Has the QuickBooks payroll service server error made it difficult for you to utilize the application smoothly? These interruptions can be pretty annoying especially when it affects deadlines. However, you need not worry; we provide practical and step-by-step procedures to eliminate the trouble.

QuickBooks Payroll feature has made the software much more convenient to use. Still, there are certain errors, such as payroll service connection error in QuickBooks Desktop, which occurs when trying to send the payroll data or to direct deposit paychecks. The payroll feature simplifies the task of preparing paychecks, depositing salaries, filing payroll taxes, tax returns, and many more. The QuickBooks Payroll Services are primarily available in three versions: Basic, Enhanced, and Assisted Payroll. Here are some of the solutions to fix the QuickBooks Payroll service server error.

Payroll server not responding is causing you to worry? Get in touch with our certified professionals immediately by Calling the Payroll Support Number 1.855.738.2784 and get rid of your problems.

What is QuickBooks Payroll Service Connection Error?

QuickBooks payroll service connection error may appear while sending the payroll data or using the direct deposit service. Invalid security certificates, sending the information in multi-user mode, and incorrect system date and time are a few triggers of this error.

When users encounter any of the following messages, they may start panicking:

- Payroll Service Server Error. Please try again later. If this problem persists, please contact Intuit .

- Payroll Connection Error

Since the user gets stuck while accessing payroll features, rectifying it can be challenging, especially when monetary transactions are involved. Therefore, in-depth information about the reasons is necessary to troubleshoot this error.

Reasons behind the QuickBooks Payroll Service Server Error

Before looking out for a solution when you are Unable to Run Payroll because of Server Error, it is important to get to the cause of the error. Listed below are some of the reasons leading to QuickBooks Payroll Service Server Error.

- Firewall configuration issues may bring forth the QuickBooks Payroll service server error.

- Internet security issues may cause this problem.

- Normal issues with the internet connection might encourage the payroll service server error.

- If you’re trying to send the file in a multi-user mode, you will see the payroll service server error in QB.

- An Invalid security certificate causes the QuickBooks Payroll service server error.

- A Network timeout might cause this problem.

- Incorrect time properties or system dates may encourage this error.

How to Troubleshoot QuickBooks Desktop Payroll Server Error?

Before diving into troubleshooting QuickBooks payroll connection error, users must consider the following things solutions:

Send Payroll After Every Fix

After trying every solution, send payroll and see if the error remains. If all these solutions can’t fix this problem, contact QuickBooks experts for help.

Remain in Single-user Mode

You shouldn’t be in multi-user mode when trying to send your files and payroll data. So, ensure you have switched ON the single-user mode as follows:

- Click File.

- Select Switch to Single-user mode.

Now, you can proceed with resolving the QuickBooks Payroll Service Error yourself by following the methods mentioned below:

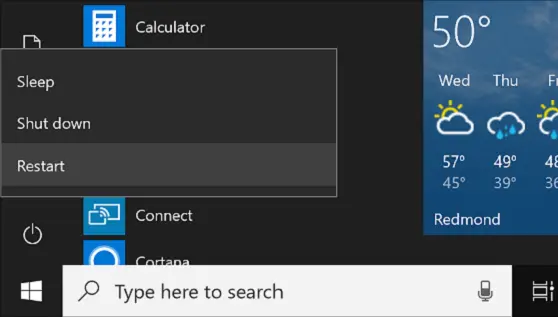

Solution 1: Reboot the System

Refresh your system with a quick reboot and fix the QuickBooks Payroll Service Server error:

- Restart your system.

- Try to launch the QuickBooks Payroll services after the computer restarts.

- If the error persists, follow along with the next solution.

