QuickBooks error PS077 is a bug indicating incorrect or misconfigured settings. Since QuickBooks has a worldwide reputation for being the best accounting solution, these technical snags are like a speck of dust in a clean room. However, with our guide to PS077 error, you need not worry about anything. Here, we have in-depth details of what the error entails, how it emerges, its trigger points, and effective troubleshooting ways to get rid of it soon.

When a user tries installing a payroll tax table update, they may face PS077 in QuickBooks Desktop. When the software throws this error on the screen, it becomes really challenging for users to handle. Take this blog as your detailed guide to get out of this sticky situation and enjoy a hassle-free QB experience.

QuickBooks error PS077 can be painful to handle, especially during heavy workload days. As a non-technical QB user, if you find implementing the methods mentioned in this blog challenging, you can contact our experts at 1.855.738.2784. These QB specialists will understand your problem and implement their expertise to hit the root cause of the error.

A Brief Overview of QuickBooks Payroll Error PS077

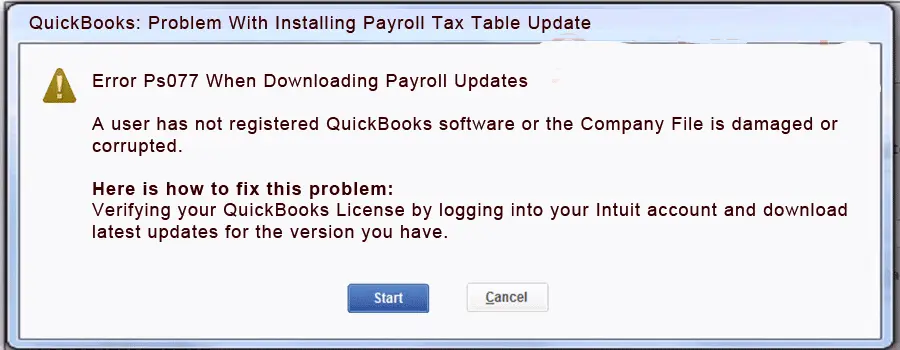

QuickBooks payroll error PS077 appears when installing QuickBooks payroll or payroll tax table updates. You may also find it challenging to print W2s or 941s.

The prefix PS indicates errors with QuickBooks Payroll and causes issues with the performance of QuickBooks Desktop. If you wish to deal with this issue, it’s crucial to note the reasons that trigger it. So, let’s dive into the causes of this error.

Triggers for PS077 Error in QuickBooks Desktop

Now that we know what the PS077 error in QuickBooks Desktop stands for, let’s plunge into the reasons that cause it to pop up:

Invalid or Corrupted Tax Table File

If the payroll tax table is corrupted, or the payroll folder or its components are invalid, damaged, or missing, you will definitely encounter QuickBooks PS077 payroll error.

Damaged QB Company Files

If your QuickBooks company files got damaged or corrupted due to any reason, it’s possible for you to encounter QuickBooks payroll error PS077.

Unregistered QB

When you haven’t yet registered your QuickBooks app, you can expect to get surrounded by different errors, including the PS077.

Problems in Billing Details

If your billing details are outdated, corrupt, incorrect, or have any problems, QB error PS077 is sure to attack you.

Troubleshooting Methods to Fix QuickBooks Error PS077

Now that we have covered everything about the error in detail, let’s now plunge into how to resolve QuickBooks error PS077:

