1: Create a New Bank Account

- Under the Lists tab, select Charts of Accounts.

- Click Accounts and hit New.

- Click Bank and press the Continue button.

- Now type in your bank account information.

- Click Save & Close.

- Once the new account is set up, you will need to update the same information under the Account Maintenance section of QuickBooks.

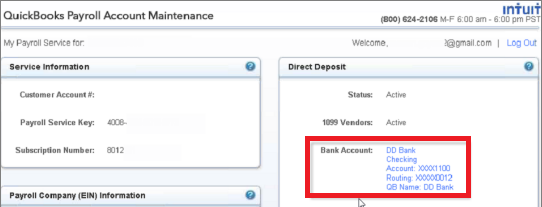

Step 2: Input the Account Information under the QuickBooks Account Maintenance Section

- Open QuickBooks, and under the Employees tab, select My Payroll Service.

- Select Accounts / Billing Information and then enter your login credentials to sign in to your Intuit® Account.

- Now choose the Bank Account Information under the Direct Deposit window and click OK on the popup window.

- QuickBooks Change Direct Deposit Bank Account Type your PIN and hit Submit

- Now, type in the information about your new bank account and click Submit.

- Enter Payroll PIN Window Click Continue on the confirmation window.

- Now choose the bank account in which you want to receive the funds back from Intuit®.

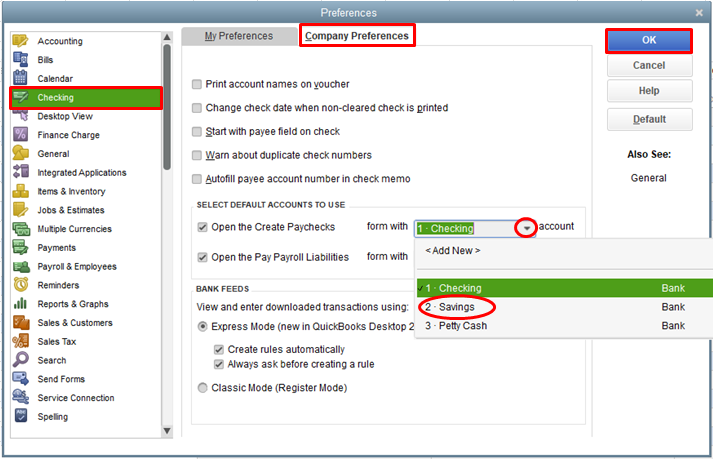

Step 3: Select the Bank Account for Direct Deposit and Fee Deduction

- Under the Employees tab, click Send Payroll Data.

- Choose Preferences under the Send / Receive Data Section.

- Click the drop-down list and select the new bank account in the Account Preferences window.

- Click OK and then hit Close under the Send / Receive Data window.

Step 4: Turn On the New Direct Deposit Bank Account

In order to verify the new bank account, QuickBooks withdraws two small amounts from your bank account, which you need to enter on the Account Maintenance Page.

- Click the Employees tab and then select My Payroll Services.

- Click Account / Billing Information and then enter your login credentials to sign in to the payroll account.

- Hit Verify beside the Direct Deposit Bank Account information and type in the two amounts debited from your bank account.

Enter the Debit Amount Window, Type the Payroll PIN, and hit Submit.

Steps to Bank Account Change Form QuickBooks Desktop

You can change the default bank account for payroll in QuickBooks Desktop by implementing the detailed steps below –

- From the Lists tab, select Chart of Accounts, then pick the current default bank account that needs to be changed from the account list.

- Right-click the default account, click Edit, and select Bank Account.

- Choose the new account from the drop-down menu and confirm your action to save it as default.

Steps to Bank Account Change Form QuickBooks Online

If you are a QuickBooks Online user, you can edit the payroll direct deposit account by using the following instructions –

- Log in to QB Online and navigate to Payroll Settings by clicking the Gear icon at the top-right corner.

- Move to the Account tab, select the bank account for QB payroll transactions, and go to the Payroll tab.

- Select Employees, click Employee Center, then pick the employee whose bank information is updated and go to the Payroll Info tab.

- Click Save to confirm the bank account changes and ensure that the updated bank details appear for the said employee.

Steps to Change the Direct Deposit Account Details in QuickBooks

You can edit or Bank Account Change Form QuickBooks by using the detailed steps below –

- Log in to QuickBooks, go to the Employees tab, click Employee Center, and locate the direct deposit settings.

- Select the specific employee for whom you want to update the direct deposit bank details, click Payroll Info, and select Direct Deposit.

- Now, you will be prompted to add the new account details, confirm the changes, and submit the information.

Learn to Change the Company Direct Deposit Info in QBO

Sometimes, you might require changes in the company’s account info while sending direct deposits to employees in QBO. In such cases, you can implement the steps below to edit the company direct deposit info –

- Go to Payroll, select Employees, and pick the specific employee by choosing their name.

- Further, click the Pencil (Edit) icon for the Pay section to access the editing fields.

- When you see the “How do you want to pay Employee?” message, select the Pencil (Edit) icon to change the response.

- Select Edit Company Direct Deposit Info, update the required account information, and click OK.

NOTE: You can also update the bank account information by submitting a form to Intuit®. Download the Bank Account Update Form and email it to sbpfcsoperations@intuit.com or send it to 877-699-8996 via fax. Remember that sending the form via fax takes longer to process and you might have to pay your employees with paper checks if the information is not updated on your account.

The expert-recommended steps given in this detailed guide will help you with the Bank Account Change Form QuickBooks Desktop. However, if you aren’t able to make changes to the direct deposit bank account or these steps are ineffective, the next best alternative is to seek professional assistance. You can contact our Accounting Helpline’s Payroll support team at 1.855.738.2784 to get immediate guidance in promptly fixing payroll-related issues.

FAQs

What does the QuickBooks direct deposit form entail?

The Intuit (Quickbooks) direct deposit form is a legal document used by employers to provide payments to their payroll employees via direct deposit. While using this form, you must decide which account you wish your employee payment to be deposited into and then report the information defining the targeted bank account(s).

How can I edit a direct deposit paycheck in QuickBooks Desktop?

You can edit or modify a direct deposit paycheck in QuickBooks Desktop by using the steps mentioned below –

– Open QuickBooks, go to the Banking menu and select the Make Deposits option.

Choose the deposit that contains the transaction you want to modify, click on the transaction you want to edit, and make the required changes.

How can I change the bank account number in QuickBooks Desktop?

If you wish to change the bank account number in your QB Desktop app, follow the instructions below –

– In your company, move to the Transactions tab from the left panel and choose Bank Transactions.

– Select the tile for the account you want to edit, click the Edit icon, and click the Edit Sign-in Info option.

– Update the account number from the new tab, then click Save and confirm the changes.

What are the steps to change the bank account for direct deposit in QuickBooks Desktop for the employer?

You can change the employer’s bank account before creating the direct deposit by using the steps mentioned as follows –

– First, you must gather certain specific info – the employer’s bank account information, the principal officer’s address, and payroll PIN.

– Set up your bank account in your Chart of Accounts and review pending tax payments and payroll transactions (direct deposits/paychecks).

– Further, update your bank account using the QuickBooks Desktop Payroll service and verify your bank account.

– Finally, Bank Account Change Form QuickBooks to match your direct deposit payment preferences.

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.