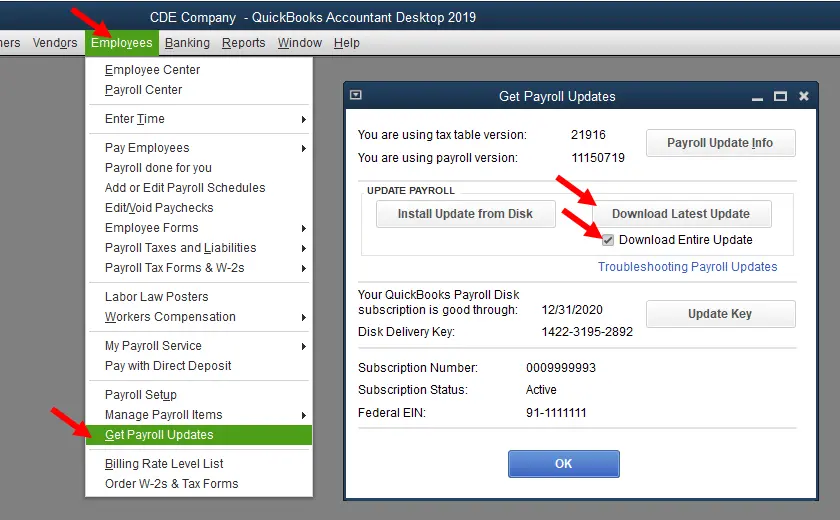

Solution 2: Update QuickBooks Tax Tables

Ensure you download the most recent QuickBooks tax tables to prevent payroll service server errors after switching to the single-user mode:

- For this, you need to ensure only you have logged into the QuickBooks Desktop.

- Ask the other person to sign out if there’s anybody else accessing the app.

- The QuickBooks File menu contains the option to Switch to single-user mode. go for it.

- Keep following the commands to continue and log in again.

- Now, attempt to resend the payroll.

- Get Payroll Updates and install them.

- Select QuickBooks application > Employees> Get Payroll updates.

- Next, hit the Download Latest Updates.

- Restart the QB Desktop once the update finishes.

- Attempt to send the payroll information again.

Solution 3: Check if the Time Properties and System Date are Correct

Double-click the time display in the MS Windows taskbar and adjust your time and date properties:

- Check the Date and Time properties and ensure the date, time zone, time, year, and other related information are correct.

- If not, then correct by tapping the clock on the taskbar. Correct the settings and confirm.

- Restart the computer to implement the changes.

- Now, send payroll data again and see if it works.

Hope the article helps you to surpass the QuickBooks Payroll Service Server Error after successful recognition of the cause. In case, you are facing issues following any of the steps mentioned above, the QuickBooks payroll Service Number 1.855.738.2784 provides quick assistance for the same.

FAQs

How do I update tax tables to fix the payroll service error?

Recheck and ensure your tax tables are updated by launching the QuickBooks application and moving to the Employees section. Download the tax tables after choosing the checkbox to download the entire update. You can verify which tax table version you have from the number next to You are using this tax table version. Confirm with the latest tax table news and updates if this version is the new one. Tap Payroll Update Info to get more details about your payroll tax table version.

What does the payroll service error mean, and how do I end it instantly?

The payroll service error in QuickBooks may appear due to a misstep, invalid security certificates, internet connectivity issues, etc. However, there’s no need to panic as several guidelines are available to fix it. Although no tool is available to fix the error, apply any of the solutions mentioned above to fix QuickBooks Payroll Service Error. It may emerge while sending payroll data or directly depositing paychecks but has straightforward solutions in this blog.

Why does the Payroll Service Server error in QB arise?

Here are some of the factors that can result in the QuickBooks Payroll Service Server Error:

1. Firewall configuration problems can trigger the QuickBooks Payroll Service Server Error.

2. Internet security issues can be a potential cause of this problem.

3. Common issues with your internet connection might lead to the Payroll Service Server Error.

4. Attempting to send a file in multi-user mode can also prompt the Payroll Service Server Error in QuickBooks.

5. An invalid security certificate is a potential factor behind the QuickBooks Payroll Service Server Error.

6. Network timeouts could be a contributing factor to this issue.

7. Incorrect time settings or system dates may also lead to this error.

What scenarios prompt the QuickBooks Payroll Service Server error?

The QuickBooks Payroll Service Server error can occur due to various scenarios, including firewall configuration issues, internet security problems, network connection disruptions, attempts to send files in multi-user mode, invalid security certificates, network timeouts, and incorrect time settings or system dates. These scenarios can disrupt the smooth functioning of QuickBooks Payroll services and result in this error, which may impede payroll-related operations within the QuickBooks software. Resolving these issues involves addressing the specific causes related to network, security, and configuration settings to ensure proper functionality of the Payroll Service Server.

What are the signs of QuickBooks Payroll service server error?

Signs of the QuickBooks Payroll Service Server error include:

1. Inability to send payroll data to the server.

2. Delayed or unsuccessful payroll processing.

3. Frequent disruptions in online payroll tasks.

4. Error messages indicating issues with sending data.

5. The system may display messages about network or security problems.

6. An invalid security certificate warning.

7. Slower performance or network timeouts during payroll processing.

8. Payroll-related operations may come to a halt or produce errors.

9. Inability to access the payroll service smoothly.

10. A need to frequently troubleshoot and resolve server-related errors when processing payroll in QuickBooks.

Edward Martin

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.