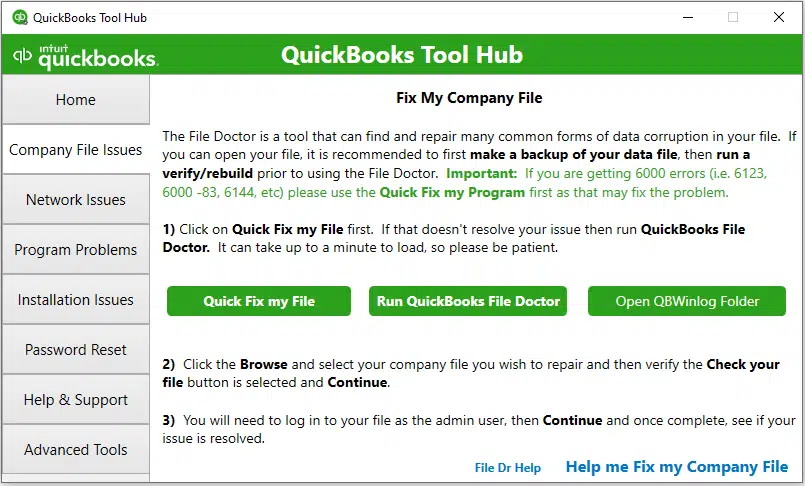

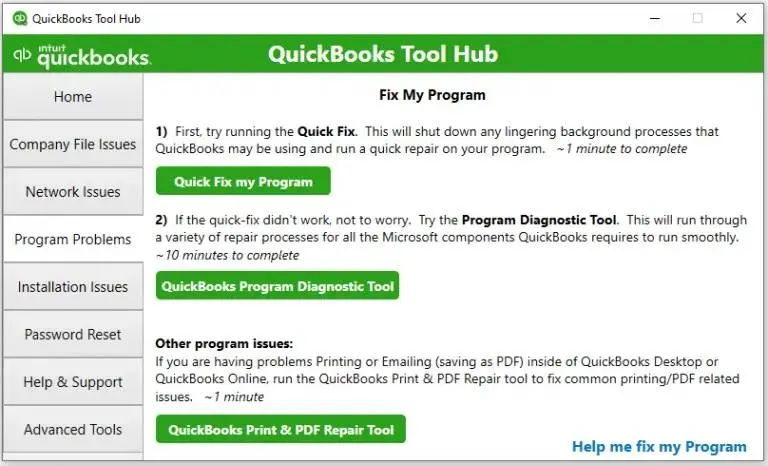

Troubleshooting Step 1: Use QuickBooks Repair Utilities

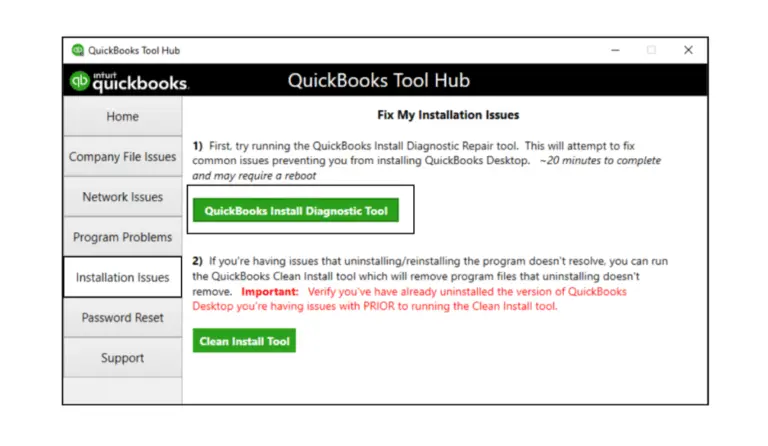

QuickBooks offers the following repair utilities from the tool hub to fix program and installation issues causing QB error PS077:

- Close the company file and QB Desktop.

- Download and install QuickBooks Tool Hub.

Troubleshooting Step 2: Repair the QuickBooks Desktop

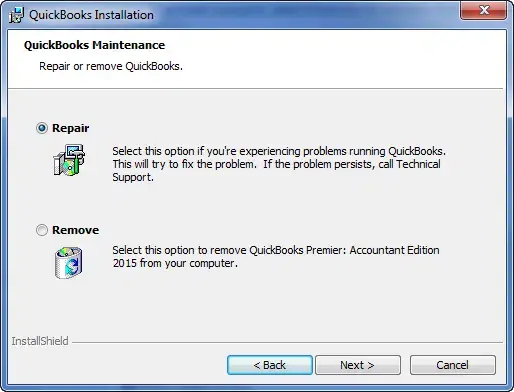

You can try fixing the QB error PS077 by repairing the QB Desktop application as follows:

- From the Start menu or the desktop, open Control Panel.

- Here, choose the option that says Programs and Features, then choose Uninstall a program.

- You will view a list of applications to remove or change. Choose QuickBooks > Uninstall/ Change.

- Now, Continue > Next > Repair > Next. Let the repair process finish.

- End by opening QuickBooks and checking if the error is fixed.

Troubleshooting Step 3: Download the Latest Payroll Tax Tables

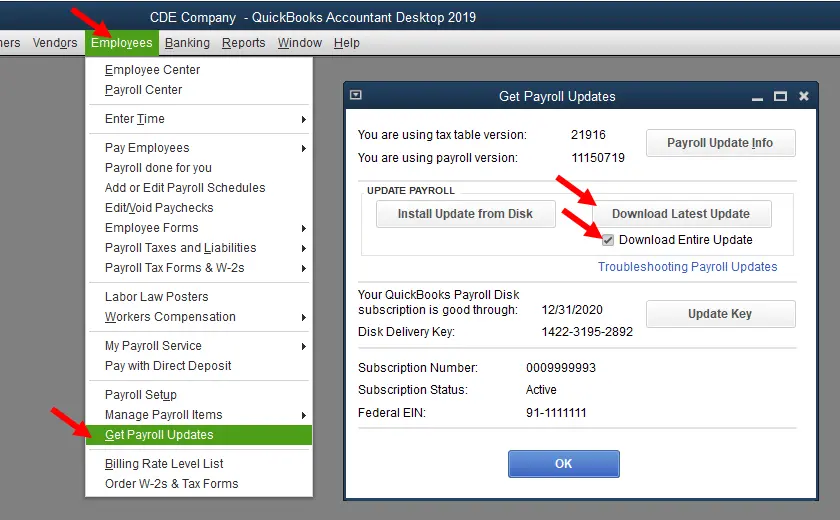

Ensure your payroll tax table has accurate payroll information by resetting its updates as follows:

- Go to the Employees menu in the QuickBooks application and hit the Get Payroll Updates option.

- In fact, you must try to reset the QuickBooks update.

- Tick the Download Entire Update box.

- Hit Download Latest Update.

- A window will show when the download ends.

If the error appears on your screen again, move to the next solution.

Troubleshooting Step 4: Assess the Payroll Service Subscription

Ensure you have a working Payroll when you see error PS077:

- Close all active company files and restart your computer.

- Launch QuickBooks, navigate to the Employees menu, choose My Payroll Service, then Manage Service Key.

- Confirm that your Service Name and Status display as accurate and indicate “Active.”

- Click on Edit to verify the service key. If it’s incorrect, input the correct service key.

- Proceed with the steps, uncheck the Open Payroll Setup box, and click Finish to download the complete payroll update.

Troubleshooting Step 5: Verify the Billing Information

The PS077 error in QuickBooks sometimes arises due to incorrect or misconfigured billing information. Keeping it exact and appropriate will help fix the error. Therefore, note the QuickBooks license details as follows:

- Press the F2 key in QuickBooks Desktop, and a Product Information window will appear.

- Next to the License Number, confirm if it says “Activated.“

- If not activated, register your QuickBooks Desktop.

- After registration, update QuickBooks Desktop to the latest version.

- Download the most recent payroll tax table update (Step 3).

Troubleshooting Step 6: Reboot

Rebooting your device and reopening QuickBooks can help refresh and avoid errors like PS077.

Summing Up

Dealing with QuickBooks error PS077 can be challenging and technical. However, we hope this easy-to-understand and detailed guide about the error satisfies and solves your issues. If not, you can reach out to our experts at 1.855.738.2784.

FAQs

How to know if QuickBooks is registered correctly and not causing the PS077 error?

You can check QuickBooks registration authentication for error PS077 as follows:

1. Launch the QuickBooks app.

2. Press the F2 key on the keyboard.

3. The QuickBooks product information wizard will pop up on the screen.

4. See the right side of the Product License number. If it’s registered, you will see the registration information.

Why do I get QuickBooks error PS077?

QuickBooks error PS077 arises because of the following triggers:

1. You have corrupt or invalid components in the Payroll and tax table file, triggering QuickBooks error PS077.

2. Your billing details for QB may be incorrect, causing QB error PS077.

3. If your QB Payroll shows unregistered, you may require re-registering your service.

4. Your QB company files may be damaged, causing QuickBooks error PS077.

When does QuickBooks error PS077 arise?

The following scenarios prompt QB error PS077:

1. While trying to update QuickBooks Payroll

2. When you try updating the latest QuickBooks tax tables

3. While you try printing critical forms, like 941 and W-2s

4. When you have corrupt components in your payroll and tax table files

5. When your billing details are wrong

6. If you haven’t registered your QB Payroll service

7. When your company files are corrupt

How do I eliminate QB error PS077?

QB error PS077 can go away as follows:

1. Reboot your device and reopen QB.

2. Use Quick Fix My Program and QB Install Diagnostic Tool.

3. Reset QuickBooks tax table update

4. Assess your billing details

5. Repair the QB program using Windows inbuilt program repair utility

6. Check your payroll service subscription in QB

What are the signs of QuickBooks error PS077?

If you want to know whether QuickBooks error PS077 has attacked your system, you should look out for the following signs and symptoms:

1. The direct consequence of the QB PS077 error is that you cannot download and install payroll updates.

2. Similarly, the payroll tax table downloading, installing, and updating process gets stuck in the middle or doesn’t begin.

3. You get the QB error message with a clear mention of the PS077 error.

4. Your system may freeze or hang periodically for regular or irregular intervals.

5. The PC doesn’t give any response when the user gives inputs from the keyboard and mouse.

Edward Martin

Edward Martin is a Technical Content Writer for our leading Accounting firm. He has over 10 years of experience in QuickBooks and Xero. He has also worked with Sage, FreshBooks, and many other software platforms. Edward’s passion for clarity, accuracy, and innovation is evident in his writing. He is well versed in how to simplify complex technical concepts and turn them into easy-to-understand content for our readers.